Cement in the Chinese growth engine

Around the world, the fading economic growth is a challenge, including China, though something indicates that the Chinese government is already trying to reverse the trend.

The macroeconomic data from China has been surprisingly positive lately, particularly that the private manufacturing sector signals progress, which was quite unexpected. The Caixin manufacturing PMI, that primarily covers the private sector, showed an increase to 51.8 in November, which in fact, is the highest reading during the past three years.

It corresponds well with the PMI measured by the National Bureau of Statistics of China, which covers the large Chinese corporations in China. In November, this PMI index moved up to 50.2 from 49.3 in the prior month, which in itself is a fairly large jump. A reading above index 50 suggests that the sector is expanding, whereas a reading below 50 indicates contraction in the sector.

The fact that the official PMI for the non-manufacturing sector rose from 53.7 in October to 54.4 in November is very encouraging, though the service sector in China continuously expands. I find that the upward move in the manufacturing sector is the interesting part of the current growth story that we should dive into.

In that context, it always makes sense to check how the global development is, where the major part of other economies also spurred some improvement in their respective manufacturing PMI indices in November. It means that it’s not an isolated Chinese improvement, but a global expectation within the sector. But the Chinese improved their reading more than many, and it was also supported by higher domestic demand. Given that the US–China trade war remains unsolved, then the growing optimism might surprise slightly.

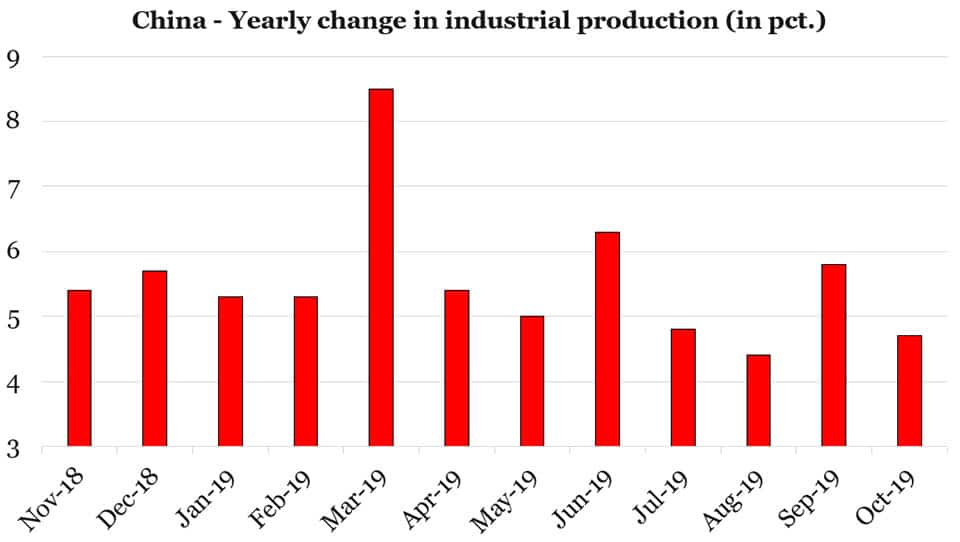

Graphic one shows the annual change in China’s industrial production, but obviously, the expectation of progress has not yet materialized into real progress. I trust that there will be a clear expectation in the financial markets about an increase of at least five pct. when the data for November is published on Monday the 16th December. Though this development is worth a consideration, or should make one wonder, as the US-China trade war was not resolved when the PMI surveys were done, then the growing optimism in China’s business world may seem surprising.

Given the pressure on the GDP growth in the third quarter this year, I have been very excited about what initiatives the Chinese central government will come up with. It’s fair to mention that this challenge is certainly not an isolated Chinese issue, as growth shrinks around the world, though it doesn’t give solace to the Chinese central government, so it has to select its action.

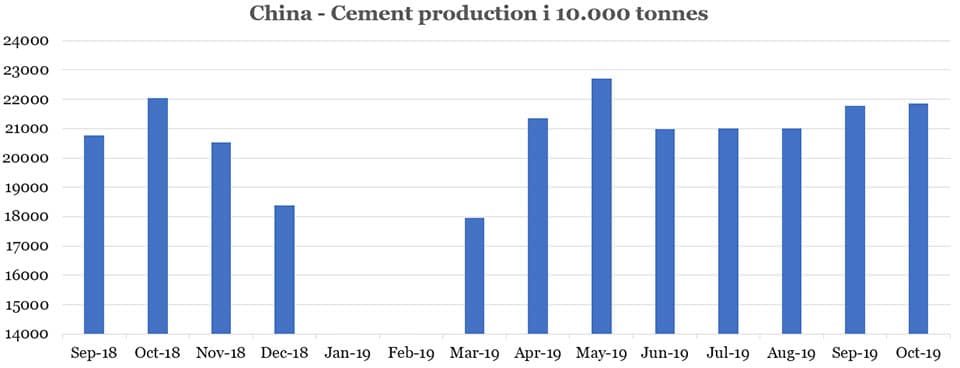

The cement production in China has gone up from 210 Mio. tonnes in June to 218 Mio. tonnes in October (graphic two), despite declining housing prices during the same period. How surprisingly strong the demand for cement is can be illustrated by the price increases for construction materials. The rumours say that the price for cement has gone up about 15 pct. during the past three months, and the price on steel bars used for construction, is also up.

Obviously, there is something going on in the construction sector, but in the national accounts, any increase in public infrastructure investments are not visible yet. Very interestingly, the provinces have been allowed to issue debt from the 2020 borrowing facilities that are meant for infrastructure investments in toll roads, ports, railways etc.

All-in-all, I argue that it seems very plausible that the central government in Beijing has, as a first step to support the growth during this quarter, returned to the good old adage of “building more infrastructure”.

The infrastructure solution is one of the least attractive options as macroeconomic support because China is running out of healthy infrastructure projects to build. It means that infrastructure spending increasingly risks to return a negative yield, which is the economic expression for an unattractive public investment that should be avoided.

These kinds of investments just keep the economy running, but do not develop or move the economy forward. Though Beijing can still manage to introduce new reforms, where I am watching out for any kind of tax reform aimed at the private households. I trust that the Chinese government is sensible enough to work in that direction as well.

In my view, the initiatives will also have a direct effect on the Chinese stock market, where I very often get the question, how much will the Chinese stock market jump if the US–China trade war comes to an end? It of course, depends on many factors, but right now, I judge that it will jump seven pct. more than the global stock market if the trade war truly ended, and the current slim “phase 1” deal. But if the Chinese GDP growth once again includes too much hot air due the mentioned infrastructure investments, then investors will hold back. Currently, there is an increasing risk that too much unhealthy infrastructure investments will offset the positive effect in the Chinese stock market should US and China find a way to a real termination of the trade war.

Graphic 1: China – Yearly change in industrial production (in pct.)

- Nov-18: 5.4%

- Dec-18: 5.7%

- Jan-19: 5.3%

- Feb-19: 5.3%

- Mar-19: 8.5%

- Apr-19: 5.4%

- May-19: 5%

- Jun-19: 6.3%

- Jul-19: 4.8%

- Aug-19: 4.4%

- Sep-19: 5.8%

- Oct-19: 4.7%

Graphic 2: China – Cement production i 10.000 tonnes

- Sep-18: 20781

- Oct-18: 22043

- Nov-18: 20521

- Dec-18: 18394

- Jan-19: 0

- Feb-19: 0

- Mar-19: 17971

- Apr-19: 21345

- May-19: 22696

- Jun-19: 20986

- Jul-19: 21003

- Aug-19: 21018

- Sep-19: 21765

- Oct-19: 21848

Written by Peter Lundgreen.

Don’t miss:

Best Hospitality And Hotel Management Schools In The World.

Best Universities In The World.

Russia’s Rich List: Richest People In Russia.

100 Most Influential People In History.

The World’s 50 Best Cities For Street Food-Obsessed Travellers.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz