Peculiar Insurance Policies to Help Protect Your Business

I am passionate about business. As an entrepreneur, I believe you are your own number one asset, and your business itself is a close second. Business owners who want to to maximize their capital, grow their business, and protect their assets are finding success working with life insurance companies in new ways.

For example, there are various roles that a Wealth Maximization Account can play in a business setting and a business owner’s corresponding personal financial situation. Here are a few key concepts that are part of a solid business foundation.

Key Person Insurance

Key person insurance is life insurance taken out by the employer on employees who are crucial to the ongoing success of the company.

If a key employee dies, the business could be in real trouble. Life insurance helps bridge the gap. In a small business, the key employees are owners, founders, partners—if these people unexpectedly pass, the company could die with them. Key person insurance can keep the company going through the loss.

In a larger business, the key employees are also high-level executives, top salespeople, and other essential employees. Let’s say you have a key person like a C-level or VP-level person that took two years to hire. If that person dies, it could take two years to replace them (not to mention time to get them trained up), so the opportunity cost is huge.

You can protect yourself against that with a properly designed key person insurance policy.

Buy-Sell and Stock Buy-Back Funding

If you have partners in your business, buy-sell or stock redemption agreements can help smooth the transition and keep the business going if a partner dies. A buy-sell agreement is a legal agreement that gives the other partners or owners the ability to buy out the estate of that individual at a certain price if one partner dies.

If there’s no agreement in place, if someone dies, suddenly the estate of that person is your new partner. The ideal way to fund these agreements is partially or wholly through life insurance.

Two Advanced Insurance Funding Programs

The strategies mentioned above are protection measures taken in advance of unexpected events. The proceeding strategies are advanced concepts for higher net worth individuals, families, and businesses.

Premium-Financed Insurance

Recently, a new approach has become available to bigger business owners who are purchasing new insurance or already have similar policies in place. They can obtain premium-financed insurance, which significantly reduces the cost.

If the business is big enough, banks will lend you the money to pay your premiums on very, very favorable terms. You only have to pay the interest on the premium loan, which means you could obtain permanent coverage at a term insurance price.

Premium-financed insurance is an advanced strategy and not for everyone. Banks that participate in these programs require participants to meet certain requirements.

If you do meet these criteria, this is one of the best financial decisions the owner of a bigger business can make regarding their foundational levels of protection.

The Split-Dollar Arrangement

How does Michigan head coach Jim Harbaugh make $2 million a year and pay less than 1 percent in income tax? He uses a split-dollar arrangement.

Split-dollar arrangements aren’t a new concept. They’re often used to attract and retain valuable employees. The arrangement is structured to fund a large life insurance plan on an employee. The economic benefit (death benefit) is split with the employee’s estate when he or she passes away.

In the Harbaugh case, the University of Michigan entered into an arrangement as part of his compensation package. They loaned him two million a year for six years for the purchase of a large life insurance policy. Harbaugh is responsible for claiming the amount of interest from the loan as earned income on his income taxes.

The interest rate used in these transactions is called the Long-Term Applicable Federal Interest Rate, set by the federal government.

Here’s how the benefit package pencils out:

- $2 million of compensation to purchase life insurance that Coach Harbaugh owns

- Cash value, which Harbaugh can use, grows tax-free

- A 2.24 percent interest rate was used for the first year of the arrangement, which means Harbaugh had to claim $44,800 of income on his tax return

If Harbaugh had been in the 39.6 percent tax bracket when the arrangement started, his tax liability would be $17,740 or 0.8 percent of the $2,000,000. Split-dollar plans are typically used as part of a comprehensive benefits package negotiation between a key person and their employer.

In the appropriate situation, these plans provide lucrative benefits to the employee. However, it also benefits the employer with a committed employee and an economic reimbursement in the future.

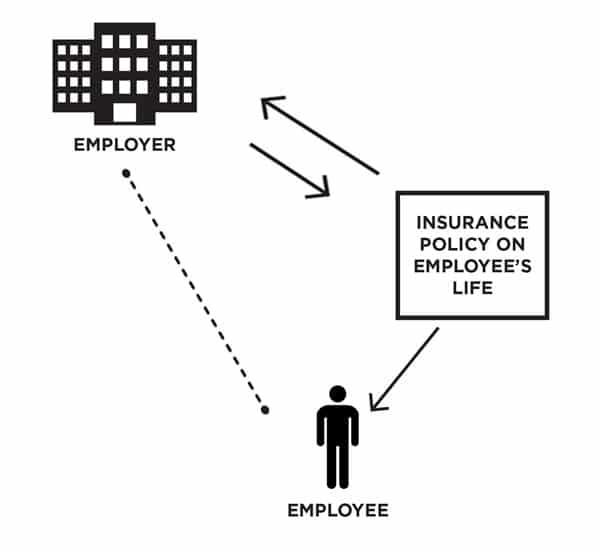

The following diagram shows how the split dollar arrangement works.

- An employer who wants to offer a fringe benefit to a key employee enters into a formal agreement to split the costs and benefits of a permanent life insurance policy.

- The employee purchases the policy and then collaterally assigns it to the employer.

- The employer pays all premiums, which are treated as a series of interest-bearing loans. If the employer chooses to forgive the loan interest each year, the employee includes the amount of the forgiven interest in the gross income and pays taxes on that amount.

- At the employee’s death (or the termination of the agreement), the employer recovers its total premiums or the cash value, depending on the terms of the agreement.

- The balance of the policy value is distributed to the employee or paid as death proceeds to the employee’s beneficiary.

Whatever method you choose, there are multiple ways to use life insurance policies to protect your business and build a solid financial foundation.

Have you read?

# Best Universities In The World For 2018.

# Best Fashion Schools In The World For 2018.

# Best Hospitality And Hotel Management Schools In The World For 2018.

# Best Business Schools In The World For 2018.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz