Wealth of the Top 3 Richest Families in India is Equivalent to Singapore’s GDP

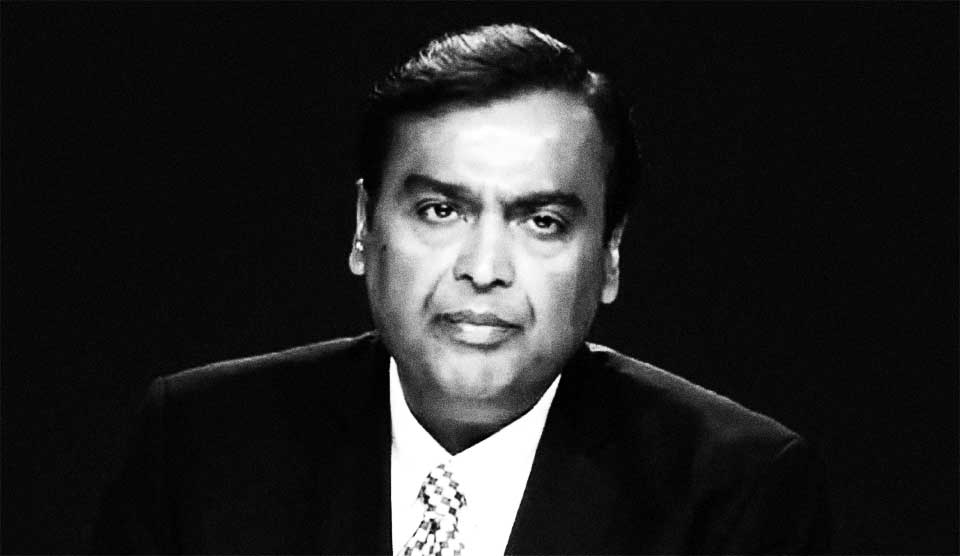

The Ambani family, helmed by Mukesh Ambani, has once again secured its position as India’s wealthiest business dynasty, boasting a staggering net worth of approximately $309 billion. This monumental figure not only places the Ambanis at the pinnacle of India’s richest families but also underscores their vast influence in the global economic landscape. According to the Barclays Private Clients Hurun India list of the most valuable family businesses, the combined wealth of India’s top three wealthiest families amounts to an impressive $460 billion—an amount comparable to the entire GDP of Singapore.

Trailing behind the Ambanis is the Bajaj family, which has a net worth of about $85 billion and is led by Niraj Bajaj. The Bajaj Group, with its diversified interests in automobiles, finance, and more, continues to be a powerhouse in India’s industrial sector. The Birla family, headed by Kumar Mangalam Birla, ranks third on the list with a total valuation of around $65 billion. The Birlas’ extensive business empire spans industries such as cement, textiles, and telecommunications, maintaining their status as one of India’s most influential business conglomerates.

The wealth of these families reflects not only their dominance in various sectors but also the extraordinary growth of their enterprises over the years. Together, the Ambani, Bajaj, and Birla families control businesses valued at $460 billion, underscoring their crucial role in India’s economy. Their combined wealth is equivalent to the GDP of a nation-state like Singapore, highlighting the immense scale of their economic influence.

The Hurun list also sheds light on the impressive rise of first-generation entrepreneurs in India. Leading this category is the Adani family, with a valuation of around $184 billion. Gautam Adani’s empire, spanning ports, energy, and infrastructure, has seen rapid expansion, making him one of the most powerful figures in global business. Following the Adanis, the Poonawalla family, renowned for their contributions to the pharmaceutical industry through the Serum Institute of India, holds a valuation of approximately $29 billion. The Divi family, valued at around $11 billion, rounds out the top three first-generation entrepreneurs. Their company, Divi’s Laboratories, has become a key player in the global pharmaceutical market, particularly in the production of active pharmaceutical ingredients (APIs).

The 2024 list of India’s most valuable business families highlights the staggering wealth concentrated within these dynasties, with the total valuation exceeding $1.3 trillion. This figure surpasses the combined GDP of Switzerland and the United Arab Emirates, showcasing the immense economic power wielded by these families. In total, 124 families featured on the list have a net worth of at least $1 billion, further emphasizing the significant concentration of wealth in India’s top business households.

Among the list’s notable highlights is the incredible growth in share prices seen by some of these family-owned businesses since inheritance. The Benu Bangur family, leading Shree Cement, has witnessed a phenomenal 571-fold increase in their company’s share price, marking the highest growth on the list. The Taparia family, known for their control of Famy Care, a global leader in women’s health products, follows with a 387-fold increase. The Dharmpal Agarwal family, who manage the renowned transport and logistics firm Transport Corporation of India (TCI), has seen a 316-fold rise in their company’s share price, showcasing the lucrative growth potential of these enterprises.

In addition to these publicly listed giants, the list also identifies India’s most valuable unlisted companies. Topping this category is Haldiram Snacks, the iconic Indian snack food manufacturer, with a valuation of around $7.6 billion. Haldiram, with its widespread brand recognition and extensive product range, continues to dominate the unlisted sector, reflecting the strong market demand and enduring popularity of its offerings.

The 2024 Hurun list serves as a testament to the extraordinary wealth and influence of India’s top business families. As these dynasties continue to expand their empires both domestically and globally, their contributions to the economy are likely to grow even further, shaping the future of India’s business landscape for generations to come.

[table “1027” not found /]

Have you read?

Countries: Powerful Passports.

Countries: Richest.

Countries: Poorest.

Countries: Happiest.

Countries: Life Expectancy.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz