Healthcare In India And The Rise Of Medical Tourism: Is Lack Of Professionalism A Roadblock?

Healthcare which comprised hospitals, medical devices, clinical trials, outsourcing, telemedicine, medical tourism, health insurance and medical equipment had become one of India’s largest sectors in terms of revenue and employment. Strengthening coverage, services and increasing expenditure by the public as well private players were some of the reasons behind the significant growth of Indian healthcare sector.

The two major components of the Indian healthcare delivery system were- public and private. The public/government healthcare system focused on providing basic healthcare facilities in the form of primary healthcare centers (PHCs) in rural areas and comprised of limited secondary and tertiary care institutions in key cities. However, the private sector majorly served in metros, tier I and tier II cities and provided the majority of secondary, tertiary and quaternary care institutions.

India had been leading in healthcare sector due to its large pool of well-trained medical professionals and competitive pricing compared to its peers in Asia and Western countries which was about one-tenth of that in the US or Western Europe. Given the global scope and growth prospects of the industry, India needed to ensure professional patient care and services. However, cases of negligence and in-human behavior at hospitals were posing a major threat to growing Indian healthcare industry. In 2017, two of the most reputed corporate hospital chains were in the news for exactly the two causes mentioned and gathered a lot of flak from the Indian public. People started questioning the morals and ethics of doctors and hospitals. Can the healthcare industry train its staff- both medical and non-medical just like any other service or hospitality industry and reduce these unhandsome episodes that question their ethics and morality? With medical tourism on the rise in India, can India afford such incidents?

WHAT HAPPENED?

Gurgaon’s Fortis Hospital was in the news in November 2017 for all wrong reasons. News went viral regarding its medical negligence leading to the death of a seven-year-old girl and also for overcharging her family. The incident got escalated all the way to Haryana health minister thus leading to loss of reputation and business of the hospital.

Haryana health minister ordered that the hospital to be removed from the list of government empaneled hospitals and had also asked the Haryana Urban Development Authority (HUDA) to look into the possibility of cancelling the hospital’s land lease. Based on this, Blood bank and pharmacy licenses of Gurugram’s Fortis hospital were suspended on December 30, 2017.

The second episode was at Max Hospital, Shalimar Bagh, New Delhi. While the couple was waiting for the arrival of their twin babies, the news of the babies’ stillbirth shook them on 30 November 2017. The babies were handed over to them in a polythene bag by Max Hospital-Shalimar Bagh after declaring the newborn twins dead. While the family was taking the babies for cremation, one of them was found to be alive and was immediately admitted to another hospital only to survive for a week. After the death of the baby on 6 December 2017, the father refused to take the body and demanded the arrest of the erring doctors at Max Hospital.

A committee constituted by Directorate General of Health Services (DGHS) on 1 December 2017 reported that the Max hospital had not maintained proper temperature and monitored vital signs of the newborn. Moreover, the committee said the staff nurses faltered in the protocol while handing over the bodies of the newborn babies without obtaining a written direction from the paediatrician.

Based on the report submitted by the enquiry panel, a prima facie case of gross medical negligence was found and the license of the hospital was cancelled by Delhi government on 6 December and the hospital was directed to refrain from admitting any new indoor patient and stop all outdoor treatment services in the premises with immediate effect.

These two hospitals were the face of modern India’s healthcare and attracted a lot of patients from across the globe. Such incidents impacted the reputation of not only healthcare in India but also an overall image of Brand India on the medical tourism map.

INDIAN HEALTHCARE MARKET

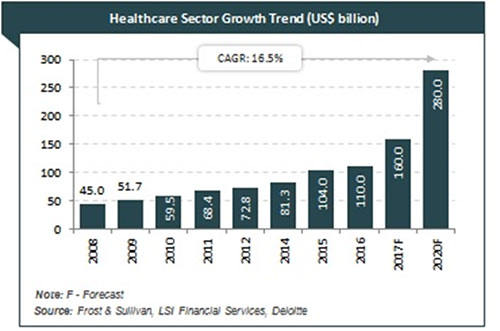

Indian healthcare market was worth around US$ 100 billion as of 2017. It was predicted that the market would grow to US$ 280 billion by 2020 and US$ 372 billion by 2022 (Exhibit 1 and 2). Indian healthcare industry operated in both the public and the private sector. Increased digital adoption was likely to have a significant impact on the growth. The Healthcare Information Technology (IT) market was valued at US$ 1 billion in April 2016 and was expected to grow 1.5 times by 2020. With the percentage of GDP rising and rural India, which was 70 percent of the population, emerging as potential demand source, healthcare services had a lot of growth potential in India.

As per data released by the Department of Industrial Policy and Promotion (DIPP), between April 2000 and December 2017 the hospital and diagnostic centres attracted Foreign Direct Investment (FDI) worth US$ 4.09 billion, Some of the key investments in the Indian healthcare industry were as follows:

- According to Ministry of Health and Family Welfare, Government of India was going to increase cooperation in the areas of health and medicine and a Memorandum of Understanding had been signed between India and Cuba.

- Fortis Healthcare had approved the de-merger of its hospital business with Manipal Hospital Enterprises. INR. 3,900 crore (US$ 602.41 million) was invested in Manipal Hospital Enterprise.

Some of the government initiatives in the field of healthcare industry were India’s first ever ‘Air Dispensary’ (which was based in a helicopter), to be launched in North East and had received INR 25 crore (US$ 3.82 million) funding by the Ministry of Development of Northeast Region (DONER). The Intensified Mission Indradhanush (IMI) which aimed at extensive coverage of immunization among children and pregnant women had been launched by the Government of India. To tackle lifestyle diseases such as cardiovascular disease (CVD), hypertension, obesity and diabetes in India, Ministry of Health and Family Welfare was going to spend over and above the current sanction of INR 955 crore (US$ 148.22 million). Setting up of National Nutrition Mission (NNM) was approved by the Union Cabinet with a three-year budget of INR 9,046.17 crore (US$ 1.40 billion) to monitor, supervise, fix targets and guide the nutrition-related interventions across the Ministries.

The Indian government targets increase in total health expenditure from current 1.15 percent to 2.5 percent of Gross Domestic Product (GDP) by 2025. Many other initiatives had also been launched like LaQshya, for Labour Room Quality Improvement, a mobile application for safe delivery, and operational guidelines for obstetric high dependency units (HDUs) and intensive care units (ICUs).In March 2018, the continuation of National Health Mission was also approved by the Union Cabinet with a budget of INR 85,217 crore (US$ 13.16 billion) from 1st April 2017 to 31st March 2020.

Despite significant growth, India’s healthcare sector had several challenges to overcome for further progression. With the majority of healthcare professionals concentrating in urban areas, there were lesser opportunities for rural areas. Key areas of concern for India’s healthcare industry were that India had the world’s second-largest population. The existing healthcare infrastructure was not sufficient to meet the needs of the population. 76 percent of Indians did not have health insurance. The rural healthcare infrastructure was understaffed leading to the rural-urban disparity.

Indian healthcare sector depended heavily on the private sector. The increase in corporate hospitals had in general contributed to the increase in professionalism. Private players had made significant investments in setting up of the private hospitals in cities like Mumbai, New Delhi, Chennai and Hyderabad. There was the emergence of latest medical technology and had created a competitive environment. The government’s share in the healthcare delivery industry was 20% while 80% was in the private sector. The emergence of corporate hospitals had led to increased professionalism in medical practices and use of hospital management tools. The top leading companies were Apollo group, Fortis, Max, Wockhardt, Piramal, Duncan, Ispat, Escorts and Ranbaxy Group Company.

PROFESSIONALISM IN THE HEALTHCARE INDUSTRY

The Healthcare Industry comprised broadly two groups – Medical practitioners and the Non- Medical support staff. Patient Management, given India’s population and medical issues, had emerged a big area. Patient Management started right from when the patient approached a hospital to sometimes years of recurring visits and treatments. The patient was mostly interacting with the administrative staff for appointments and billing related issues, nurses for follow-ups and medications, doctors for consultation. In such a situation, it became important that the different kinds of staff were aligned in their objectives and communicated well with each other as also the patient. Indian healthcare was constantly being challenged on Patient Management where the patients felt highly dissatisfied with what was communicated to them. The patient was often left wondering who to place their trust in – the doctors, nurses or the administrative staff. The two episodes listed above were one of the very few that got reported in the media but ensuring good service processes and delivery was a constant challenge that the healthcare Industry was facing.

Given the growth of the healthcare industry and its contribution to the Indian GDP, both private and public sectors were looking at training medical and non-medical staff on basic service delivery. This had emerged even more significant with India rising quickly and branded as one of the destinations of choice for Medical Tourism.

MEDICAL TOURISM IN INDIA

With general tourism on the rise, it was estimated that the volume of medical tourists reached 4 million per annum by 2012 (Deloitte 2008a). Medical tourism was becoming a major force for the growth of service exports worldwide while concentrating on a selective number of recipient countries – with India and Thailand as major global markets. Medical tourism which was also called as medical travel, health tourism or global healthcare signified the rapidly-growing overseas travel for healthcare services.

Medical Tourism was a growing sector in India. In October 2015, India’s medical tourism sector was estimated to be worth US$ 3 billion. It was projected to grow to US$ 7-8 billion by 202o. According to the Confederation of Indian Industries (CII), the primary reason that attracted medical value travel to India was cost-effectiveness and treatment from accredited facilities at par with developed countries at much lower cost. The Medical Tourism Market Report: 2015 stated India offered a wide variety of procedures at about one-tenth the cost of similar procedures in the United States thus rated as one of the lowest cost and highest quality of all medical tourism destinations. Foreign patients travelling to India to seek medical treatment in 2012, 2013 and 2014 numbered 171,021, 236,898, and 184,298 respectively. Traditionally, the United States and the United Kingdom had been the largest source countries for medical tourism to India. However, according to a CII-Grant Thornton report released in October 2015, Bangladeshis and Afghans accounted for 34% of foreign patients, the maximum share, primarily due to their proximity with India and poor healthcare infrastructure. Russia and the Commonwealth of Independent States (CIS) accounted for 30% share of foreign medical tourist arrivals. Other major sources of patients included Africa and the Middle East, particularly the Persian Gulf countries. In 2015, India became the top destination for Russians seeking medical treatment. Chennai, Kolkata, Mumbai, Hyderabad, Bangalore and the National Capital Region received the highest number of foreign patients primarily from South Eastern countries, with Chennai having come to be known as “India’s health capital“.edical tourism was growing in India at a steady rate. It was anticipated that Medical tourism in India would grow from its current size of $3 billion to $ 7-8 billion by 2020. Medical Tourism in India was recording a 22-25 percent growth as of 2017. Medical tourist arrivals in India increased more than 50 per cent in 2016 from 2015 and the industry was projected to double its size from (April 2017) US$ 3 billion to US$ 6 billion by 2018.

Over the years, India had emerged as a sought-after destination for medical tourism. The reason why India was such a preferred choice is that it offered world-class facilities and medical resources at nearly 1/10 the cost in USA and UK. (See Exhibit 3).

Road Ahead

Being one of the fastest growing sectors, India’s healthcare industry was a gold mine that was expected to reach $275 billion by 2025. Its foray into high-end diagnostic services, Abbreviated New Drug Application (ANDA) approvals, R &D, medical tourism led to multifold opportunities for providers, players and medical technology. With healthcare on the rise and India enjoying the preferred brand position in medical tourism, could India afford poor professional practices and service delivery at its hospitals?

EXHIBIT 1:

- Healthcare has become one of India’s largest sectors both in terms of revenue & employment. The industry is growing at a tremendous pace owing to its strengthening coverage, services and increasing expenditure by the public as well as private players

- During 2008-20, the market is expected to record a CAGR of 16.5 per cent

- The total industry size is expected to touch USD160 billion by 2017 & USD280 billion by 2020

- As per the Ministry of Health, development of 50 technologies has been targeted in the FY16, for the treatment of diseases like Cancer & TB

- Government is emphasizing on the eHealth initiatives such as Mother & Child Tracking System (MCTS) & Facilitation Centre (MCTFC)

- Indian companies are entering into merger & acquisitions with domestic & foreign companies to drive growth & gain new markets.

Source: Frost & Sullivan, LSI Financial Services, Deloitte

EXHIBIT 2

Source: Frost & Sullivan, LSI Financial Services, Deloitte

EXHIBIT 3

Facilities

Robust accreditation system and a large number of accredited facilities, a good number (22) of JCI (Joint Commission International) accredited hospitals had positioned healthcare system in India above global standards.

Frontier technologies

Investing in cutting-edge technology to support medical diagnostics and medical procedures was the key to significant growth in Indian healthcare industry. The recent advancements in robotic surgeries, radiation surgery or radiotherapies with cyberknife stereotactic options, IMRT / IGRT, transplant support systems, advanced neuro and spinal options were all available in India.

Finest doctors

The world-class technology was complemented by skilled world-class doctors and medical personnel. The country had the largest pool of doctors and paramedics in South Asia (1.2 million Allopathic doctors. 0.17 million dental surgeons, 2 million nurses) and approximately 0.8 million formally trained Ayurvedic doctors.

Financial Savings

Quality of care in the healthcare industry was of key importance for patients however it was the quality at an affordable cost that made India the preferred destination for estimated 600,000 people who step into India from other countries. For most of the treatments, the difference ranges from a fifth to a tenth when compared to Western countries and 80 to 90 per cent of what was charged in other South Asian medical destinations

Fast Track – Zero Waiting Time

Besides quality and affordability, what attracted the patients was zero waiting time for surgeries and all interventions.

Feeling the pulse

What made it all the more convenient was India having the highest percentage of English language speaking people which added on to a better understanding of the patients thus reassuring hospitality and great aftercare.

Written by:

Dr. Shalini Kalia is the Deputy Director – EMBA and Associate Professor – Communications at S P Jain School of Global Management, Mumbai, India.

Dr. Lubna Nafees is Assistant Professor of Marketing at the Walker College of Business, Appalachian State University, Boone, NC, USA.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz