What Really Impacts B2B New Product Success Rates?

Experts have bemoaned the low success rates of new products for years. One highly respected researcher, Dr. Robert Cooper, puts the success rate at one-in-four, when measured from the beginning of the development stage.

What’s the cause for such a low success rate?

Since the early 1970’s, research has shown the main problem isn’t with scientists and engineers failing to come up with the right answers. Rather, they are working on the wrong questions.

For more than four decades, research and experience have pointed to this simple truth: Suppliers lack proper insight into customers’ needs. In other words, what if your R&D was guessing at customer needs – and guessing badly?

The new study by The AIM Institute shows this is exactly the case for most B2B companies.

New research revealed just how poor customer insight actually is for B2B suppliers. They took an interesting approach to the research – in-depth interviews were conducted to understand customers’ real needs and compared to what new-product teams had thought those needs were before the interviews.

The Interviews

A total of 675 interviews were represented in the study, conducted by 35 project teams from 14 different companies. The project teams in the study were not from “slacker” companies: Over two-thirds of these project teams were from Fortune 500 companies (or similar size, if headquartered outside the US). Also, over half of the businesses studied already had a “leading” or “strong” position in the markets they were interviewing, so one would have expected reasonably good pre-existing customer insight.

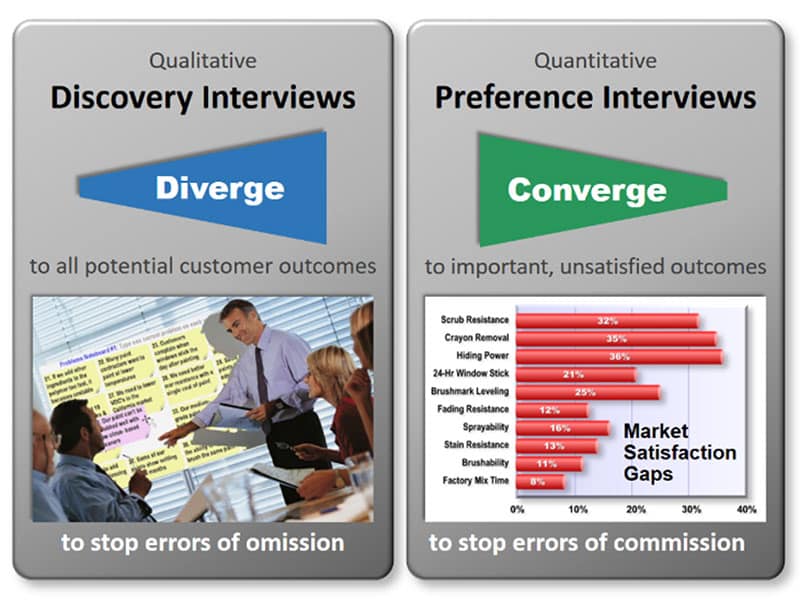

The in-depth interviews were conducted in two phases: First, qualitative, divergent Discovery interviews uncovered a full range of customers’ outcomes (desired end-results). Then quantitative Preference interviews converged on just those important, unsatisfied needs that customers wanted “fixed.” The first round of interviews minimized errors of omission, and the second minimized errors of commission. (An outcome with a “Market Satisfaction Gap” in excess of 30% gave unbiased, unfiltered evidence that the market was eager to see it improved.)

The Surprising Outcome

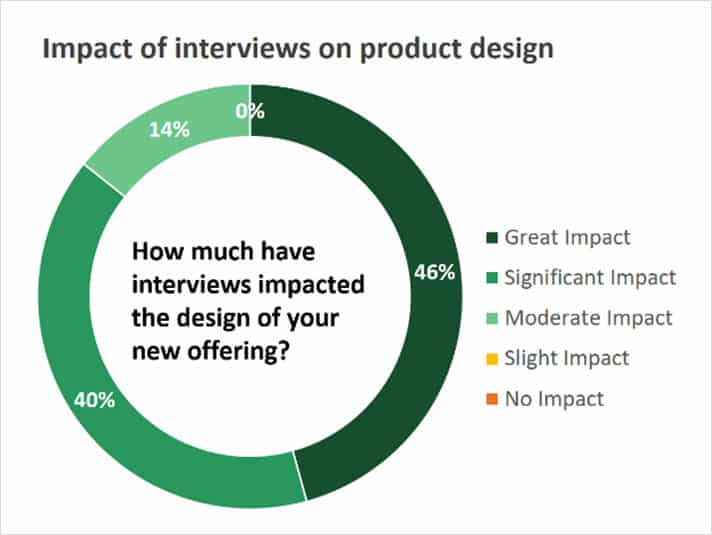

Remarkably, 86% of the project teams said their interviews had a “great” or “significant” impact on their new product design. Clearly, these teams would have developed different products without these in-depth interviews, and changed their new product design as a result of these interviews.

The results were unexpected because we’ve worked with clients as they implemented New Product Blueprinting methods and we’ve heard a recurring theme that suppliers were surprised by customers’ real needs. But to learn that 86% of teams had to change their design this significantly? We didn’t see that coming.

The study also revealed some other surprises:

- Many teams not only changed their product design as a result of the interviews: About 50% also changed their project scope—the topic area they were pursuing—either “greatly” or “significantly.

- Among the 35 market segments pursued, customer eagerness for improvement varied greatly. Some markets were uninterested in suppliers innovating for them; they were “over-served.” But nearly 50% of the markets showed great eagerness, with Market Satisfaction Gaps over 50%: At least one outcome was critically important and below the “barely acceptable” satisfaction level. This is a large identified opportunity area.

- Nearly 90% of respondent reported they were able to both listen and probe more effectively during their interviews leading to better outcomes.

- The mere act of closely engaging a customer in these types of interviews raised the customer’s estimation of the supplier. More than 90% of teams reported that their interviews led to “increased customer interest” in the supplier.

The key is ensuring your R&D works only on that which customers care about while your competitors’ R&D keeps guessing. In 20 or 30 years, most B2B suppliers will be fully tapping the incredible knowledge of their customers. But this is still rare today. B2B-optimized customer insight is an enormous source of competitive advantage for those pursuing it now.

So perhaps the bad news of poor customer insight could become good news for your company.

Have you read?

Bravery vs Bravado – what type of leader are you?

Why great leadership isn’t a popularity contest

Here Are 9 Simple Ways To Make Your Customers Happy

Advancing Strategic Decision-Making with Expert-Sourcing and Big Knowledge

Written by Dan Adams, Founder and President of The AIM Institute.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz