The Elite Future Leader of 2030: An Insight into the New Leadership DNA

The Financial Services Environment: The leadership skills and managerial practices of many financial services professionals have been subject to ever-increasing levels of scrutiny, rules and a demand for a shift in approach, ever since the global financial crisis took place more than a decade ago.

During the past two years, however, the convergence of a number of contributing factors, namely, the advent of new technologies, the rising number of millennials in the workforce, moves towards global regulatory standardization, and access to improved levels of data transparency, have all led to the recognition that workforce composition and demands are changing; a further dimension of organisational and accountability is appearing at Board level, that is commonly referred to as the ‘millennial shift’.

A Fresh Perspective – Addressing the Millennial Shift

Whilst trying to address the big ‘millennial shift’ for their Boards, many HR Leaders and L&D professionals within global financial institutions started to recognize that a critical skills gap would exist by 2030 that would have to be filled by some big innovative learning initiatives, and set about finding potential remedies for their organizations – with C-Suite endorsement.

As is often the case, some firms were luckily already quite a long way down the road on this new learning adventure, and building and designing a range of bespoke development programs, but others were not as advanced in their thinking or actions. However, the message to all was clear: this is a pivotal moment in the allocation and development of talent in our industry and this change in the workforce demographic is the top critical factor in the need to take action.

Whatever their current organizational realities, it rapidly became clear to HR and Learning professionals that they would have to design a range of new L&D initiatives to cater for a more diverse and different motivated group of future leaders within financial services firms, that would also enable them to deliver a great return on investment both now and for their firms over the longer term.

Today, some HR leaders have a first mover advantage having already started to report impactful progress to their CEOs, but it is still not the case across the board. Most L&D professionals recognize that improvements can, and will, still need to be made along the way to their programs, backed with C-Suite endorsement and shrewd levels of financial investment, if they are going to get it right.

The plain and simple truth is that most C-suite leaders in financial services firms are now widely acknowledging that if we don’t support millennials properly, foster emerging talent and investigate new ideas, they will quickly find themselves at a competitive disadvantage by 2030. This applies not only when guiding our organizations through the current highly unpredictable global economic and geopolitical climate, but also for correctly positioning our businesses for sustainability, profitability and future growth in the wider societies in which they operate. It’s worth pointing out one key statistic here – that inside seven years, more than 75% of the financial group’s workforce will be millennials.

Raising the Impact – A New Gameplan for the Corporate Learning Pathway to 2030

The combination of shifting C-suite attitudes, along with recent reviews of requirements for future top-tier talent, has inevitably led to a revision of thinking around the application of effective learning techniques and a roadmap of development for market-leading L&D.

Current professional development solutions are not felt to always be in ‘peak condition’, but there is great excitement about the potential to develop a better learning experience for financial services that has built up inside institutions. To realize this excitement firms will need to seek learning providers with the resources to meet their ambitions. This will see a divergence in the learning provision market between providers who can operate at their client’s strategic level and others who provide a more operational and transactional experience. It is anticipated that by 2024, 60-70% of talent development programs will be based on experiential learning solutions, including simulations, cohort-based learning, case study assignments, role play and gamification. Again, this will fall more towards the learning providers in the market who are willing (and able) to commit resources towards developing these in-demand solutions.

Discovering the Ideal Leaders of Tomorrow

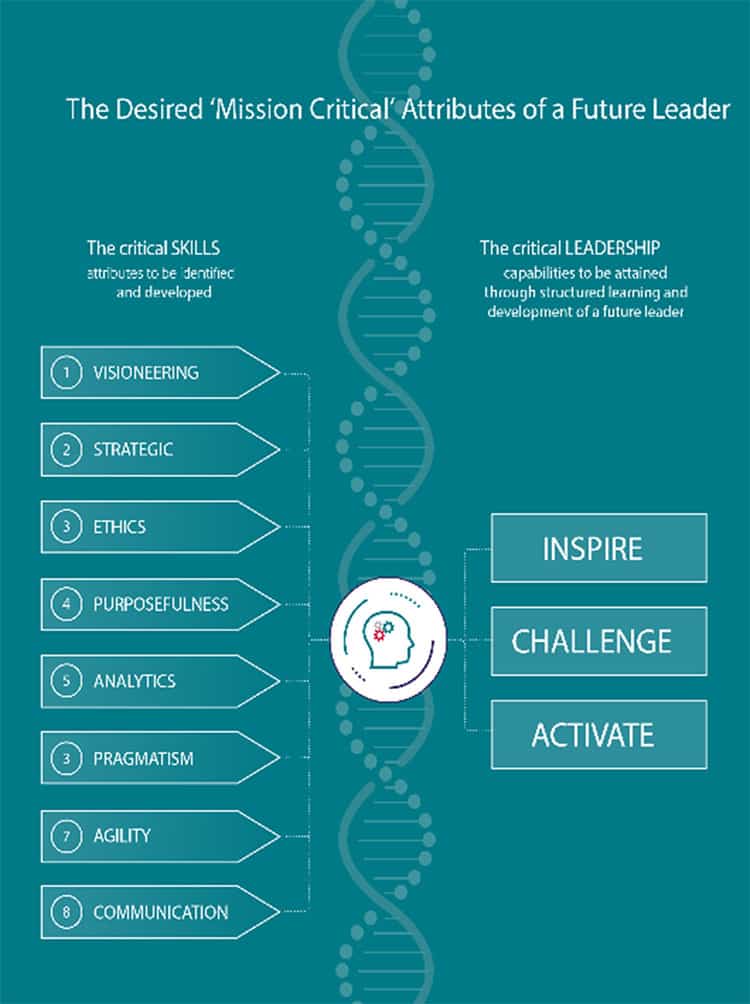

With collective improvement front of mind, a group of senior HR & L&D professionals from across the global financial services industry recently met with me to discuss our best-practice insights together, benchmark current practices and share millennial attitudes to work. We’ve created a new DNA blueprint that I am convinced will aid Board members and CEOs to better recognize the mission critical attributes of this next generation of leaders.

Some of our key findings and the DNA of the Elite Future Leader of 2030 are set out below:

What do Millennials Want?

- Firstly, millennials place a strong focus on achieving work life balance, experiencing other cultures and building inclusive societies, so any solution needs to address all of these factors. Whilst this may not be a new phenomenon, it is safe to suggest that today’s future leader has access to more opportunities and will use them if their ambitions are not being realized.

- Secondly, if you want to engage tomorrow’s leaders then you need to create structured and dynamic learning paths for them, with modules delivered via the latest technologies which they can access at a place and time that suits them best, wherever they are in the world. This will allow them to keep pace with the ever-evolving financial services industry, and know about crucial developments as and when they happen. Learning is no longer a ‘one time’ experience but instead a continuous journey with multiple junctions for the learner to navigate.

- Thirdly, the future workforce is largely comprised of a robust, inspiring individuals, who will be capable of operating equally well with at all organisational levels within number of operational functions, departments and geographies, if we just give them the right balance of structured mentoring and training to become effective leaders and help drive their organizations to greater success.

The Key Requirement for Future High Performance Leaders

- We need individuals that know how to frame an organizational vision, direct others to be part of a mission and lead with sound principles.

The Desired Mission Critical Attributes of a Future Leader

Making The Most of Change

The challenge for the financial services industry now is for us all to adopt a measured and strategic approach to people development. Our ambition should be to aim to develop the best talent there can be, but within a realistic timeframe.

This will require a maturity and realism amongst the C-suite leaders of today to create the elite future leaders of 2030. Additionally, a new strength of capability and openness to collaboration and innovation in the field of professional development is needed amongst global HR and L&D leaders right now if we are going to enable the talent of tomorrow to make the most of the curated learning opportunities presented to them today.

Written by Andreas Karaiskos.

Have you read?

The World’s Safest Cities Ranking, 2019.

The Best Hotels In New Delhi For Business Travelers, 2019.

Best CEOs In The World 2019: Most Influential Chief Executives.

Countries With The Best Quality of Life, 2019.

World’s Best Countries To Invest In Or Do Business For 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz