Tech Change Is Coming To Banking In 2019 – Here’s What to Expect!

The latest banking industry report by Deloitte provides fascinating insights into the capital markets in 2019. Transformation is rife, and banking institutions are adapting to the innovative new technologies that are being developed, and implemented across the financial world. The Deloitte Report offers an in-depth perspective into the stability of the global financial paradigms, capital markets, and regulatory arena, et al.

Among others, a comprehensive study of the world’s top 1,000 banking institutions indicates that the overall asset value in trillions of dollars was substantially higher in 2017 ($123.7 trillion) than it was in 2008 ($96.4 trillion). Additionally, there is far greater capitalization per asset at 6.7% (2017) than in 2008 (4.4%). This data was compiled by Danielle Myles (top 1,000 banks 2017) and Charles Piggott.

More importantly, there has been significant growth by region among the world’s top 1,000 banks. This indicates that the European Union, Emerging Europe, and Latin America are on an upward trajectory. Perhaps the most exciting change in banking is coming from the use of digital technologies. Banking organizations and capital markets are increasingly relying on technological advancements for the improvement of their services, product offerings, and profitability. For example, there are 5 key areas where banking organizations intend implementing digital technology. These include the following areas:

- 10% of banks plan to adopt cloud services

- 15% of banks plan to build the modern workplace

- 18% of banks plan to manage privacy, identity, and security

- 23% of banks plan to modernize legacy systems

- 28% of banks plan to create digital capabilities

9 Key Areas Where Banking Is Using Technology

- ICT (Information and Communication Technology) In Retail Banking Operations

Retail Banking is that aspect of banking which deals with the end customer. It is a burgeoning market, and the bank’s net interest margin grew substantially during Q1 and Q2 of 2018, registering a reading of 3.59% at the time, with customer loans growing to 7.84%. Increasing interest rates in the US, and elsewhere are helping to prop up the profitability of banks. Across the world, retail banking is increasingly shifting towards a mobile-ready platform and dramatic strides have been taken in this regard. Notable among the countries and regions adopting retail banking or Asia-Pacific.

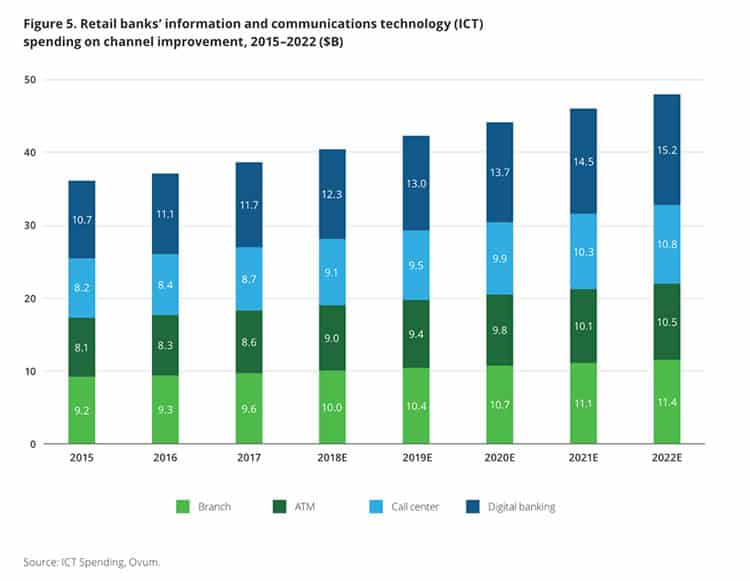

Additionally, the Deloitte study found that well over a dozen countries are particularly brand sensitive when it comes to their banking activity, with preferences for Google, Amazon, and Apple. In 2019, the majority of retail banking activity will be taking place via the bank branch at 10.4%, at an ATM 9.4%, at a call center 9.5%, and to digital banking at 13%. It is the latter aspect which is going to show dramatic growth prospects through 2022.

- Digitization of Corporate Banking Activity

Corporate Banking is that aspect of banking which deals with corporations, corporate lending, and corporate financing. This banking area is generally growing strongly in the Americas, but in emerging markets, it is declining. Increases in the Asia-Pacific countries are encouraging, but it’s the relaxation in credit markets that is fueling a rise in corporate banking profitability and activity in the United States. From a technological perspective, more efficient financial services through streamlined networks, divestitures, borrower-friendly loans and more consumer-centric operations have allowed corporate banking to exceed $1 trillion.

Intense competition is expected in the corporate banking realm in 2019, thanks largely to significant easing in credit underwriting, increased banking expertise, and modernization of banking technologies for corporate clientele. The market which corporate banking is going to be targeting heavily in 2019 is the middle market where growth of 6.7% is anticipated. Automated banking activity is likely going to replace traditional human bankers, with generalists taking over from specialists. While many have high hopes for artificial intelligence, it is not quite ready to assume a dominant role in corporate banking.

- Rapid Growth of Mobile Payment Services

It comes as no surprise that mobile payment services are outstripping the rate of growth for traditional banking at branches, ATMs, PC and Mac-based banking. It is expected that sub-Saharan Africa and Latin America will enjoy mobile payments growth of approximately 75% by 2020, and a global uptick in mobile payment activity in the region of 60% will take place within the same timeframe. This is thanks to the widespread adoption of mobile technology, decreased costs of Internet connectivity, and the ubiquity of smartphones, tablets and other mobile computing devices. Increased customer literacy vis-a-vis banking, apps, and mobile technology is a major driver of this technological change in banking paradigms.

- Robotic Process Automation (RPA) in Banking and Finance

The huge growth in connected devices is going to play a major part in banking and capital markets, FinTech, loans, and non-bank lending facilities in 2019. Increasing mobility, widespread use of Android and iOS apps for banking, and regulatory changes will be infused with AI technology to make it easier for the processing of banking data. Robotic Process Automation (RPA) is a generic term used to describe the automation of repetitive processes typically performed by a human. Without human inefficiencies in play, the RPA software can effectively complete tasks. This results in enhanced time management, and while expensive to acquire and maintain, there is a typical return on investment between 40% and 100% within 3 – 8 months. This information was compiled by the FinTech Symposium 2018.

- Adoption of Robotics and AI in the workplace

Automation cannot be stopped in the banking industry, or elsewhere. The use of sophisticated computing devices, programs, and hardware to perform routine banking functions far outweighs the downsides of reduced human reliance. For the most part, banking activities that are routine, or mundane are being replaced with automated systems, particularly at major banks like Wells Fargo, Banco Popular, and US Bank. AI is proving to be a significant boon in terms of streamlining work processes, and allowing for uniform procedures in banking activity. A quick look at banking jobs boards confirms what the banking industry already knows: employees with robotics expertise are being sought out by the big banks.

- Open Banking

Increased data sharing is more likely to take place in 2019. As trust and confidence grows, banking institutions and nonbanking entities like will establish protocols designed to enhance the safety and security of data dissemination and third-party applications and intervention. There are many such examples of this, particularly by Citibank, Capital One, and BBVA Compass. The Financial Data Exchange (FDX) was designed expressly for this purpose.

- Rapid Pace of Online Lending Facilities

Given all the technological advancements expected to take place in 2019, it makes sense that lending practices will facilitate rapid online transfers. The development of blockchain technology and related payment systems is allowing such matters. While security cannot be compromised for pace, there are top-tier MFA and biometrics standards in play to enhance the security of platforms. Loans processing is also being fast tracked with additional contact options, making it easier for customers to get in touch with lenders and banks. This cuts the waiting time, particularly with online lending facilities.

- Enhanced Simplification of the Customer Journey

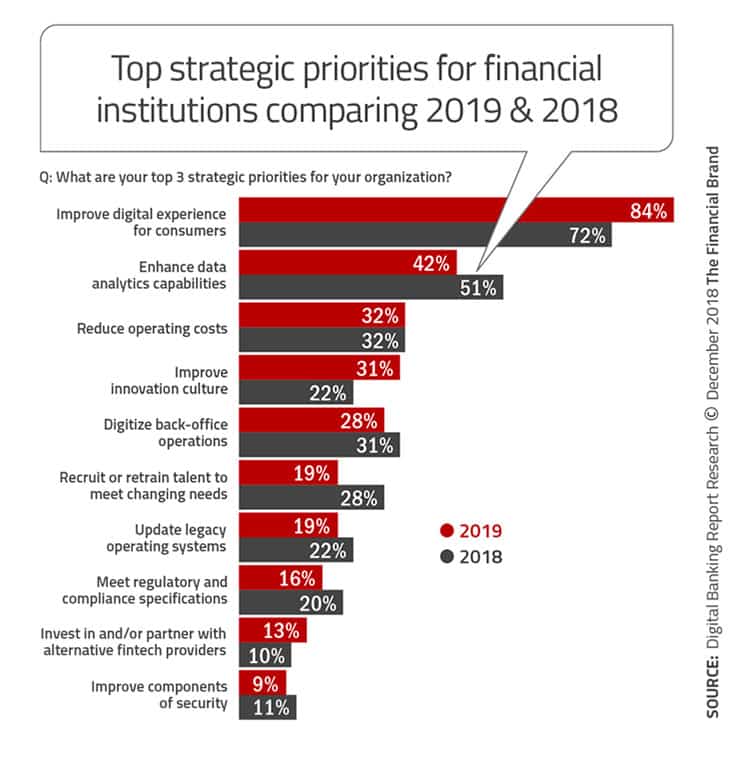

The ubiquity of real-time intelligent data integration, analytics, and cognitive computing abilities makes it much easier for transformations in banking to take place. The customer journey benefits as a result of this. Banks have listed many top strategic priorities for 2019, chief among them improvement of the digital experience for customers, enhanced data analytics, and reduced operating costs. A culture of innovation is also inherent in the overall strategic mindset, and banks are also moving to update their legacy operating systems and meet with compliance standards across the board.

- Targeting Specific Demographic Profiles For Improved Service

Banks are working hard to target initiatives that specific demographics, such as Millennials, older people, and various lifestyle choices/preferences. These boxes are a combination of ideological bents, physical demographics, cultural demographics, or simply customers with specific preferences. Banks are innovating their product offerings, and the types of services they provide based on these targeted groups. Value is being generated in these demographics and banks of profiting accordingly.

There are many exciting areas to watch where technological advancements are breeding about changes in banking in 2019. Such developments span dozens of categories, but they’re all geared towards better serving the needs of banking customers at corporate and retail level.

Have you read?

- Best Countries to Invest In.

- Most Startup Friendly Countries.

- World’s Safest Cities Ranking.

- Global Passport Ranking, 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz