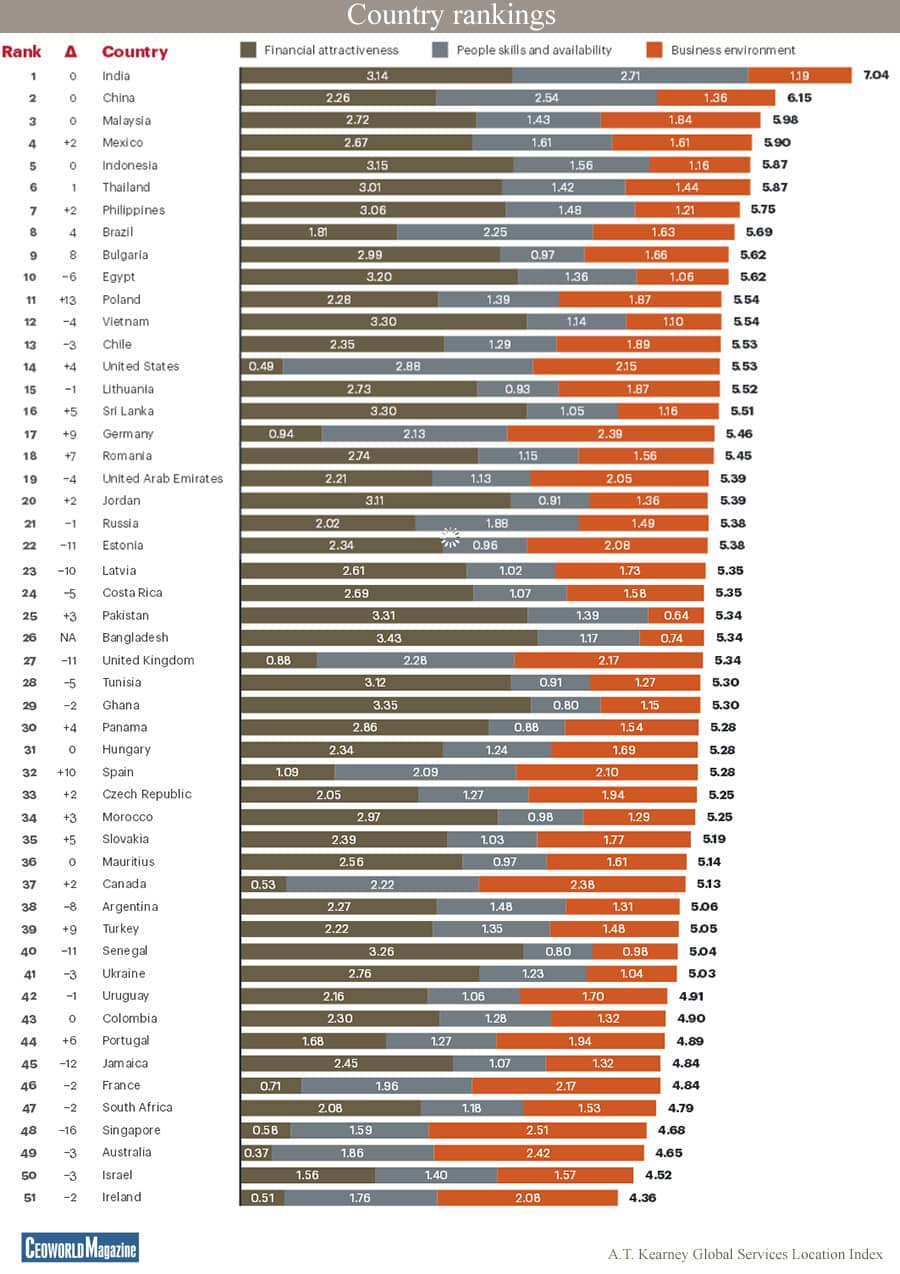

Top 26 Outsourcing Destinations For Information Technology (IT) companies: List of Countries

India remains the top offshoring destination for information technology (IT) companies, followed by China and Malaysia, according to a study by consulting firm A.T. Kearney.

Mexico came in at No. 4, Indonesia, Thailand and the Philippines were ranked fifth, sixth and seventh in the list, and Brazil was No. 8.

The 2014 A.T. Kearney Global Services Location Index™ (GSLI), which measures the offshoring potential in 51 countries based on three categories:

1) Financial attractiveness

2) People skills and availability

3) Business environment

India “is unrivaled in both scale and people skills” and leading information technology services firms are expanding their traditional offerings to include research and development, product development, and other niche services, A.T. Kearney said.

Based on an assessment of 25 metrics, help identify the countries with the strongest underlying fundamentals to potentially deliver information technology (IT), business process outsourcing (BPO), and voice service.

1. India (Financial attractiveness: 3.14 | People skills and availability: 2.71 | Business environment: 1.19 | Overall : 7.04) — undisputed leader in the field for the past decade, India is still unrivaled in both scale and skills. The IT services sector dominates the industry with exports of $40 billion, followed by BPO exports of $20 billion.

2. China (Financial attractiveness: 2.26 | People skills and availability: 2.54 | Business environment: 1.36 | Overall : 6.15)

3. Malaysia (Financial attractiveness: 2.72 | People skills and availability: 1.43 | Business environment: 1.84 | Overall : 5.98)

4. Mexico (Financial attractiveness: 2.67 | People skills and availability: 1.61 | Business environment: 1.61 | Overall : 5.90)

5. Indonesia (Financial attractiveness: 3.15 | People skills and availability: 1.56 | Business environment: 1.16 | Overall : 5.87)

6. Thailand (Financial attractiveness: 3.01 | People skills and availability: 1.42 | Business environment: 1.44 | Overall : 5.87)

7. Philippines (Financial attractiveness: 3.06 | People skills and availability: 1.48 | Business environment: 1.21 | Overall : 5.75)

8. Brazil (Financial attractiveness: 1.81 | People skills and availability: 2.25 | Business environment: 1.63 | Overall : 5.69)

9 Bulgaria (Financial attractiveness: 2.99 | People skills and availability: 0.97 | Business environment: 1.66 | Overall : 5.62)

10. Egypt (Financial attractiveness: 3.20 | People skills and availability: 1.36 | Business environment: 1.06 | Overall : 5.62)

11. Poland, moves up 13 spots in the index this year. The biggest country in Central and Eastern Europe, it boasts a large labor force and multitude of city options. With industry dispersed across Warsaw, Krakow, Lodz, Katowice, and other cities, the country has a reasonable cost profile that, while slowly converging with Western Europe, is still lower by several magnitudes. Multinationals Sabre and Motorola operate large software development centers in Poland, accompanied by Comarch, Capgemini, and HCL in IT consulting.

12. Vietnam

13. Chile

14. United States (tier 2)

15. Lithuania

16. Sri Lanka

17. Germany (tier 2)

18. Romania

19. United Arab Emirates

20. Jordan

21. Russia

22. Estonia

23. Latvia

24. Costa Rica

25. Pakistan

26. Bangladesh

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz