Succession Planning: Organizations Still Have Some Work to Do

When asked about their organization’s preparedness to replace key leaders, the survey uncovered a surprising dichotomy. Almost six in 10 respondents said their company had a succession plan in place, but 80 percent said their company would need at least a year to replace them if they were to leave.

The explanation to these seemingly conflicting statistics is quite simple. While companies may have a succession plan in place, it is not the same thing as saying they have a direct replacement for the departing senior-level executive. Such a succession plan could involve a planned transition of several months or longer, with an interim leader appointed to take over the executive duties during the search for a full replacement.

Surprisingly, 26 percent of respondents said their organization did not have any succession plans in place. Publicly owned companies fare better with 68 percent having a succession plan in place, while only 40 percent of not-for-profits and 42 percent of family-owned businesses were prepared. Additionally, EMEA organizations are the most prepared for senior executives to leave.

Clearly, there remains a gap in succession planning by many organizations. This oversight will likely be exacerbated by the exit of Baby Boomers from the workplace, as well as the different relationship with work that many younger employees have.

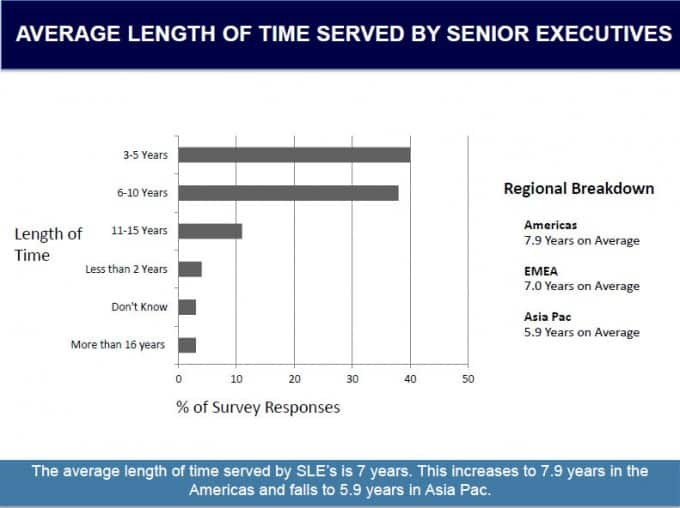

Organizations around the world have different expectations of how long a senior executive will remain with an organization, but the average is seven years. In the Americas, the expectation was slightly longer (7.9 years), while in Asia-Pacific, it was shorter (5.9 years).

Length of service also differed by industry. Professional services tend to retain senior executives the longest (8.1 years), while the pharmaceutical (5.7 years) and consumer products (6.1 years) industries hold them for shorter periods of time.

In the future, it is likely that this statistic will change drastically; corporate expectations for length of service may have to be managed as Gen-X employees reach the C-suite, given how much more frequently they tend to change jobs.

While respondents reported differing levels of preparedness to replace a key executive, more than half of them said an unexpected departure within the last three years caused some difficulty in their place of business. Only one in eight said that the unexpected departure of a senior manager did not impact their business.

Not-for-profit companies experienced the most hardship when a senior team member left unexpectedly, with 95 percent saying it caused some level of difficulty. Similarly, those in the pharmaceutical and professional services sectors were also likely to suffer, with 67 percent saying it caused some or considerable difficulty.

When asked what implications these unforeseen departures caused, respondents said:

- Negative impact on current culture

- Loss or delay of a new product or service

- The departure of another executive

- Loss of revenue

- Negative publicity

Notably, loss of revenue was ranked number two by respondents in EMEA and loss of planned merger or acquisition was least affected by unforeseen departures of senior executives across all regions. Globally, most functional effects – loss of profit, loss of products, loss of clients – scored considerably lower than those that ranked.

Respondents at small organizations saw the least impact from unforeseen departures, with 56 percent saying that it had no significant business impact. Family-owned businesses were most likely to experience a negative impact, likely due to breakdown of personal relationships.

New Global Survey Reveals Surprising Consistency Around the World, By Christine Hayward, Executive Director of IIC Partners.

- What Do Companies Seek Most in a Senior Executive?

- More Female Representation on Senior Executive Teams: What is Driving Organizations

- Succession Planning: Organizations Still Have Some Work to Do

- Do Companies Prefer Internal or External Candidates When Filling Senior Positions?

*****

About the Survey Respondents

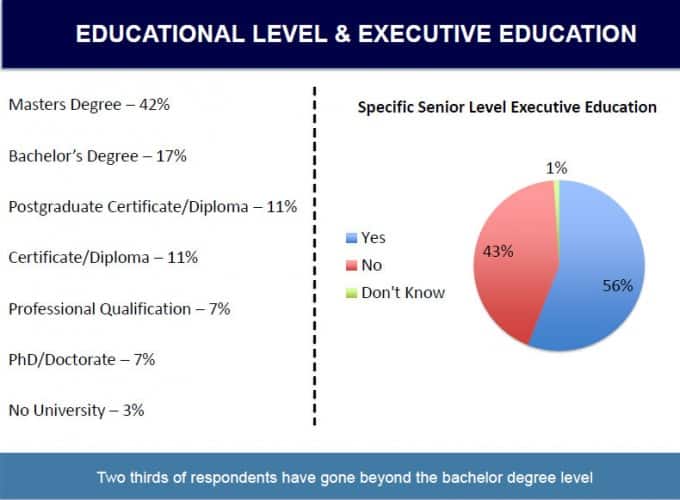

The survey respondents came from 18 industry sectors ranging from manufacturing and financial services to mining and retail. Sixty-two percent of the respondents were at the C-suite or Managing Director level, with 520 from the Americas, 383 from EMEA and 347 from Asia-Pacific. Two-thirds of respondents have a Master’s Degree or higher.

The survey, administered by Amárach Research of Dublin, Ireland, consisted of responses from executives at publicly held organizations (38 percent), privately held firms (43 percent), family-owned companies (8 percent), not-for-profits (5 percent) and other types of businesses (3 percent).

Christine Hayward is Executive Director of IIC Partners, one of the top 10 executive search organizations in the world. The network of Independent International Consultants is made up of 40 independently owned and managed executive search firms representing 48 offices in 34 countries, all considered to be leaders in the geographic and industry markets they serve.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz