These are the 8 global cities on the verge of a real-estate bubble

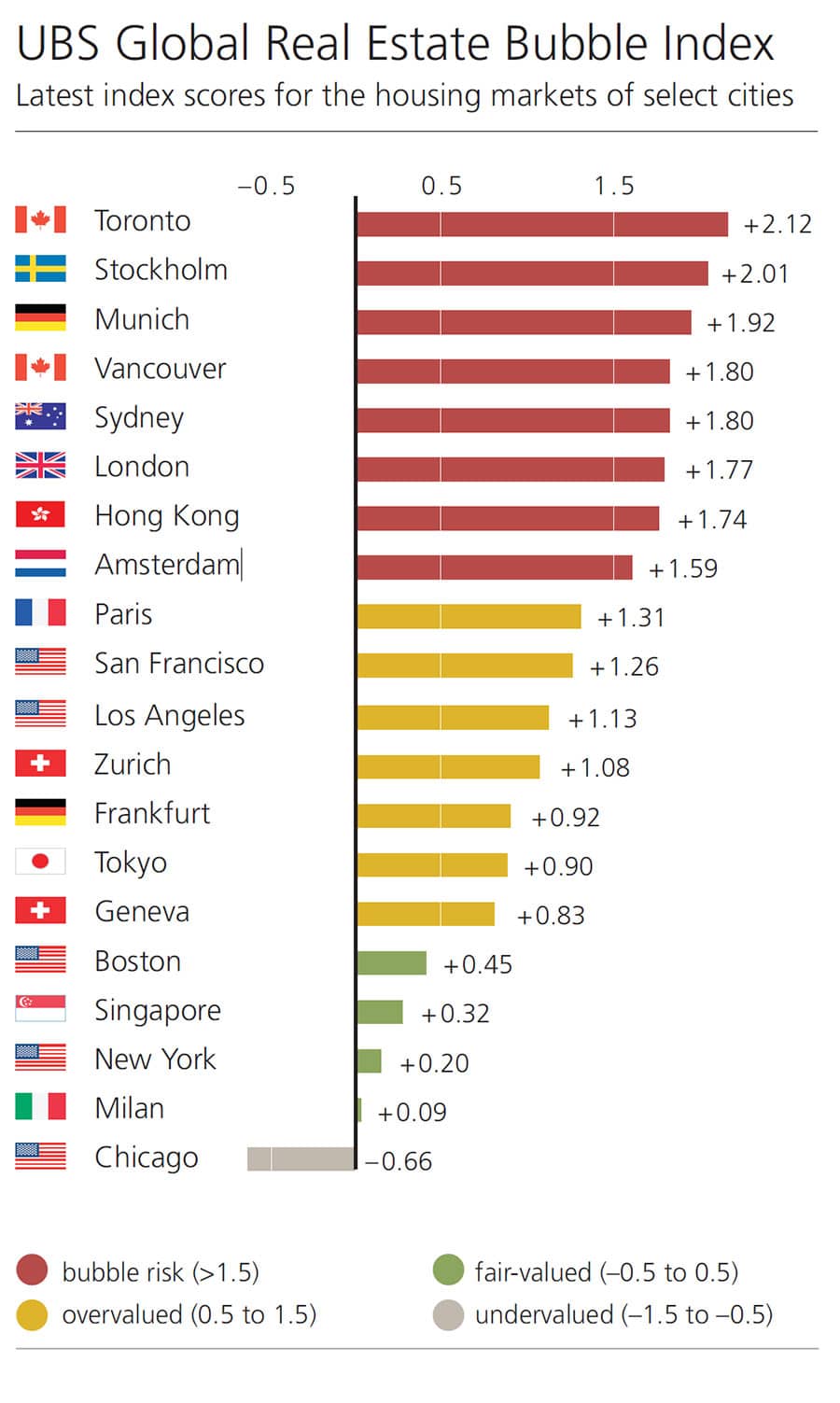

For the first time, Amsterdam, the Dutch capital, has entered the UBS list of eight cities on the verge of a real-estate bubble — and guess what, none of them are in the United States.

The number one on the bubble-risk list is Toronto, followed by Stockholm, Munich, Vancouver, Sydney, and London.

The bank highlights Toronto as the most prominent potential bubble risk, noting that real prices have doubled over 13 years, while actual rents and real income have only increased 5 percent and 10 percent respectively.

Stockholm ranked second on the list, where real prices have climbed by 60 percent over the past five years. The global real-estate bubble index lists the cities whose housing markets are at highest risk of becoming bubbles that could eventually deflate, or worse.

These are the eight global cities on the verge of a real-estate bubble

1. Toronto

Price growth: Real prices have doubled in 13 years.

2. Stockholm

Price growth: Real prices have risen 60 percent in the last ten years.

3. Munich

Price growth: Real prices have increased 85 percent in the previous ten years.

4. Vancouver

Price growth: Real prices soared 25 percent year on year, while real rents and real income have only increased 5 percent and 3 percent respectively.

5. Sydney

Price growth: Real prices again shot up 12 percent in the last seven quarters and are now 60 percent higher than in 2012.

6. London

Price growth: Housing prices were almost 45 percent higher than five years ago and 15 percent higher than before the financial crisis a decade ago.

7. Hong Kong

Price growth: Real prices are close to 3 times higher than in 2003, having increased at an average annual growth rate of 10 percent. Real rents rose in the same period by 3 percent, while incomes were unchanged.

8. Amsterdam

Price growth: since 2015 actual prices have increased by 30 percent.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz