Insights into the Potential and Growth of the Indian Hospitality Industry and India level challenges

The Indian hospitality industry has emerged as one of the key industries driving growth of the services sector in India. It has evolved into an industry that is sensitive to the needs and desires of people. The fortunes of the hospitality industry have always been linked to the prospects of the tourism industry and tourism is the foremost demand driver of the industry. The Indian hospitality industry has recorded healthy growth fuelled by robust inflow of foreign tourists as well as increased tourist movement within the country and it has become one of the leading players in the global industry. Foreign tourist arrivals (FTAs) into the country increased steadily from 2002 to 2008. FTAs dipped in 2009, due to the global economic slowdown; however, the impact on the Indian industry was much lower than that on the global counterparts. FTAs are expected to increase in 2010. On the other hand, domestic tourist movement within the country was the highest in 2009.

Hospitality industry faces some inherent challenges as illustrated below:

- High seasonality: The Indian hotel industry normally experiences high demand during October–April, followed which the monsoon months entail low demand. Usually the December and March quarters bring in 60% of the year’s turnover for India’s hoteliers. However, this trend is seeing a change over the recent few years. Hotels have introduced various offerings to improve performance (occupancy) during the lean months. These include targeting the conferencing segment and offering lucrative packages during the lean period.

- Labour intensive: Quality of manpower is important in the hospitality industry. The industry provides employment to skilled, semi-skilled, and unskilled labour directly and indirectly. In India, the average employee-to-room ratio at 1.6 (2008-09), is much higher than that for hotels across the world. The ratio stands at 1.7 for five-star hotels and at 1.9 and 1.6 for the four-star and three-star categories respectively. Hotel owners in India tend to “over-spec” their hotels, leading to higher manpower requirement. With the entry of branded international hotels in the Indian industry across different categories, Indian hotel companies need to become more manpower efficient and reconsider their staffing requirements. In case of Mid market brands like Keys we run the ship on a ratio of 0.7 to 1

- Fragmented: The Indian hotel industry is highly fragmented with a large number of small and unorganised players accounting for a lion’s share.

- Huge upfront investment costs

- High cost of Debt

- Longer breakeven periods

- High incidence of Taxes – Indirect taxes like VAT , Service Tax , Luxury Tax , Excise etc

Classification of hotels plays a Key Role in facilities and Pricing

The Ministry of Tourism has formulated a voluntary scheme for classification of operational hotels into different categories, to provide contemporary standards of facilities and services at hotels. Based on the approval from the Ministry of Tourism, hotels in India can divided into two categories:

1) DoT (Department of Tourism) classified hotels

2) DoT (Department of Tourism) unclassified hotels

1. Classified hotels

Hotels are classified based on the number of facilities and services provided by them. Hotels classified under the Ministry of Tourism enjoy different kinds of benefits such as tax incentives, interest subsidies, and import benefits. Due to lengthy and complex processes for such classification, a significant portion of the hotels in India still remain unclassified. The Ministry of Tourism classifies hotels as follows:

• Star category hotels

• Heritage hotels

• Licensed units

Star category hotels: Within this category, hotels are classified as five-star deluxe, five-star, four-star, three-star, two-star and one-star.

Heritage hotels: These hotels operate from forts, palaces, castles, jungles, river lodges and heritage buildings. The categories within heritage classification include heritage grand, heritage classic and heritage basic.

Licensed units: Hotels/establishments, which have acquired approval/license from the Ministry of Tourism to provide boarding and lodging facilities and are not classified as heritage or star hotels, fall in this category. These include government-approved service apartments, timesharing resorts, and bed and breakfast establishments.

2. Unclassified hotels are the Hotels who have not taken or applied for classification from dot and could fall in any of the above categories

Further classification happens basis whether the hotel belongs to a chain or Brand and brings in the efficiencies of the chain in terms of service promise and delivery

1. Branded players : This segment mainly represents the branded budget hotels in the country, which bridge the gap between expensive luxury hotels and inexpensive lodges across the country. Budget hotels are reasonably priced and offer limited luxury and decent services. Increased demand and healthy occupancy have fuelled growth of budget hotels. These hotels use various cost control measures to maintain lower average room rates without compromising on service quality. Keys Hotels, Ginger Hotels, ITC Fortune, Hometel, and Ibis are some of the popular Mid market / budget hotels.

2. Other smaller unbranded players :These are small hotels, motels and lodges that are spread across the country. This segment is highly unorganised and low prices are their unique selling point.

Growth drivers which the Industry has seen

The fortunes of the hospitality industry are closely linked to the tourism industry and hence tourism is one of the most important growth drivers. In addition, all factors that aid growth in the tourism industry also apply to the hospitality industry. The Indian hospitality industry has recorded healthy growth in recent years owing to a number of factors:

1. Increased tourist movement

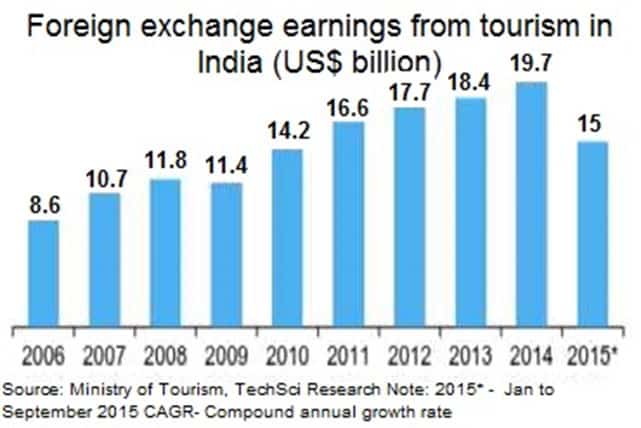

Increased FTAs and tourist movement within the country has aided growth in the hospitality industry. Healthy corporate profits and higher disposable incomes with easier access to finance have driven the rise in leisure and business tourism, thus having a positive impact on the hospitality industry. India is a large market for travel and tourism. It offers a diverse portfolio of niche tourism products – cruises, adventure, medical, wellness, sports, MICE, eco-tourism, film, rural and religious tourism. India has been recognised as a destination for spiritual tourism for domestic and international tourists. Total contribution by travel and tourism sector to India’s GDP is expected to increase from US$ 136.3 billion in 2015 to US$ 275.2 billion in 2025. Travel and tourism is the third largest foreign exchange earner for India. In 2014, the country managed foreign exchange earnings of USD 19.7 billion from tourism.

The launch of several branding and marketing initiatives by the Government of India such as Incredible India! and Athiti Devo Bhava have provided a focused impetus to growth. The Indian government has also released a fresh category of visa – the medical visa or M visa, to encourage medical tourism in the country. India is expected to receive nearly half a million medical tourists by 2015, implying an annual growth of 30 per cent. In November 2014, Government of India launched Tourist Visa on Arrival (TVoA) which is enabled by Electronic Travel Authorization (ETA), known as the e–Tourist Visa scheme for 43 countries. The facility is likely to enable 7.5 percent growth in the tourism sector in 2015.

The Government has also been making serious efforts to boost investments in tourism sector. In the hotel and tourism sector, 100 per cent FDI is allowed through the automatic route. A five-year tax holiday has been offered for 2, 3 and 4 star category hotels located around UNESCO World Heritage sites (except Delhi and Mumbai). The investment in tourism sector is expected to be US$ 12.4 billion in the 12th Five Year Plan; of these, private investments are likely to total US$ 9.2 billion

2. Economic growth

India is one of the fastest growing economies in the world. It recorded healthy growth in the past few years, at more than 9% each during FY06-FY08. Despite the global economic slowdown, the Indian economy clocked growth of 6.7% and 7.4% in FY09 and FY10 respectively. Attractiveness of India has encouraged foreign players to set up their operational facilities in the country. Domestic industries have also made heavy investments to expand their facilities through Greenfield and Brownfield projects.

3. Measures undertaken by the government

Various policy measures undertaken by the Ministry of Tourism and tax incentives have also aided growth of the hospitality industry; some of them include:

• Allowance of 100% FDI in the hotel industry (including construction of hotels, resorts, and recreational facilities) through the automatic route

• Introduction of ‘Medical Visa’ for tourists coming into the country for medical treatment

• Issuance of visa-on-arrival for tourists from select countries, which include Japan, New Zealand, and Finland

• Promotion of rural tourism by the Ministry of Tourism in collaboration with the United Nations Development Programme

• Elimination of customs duty for import of raw materials, equipment, liquor etc

• Capital subsidy programme for budget hotels

• Exemption of Fringe Benefit Tax on crèches, employee sports, and guest house facilities

• Five-year income tax holidays for 2-4 star hotels established in specified districts having UNESCO-declared ‘World Heritage Sites’.

4. Changing consumer dynamics and ease of finance

The country has experienced a change in consumption patterns. The middle class population with higher disposable incomes has caused the shift in spending pattern, with discretionary purchases forming a substantial part of total consumer spending. Increased affordability and affinity for leisure travel are driving tourism in India and in turn aiding growth of the hospitality industry. Emergence of credit culture and easier availability of personal loans have also driven growth in the travel and tourism and hospitality industries in the country.

Trends in the industry

The hospitality industry recorded healthy growth in early-2000, leading to a rise in occupancy rate during 2005/06 and 2006/07. Consequently, average rates for hotel rooms also increased in 2006/07. The rise in average rates was also a result of the demand-supply gap for hotel rooms, especially in major metros. Hotels were charging higher rates, at times much higher than that those charged by their counterparts in other parts of the world.

Lured by higher returns experienced by the hotel industry, a number of players, domestic as well as international, entered the space. India became one of the most attractive destinations for such investments.

While on the one hand, investments continued to flow into the hotel industry, hit by sharp rise in rates, corporate started looking for alternate cost-effective lodging options. This led to emergence of corporate guest houses, especially in major metros, and leased apartments as replacements for hotels. While average room rates rose in 2007/08, occupancy rates dropped. Occupancy rates plunged sharply next year, as demand declined following the global economic slowdown and the terror attacks in Mumbai. As a result, hotel rates declined during 2009-10.

The hospitality industry reported improvement in 2009-10, with domestic tourist movement in the country being at a high. While average rates remained lower, occupancy rates rose, supported by surge in domestic tourist movement. The industry is expected to report healthy growth in 2010/11, with expected increase in domestic tourist movement and rise in international tourist arrivals.

Development of other markets

A major trend in recent times is the development of the hotel industry in cities other than major metros. As real estate prices have been soaring, setting up and maintaining businesses and hotels in major metros is becoming more expensive, leading to search for other cities entailing lesser costs. Consequently, hotel markets have emerged in cities such as Hyderabad, Pune, and Jaipur. This has led to increase in hotel development activity and expansion of hotel brands within the country.

The industry has also seen development of micro markets, especially in primary cities. As cities grow larger and more office spaces come up across the city, travellers prefer to stay at hotels closer to the place of work/visit to save on time. This has led to the same hotel company setting up hotels across different location within a city.

New emergence of marketing strategies and developments on Technology

Marketing strategies in the hospitality industry have changed drastically over the past decade. A decade back, the brand name of the hotel was a major driver. However, with the arrival of well educated and experienced travellers, hotel companies have had to change/realign their marketing strategies. Today, hotel companies marketing strategies are differentiation, consistency, customer satisfaction, delivery of brand promises, and customer retention. Development and use of technology have also changed the way hotel companies operate, creating the need for online marketing. Travellers increasingly conduct basic research on the Internet. Blogs, networking sites, and travel sites are therefore being used for making choices and the information provided tends to influence opinions and choices. Several travel portals have emerged in recent times and travellers are increasingly using these portals to make hotel reservations.

The Emergence of Online Travel Agents (OTAs) in India:

Internet and mobile penetration is on the way up Estimated 8.4 million Indians likely to book hotels online by 2016 up from 3.5 million in 2014 Indian online hotel industry to be US$1.8 billion by 2016 from the current US$0.8 billion Hotel bookings is one of the least penetrated segment within the travel categories in India; online bookings account for 16% of the hotel booking currently (expected to grow to 25% by 2016) In Europe, 70% of the hotel rooms are booked via online booking portals while it stands at 35%-50% in USA. Online Travel Agents (OTAs): OTAs are agents selling travel products and services like airlines, car rental, cruise lines, hotels, railways and vacation packages on behalf of suppliers. They establish an online market place and earn profits on the discount-commonly referred to as commission, offered to them by the suppliers. Some deeper pocket OTAs also provided heavy discounts- at times incurring losses, in order to gain market share, thereby disrupting the market place. The resultant price war amidst OTAs at times leads to prices lower than those offered by the hotel’s website-eroding the hotel’s pricing power and positioning in the market. When the global hospitality industry was facing a drop in demand during the economic downturn of early 2000, hotel service providers had to turn to OTAs (which were cropping up fast aided by the dawn of the internet age) to market perishable room nights. The gain in popularity of these channels meant that the number of bookings routed through OTAs increased, thus impacting hotel revenues, and hence from 2002-03 onwards, majority of global hospitality majors started implementing strict rate parity rules. Larger OTAs also use their clout in the online space against hotel service providers, mandating rate parity featuring clauses, effectively dictating hotel tariffs at times. Hotels accept these clauses for fear of dropping down on the OTA’s search results list. However, these clauses have led to investigations from competition authorities of various countries, largely due to the uneven playing field that they create for smaller OTAs

The internet age has transformed the way a traveller chooses and executes his travel plans. Travellers are increasingly using the internet to research and book flight tickets and hotel accommodation, swapping traditional travel agents for online travel agents (OTAs). The deepening penetration of internet usage has lead to increased booking of hotels through online portals and applications in recent times. While the ease of access has provided hoteliers with an effective marketing avenue for their rooms, it has also increased the cost of customer acquisition due to Commissions paid to hotel aggregators and OTAs and Expenditure on upgrading IT systems, Websites, Mobile applications.

Hotel website:

Apart from registering with OTAs and Meta-search services, hotel companies also operate their own branded websites which allows customers to book hotel rooms across their respective brands. Hotel operators generally strive to capture a larger share of online bookings through their own websites, as this significantly lowers the cost of customer acquisition and leads to stickier customers. In view of the rate parity clause between hotels and OTAs, the differentiating factor for hotels has been loyalty benefits like free stays, complimentary amenities and even frequent flier miles on direct bookings through the hotel company’s website. Recently to counter this, OTAs themselves have started offering loyalty programs to booking routed through them. It would be prudent on the part of any hotel revenue manager to constantly monitor the various channels and search engine offerings to maintain the lowest cost of sale and the highest return on investment for its website, thereby driving traffic to its own websites

Hotel Aggregators:

Over the past few years, hospitality in India has seen the budget-hotel segment grow and make its mark on the industry. The entry of OYO Rooms has been a game-changer, giving birth to a whole new industry, and organising properties within this segment. This has helped highlight the value of independently run hotel businesses. Never before has the country’s hospitality industry witnessed such a surge in the growth of these ‘budget brands’.

It is the sudden influx of these ‘budget brands’ that has ignited the growth of this sector, fuelled by the drastic, almost unrealistic pricing that they have introduced. Domestic tourism has especially benefitted from this and has been growing steadily from 2014, with the number of trips increasing by 12 per cent. India is beginning to witness an increasing interest in internal tourism, as a younger generation of travellers begin to dictate trends in the country. This is a direct consequence of the growth of smaller segments and businesses within hospitality. While the impact that these businesses have had on the industry is impressive, this is just the beginning, and well begun is still only half done. To take their business to the next level, these brands need to implement stringent quality standards and focus on the guest experience.

These brands today have a lot in common with the dedicated aggregators; in fact, MakeMyTrip has gone the extra mile, creating a dedicated Value+ category to go head-to-head with these new age-brands. In the case of aggregators like Keys Lite, Best Western or Choice, the properties carry a signature of their branding – making it necessary to maintain the quality of experience guaranteed by this branding. Prioritising this guest experience becomes a critical component of this model.

The guest’s journey actually begins the moment he or she starts looking for a room, and doesn’t end until post-checkout. The hotel will need to ensure that this experience remains consistent and meets all the expectations set by the brand. As of today, there are a number of technical difficulties scattered throughout the booking process, from which problems can arise at any point.

The aggregators have created demand; this now has to be provided a standardised solution

Veteran Hoteliers have invested a significant amount of time and money into monitoring and performing in-depth audits on brand standards and guidelines. The new-age budget brands in India now need to step up and claim control or establish a process to deliver a consistent, high-quality guest experience. Because there is no standardised routine to ensure this in an independent budget hotel, the quality of the guest’s visit is put at risk – this is what these brands have to overcome. Reservations can get mixed up, double-bookings can occur, room availability may be misinterpreted and guests may need to be accommodated at other properties. These issues can severely hamper the growth of this segment as a whole. Without end-to-end automation, the odds of a catastrophic mix-up escalate rapidly along with the hotel’s own growth. This percentage of hotels encountering the above-mentioned problems should easily be in double digits.

When such a high level of deficiency exists, it complicates matters for demand generators, who then have to organise manual checks and follow-ups to oversee the management. This is unchartered work for them and negatively impacts their bottom-line at the end of the day. Moreover, with room prices starting from just Rs.999, the commissions that these demand generators earn would be as little as Rs.200! With margins this low, the additional overhead costs that come with maintaining consistency can severely inhibit the model’s profitability.

Without a certain degree of control over the properties being listed, establishing consistency can become a real challenge as most of these properties have no comprehensive processes to ensure clean rooms, washed linen, replenished toiletries and so on. We owe it to the buyer to provide everything that is promised during the sale, and given the existing infrastructure, resource base and automation levels of these suppliers, it is almost impossible to fulfil this promise. Having said that, the demand generators cannot be expected to monitor each and every guest-cycle either as it will affect their long-term economic stability. There is an overwhelming need for a solution that allows the properties to monitor their own operations effectively, while also simplifying communication between the supplier and the brand/demand generator. This is what the demand generators can do – focus on supplier-side technology.

Disruption has Improved Proactivness in the Industry

By taking initiative beyond generating bookings and branding the property, the brands can equip these properties with processes and technology that can simplify this management for both parties. Take automation of repetitive tasks for instance: this can significantly bring down the number of human errors and unsatisfied guests, enhance the guest experience, and even lighten the load on the hotel’s staff. In addition, technology can also automate certain aspects of the collaboration between the supplier and the demand generator, lowering costs as well as dependence on manpower. By employing these methods, these demand generators can ensure long-term sustainability; to be fair, it’s not easy! As I write this article, I’m sure that even they are probably mulling over this strategy. It’s easier said than done, but it is necessary to bring about the disruption we all want to see.

Domestic tourism is scaling new heights every year and is among the primary elements behind inbound tourism – there were over 1.3 billion domestic trips recorded in 2014. The opportunity to ride this wave is there for the taking and with the right tools, properties across the country will be able to benefit from this growth. We are already seeing these companies target the South-East Asia Market. Thailand, Indonesia, Malaysia and many more nations could benefit from such initiatives, and soon we will either see these brands venture into these markets, or their clones mushroom there. These are good times for small and medium business owners, a segment of hospitality that is well-poised for rampant growth and the hoteliers couldn’t be happier!

Opportunities

The prospects for the hotel industry in India are bright. With revival in the global economy, international tourist inflow into the country is expected to rise. Additionally, hosting of international sports events and trade fairs and exhibitions in the country are expected to aid both inflow of international tourists and domestic tourist movement.

The upcoming industrial parks, manufacturing facilities and ports across the country provide a good opportunity for budget and mid-market hotels. Although around 89,500 additional rooms are expected to come up in India in the next five years, the supply of branded/quality rooms in India is much lower compared to other countries across the globe. Hence, there exists huge potential for investors and operators across all the segments of hotel industry in India. The increase in room inventories is expected to make the hotel industry more competitive and hotels would be under pressure to maintain quality and service levels at competitive prices. Competitive pricing amongst the branded hotels along with the addition of more budget and mid-market hotels would make the hotel industry cost competitive with other destinations. This would aid the growth of segments such as MICE, amongst others.

While there is immense potential, concerns for growth of the industry remain. These include high real estate prices in the country, security threats, shortage of manpower, high tax structure, and non-uniformity in taxes.

Key drivers to growth would be the increase in domestic travel. The Companies believe that this could be a game changer and the factors which could help achieve this demand increase would be

1. High disposable income: With the buoyant growth in the Indian economy, the Indian middle class has higher disposable income. This has been identified, by about 94% of the respondents as a key factor for the increased domestic travel across the country.

2. Advent of new locations: the increased demand would come from new locations largely due to better access and improved infrastructure. Therefore, a significant supply is being developed and likely to develop at such locations All categories are under served at this point of time. Though there are fewer cities where you can have five-star hotels but much larger number of cities with greater potential for budget category hotels in India. Affordability and quality of experience are key factors in defining this shift away from five star to more budget category hotels.

3. Loyalty programmes and promotion: Although travellers value loyalty programmes and promotional schemes, our survey participants do not see it as a key determinant in selecting their accommodation. Other factors that are contributing to the growth in domestic tourism include access to online travel and hotel bookings.

Companies have to Build efficiencies and put in place strategies to expand which they are doing .They are taking initiatives to build efficiencies in their current operations. Better management of costs is at the top of the agenda.. The big ticket initiatives to reduce costs include the following:

• Converting fixed costs to variable: Increase proportion of non-contracted labour and outsource back-end operations.

• Reducing energy costs: Eliminate wasteful consumption and adopt ‘green’ building methods.

• Managing manpower costs: Train employees across multiple skills, invest in technology, explore outsourcing and manage attrition better.

• Decrease project costs: Reduce construction costs and crash time for new project development.

Tier I cities preferred for expansions: Tier I cities, primarily Mumbai and Delhi, continue to be the most preferred locations for expansion. However, more and more hospitality players are now willing to invest in Tier II towns to capitalise on the growth of domestic travel. Although most players are not looking for international locations actively, some (especially the larger Indian chains) are open to expanding internationally, provided there is opportunity available. Several players are opting for the multi-location and multi-format strategy to expand their business and are entering new geographies for growth. With this multi-format and multilocation strategy, managing brands to ensure clear positioning and identifying the strategic role of each brand within the portfolio is likely to be very critical. While some of the international chains have clear views on the distinct positioning of their brands some of the Indian chains are in the process of formulating their brand strategies. This could be key to sustainable growth in the future.

While Companies and Top management are working on expansion and building operational efficiencies, there are several other challenges that need to be addressed by various stakeholders.

Key among them include talent management, tax and regulatory issues and addressing the infrastructure deficit.

• Inadequate supply of quality talent

• High talent attrition to competitor industries

• Low employee productivity and high regulatory Infrastructure

• Poor connectivity

• High cost of developing property

• Multiple approvals from various government bodies

Tax and regulatory

The rising land prices in India and the high financing costs have resulted in high room tariffs and long gestation periods for achieving break even. The industry needs Preferential FSI norms to the sector which will lead to rationalisation of per room cost and hence result in better economies of scale. Additionally, the recognition of the hospitality sector with an ‘infrastructure status’ has been a long pending demand. This recognition will facilitate availing loans at lower interest rates, extend other fiscal benefits under the Income-tax Act, 1961 and ease the utility of ECB regulations. CFO’s need to ensure the business strategy and plans are de risked and take into account cycles as well as the regulatory and approval cycles along with the seasonality of business. They need to ensure that the Debt equity ratios are kept in check and debt is serviced through the cash flows from operations over a longer period of time. CFO’s work closely with bankers to try and get the best Loan tenures and interest rates and ensuring the cash flow mismatches in the initial period of the hotel opening are the minimum.

Economic Cycle Sensitivity and Future

The hotel industry is sensitive to economic cycles and witnesses cyclicality, accentuated both by supply and demand. The Indian hotel industry, over the past nine years (FY2008-FY2016), has been in a state of flux—starting from the FY2008 peak to a trough in FY2010, a brief pickup in FY2011 and downhill till it bottomed out in FY2015-2016. After strong headwinds from an adverse demand environment and excess room inventory, the situation has improved over the past 12 months with the pace of room addition slowing down and domestic demand being supportive.

Traction in ARRs is critical for the Indian growth story as potential demand had—during industry peak of FY2008—led to a spate of new hotel project announcements by Indian and international hospitality majors who were keen to establish their presence in the Indian market. However, with the subsequent economic slowdown, supply outpaced demand, suppressing pricing power and reducing occupancies. Hotel projects being capital intensive, many players ended up with high leverage (industry sample leverage has been greater than 1.1x over the last five years) and the resulting high-interest outgo (interest coverage for the sample industry at 2.1x in FY2016e). Subdued operating metrics and capital intensity in the business along with significant investment in new supply over the last five years have suppressed industry-wide profitability (Return on Capital employed, or ROCE, of around 5).

For newly launched properties, the gestation (to achieve breakeven) period has stretched because of lower than anticipated occupancies and average room rates (ARRs), resulting in an extended period of losses.

Pan-India occupancies have grown by 5% during FY2016e to around 63% (from 60% in FY2015); ARRs however continue to be at previous-year levels leading to a 5% growth in Revenue per Available Room (RevPAR) during FY2016e.

Supply pipeline looked strong going into FY2017 During the current year (FY2016e), the industry has witnessed a marked improvement in occupancy level, though ARRs continued to flatten out. With the sub-cost ROCE, there has been a considerable slowdown in new project announcements in addition to deferment of a number of already announced projects. This has resulted in slower than estimated supply growth during FY2016. While the estimated pipeline growth going into the next year is strong at 15%, actual supply growth during FY2017 could be lower at 7-8% with continued delay and deferment in projects. Demand momentum supported by domestic travellers Domestic travellers have been the bedrock of demand for the Indian hotel industry over the past several quarters, as we have had a 20 consecutive months of YoY occupancy increase, lack of traction in ARR is a worrying feature .

Foreign traveller arrivals (FTA) have been slow but now with the government’s efforts on Visa on arrival and better connectivity we should see an increase in demand . Demand grew by over 10%-12% in FY2016e following 6% and 8% during FY 2014 and FY2015, respectively.

Meetings, incentives, conferences, and exhibitions (MICE) traffic (despite the weak corporate results), destination events, government meetings (particularly in Delhi and State capitals like Hyderabad) and Defence stays collaborated with short-stay business travel to drive demand for rooms despite a 6% growth in supply.

Domestic demand outlook is expected to be strong with pickup in economic activity and increase in urban disposable incomes (following the Seventh Pay Commission payouts). FTAs are however expected to be weak during FY2017, given the weak global economic outlook and heightened security concerns worldwide.

With a pan-India occupancy increase, revenue growth would continue; margins exhibit marginal uptick and the industry growth is expected to be around 15%. Revenue growth is expected to improve in FY2018 to 15-17%, aided by stronger domestic demand, pickup in FTA and the return of pricing power as supply additions slow down. None of the large hotel companies has significant capital expenditure plans in the pipeline at present—unlike during the high fixed capital formation period of FY2007-FY2013. Some of these companies though might engage in opportunistic distressed-asset acquisition while others would be keen to reduce debt through monetization of their assets.

++++++++

Written by Vikas Chadha, Executive Director and CFO Berggruen Hotels Pvt Ltd, Run under the Brand “ KEYS” in India.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz