Risk management in car rental: key aspects

Car rental is a dynamic and competitive industry where business success depends on the ability to effectively manage a variety of risks. This article discusses key aspects of risk management in car rental, including insurance, customer vetting, equipment maintenance, legislative protection and safety monitoring. Proactive risk management enables lessors to minimize potential threats, increase the reliability of their operations, and compete successfully in this dynamic industry.

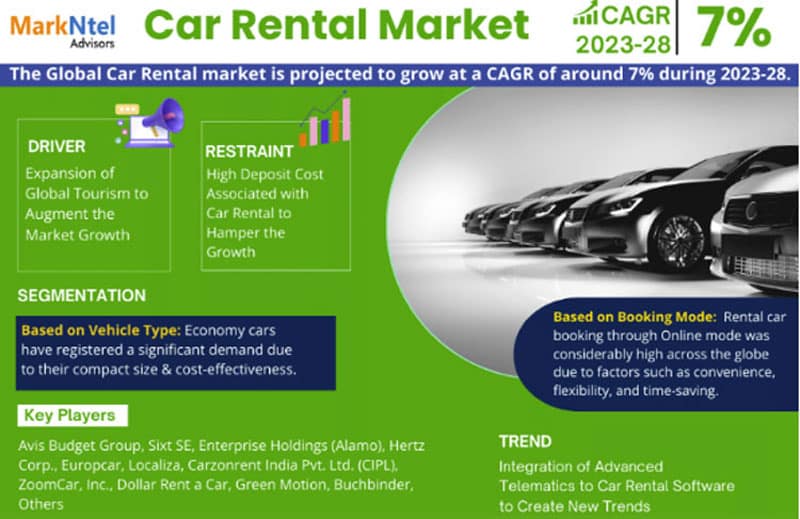

Risks in car rental: Car rental has become an integral part of modern mobility. It offers convenience and flexibility, allowing customers to rent a car on demand. Analysts have estimated that the global car rental market was worth $92 billion in 2021 and will grow to $140 billion by 2027.

However, as with any business, there are risks in the car rental industry that need to be considered and managed:

Car damage and loss. One of the most obvious risks in car rentals involves vehicle damage and loss. No matter how careful the renter is, accidents and mishaps can happen. This causes not only financial loss, but also downtime in the rental schedule.

Non-payment by customers. Another major risk is non-payment from renters. Some customers default on rental payments, which can worsen the financial health of the company.

Changing legislation. Legislation in the field of car rental is subject to changes. In this case, the current formats of work, including the terms and conditions of the lease, also change and at times this hampers the ability to conduct business.

Market Competition. The vehicle rental market is competitive and this affects pricing and margins. The emergence of new players forces companies to introduce discounts and flexible rates, which can affect the company’s profits.

Technical glitches and breakdowns. Technical glitches and breakdowns of vehicles cause inconvenience to customers and loss of time for repairs.

Customer and employee safety. The safety of the company’s customers and employees is always a priority. Any safety incidents inevitably cause reputational losses and legal consequences.

Force majeure situations cannot be ruled out either. A typical example was the coronovirus pandemic, which significantly worsened the financial performance of car rental companies. Thus, in the US, their total revenue for 2020 was the lowest in 10 years – $23.2 billion. The drop amounted to 27.4% compared to the previous year. In addition, due to COVID-19, about 40 thousand car rental employees lost their jobs.

Risk management strategies for the car rental market

Car rental offers many opportunities, but it also comes with risks. Effectively managing these risks, keeping strategies up-to-date and maintaining high standards of customer service will help successful companies in this field stand out and thrive. Let’s take a closer look at the topical areas of risk minimization in this sphere.

Insurance

Insurance is the cornerstone for minimizing financial risks in the car rental industry. It includes several key aspects:

Car Damage: This is important both to protect your own assets and to provide the car company’s customers with confidence that their interests will be protected in the event of an accident.

Car Theft: Car theft insurance provides security in the event that a customer’s vehicle is stolen. This allows for the recovery of financial loss.

Third Party Liability: This insurance covers the cost of property damage or injuries to third parties due to an accident involving a rental car.

Car rental owners should carefully analyze and select insurance policies that best suit their needs and provide maximum risk coverage.

Thorough Customer Due Diligence

The next aspect of risk management is customer vetting. This approach prevents potential negative tenant situations.

Credit reports: A credit history check helps in assessing the financial reliability of clients. It helps to identify tenants in arrears and take appropriate action.

Driver’s License Check: It is important to make sure that the client has a proper driver’s license and does not have any serious traffic violations.

Rental History: Checking a customer’s rental history helps identify potential renters who may be using the vehicle in a manner that is not in compliance with regulations or may be causing problems.

Regularly updating customer information is also important for effective risk control. If new information about a customer comes to light, such as a change in financial status or the existence of debt, action must be taken in a timely manner.

Service and maintenance

Regular servicing and maintenance of vehicles is not only a matter of safety, but also of reducing operational risks.

Regular maintenance: Carrying out systematic technical checks and servicing of vehicles helps to prevent unexpected breakdowns and accidents on the road.

Replacing parts and tires: It is important to keep a close eye on the condition of vehicle components such as brakes, tires and engine. Replacing worn or damaged parts in a timely manner helps keep the fleet reliable and reduces the risk of accidents.

Contracts and legal protection

Clear and legal contracts with customers are a basic element of legal risk protection. Such contracts define the rules for the use of the rented vehicle and liability for possible damages. They may include the following aspects:

Rules of use: Contracts should clearly define how customers can use the rental car. This includes restrictions on travel, transportation of goods, and other conditions.

Liability for damages: Contracts should detail what liability is placed on customers if the car is damaged or stolen. This is important to determine who will bear the financial costs in the event of an incident.

Lease terms: Defining lease terms and renewal terms is also important for clarity and to prevent disputes.

Having access to legal support in the event of legal disputes and conflicts is also critical in managing legal risks.

Security and monitoring

The use of advanced security and monitoring systems helps prevent car theft and unauthorized use. Key security and monitoring parameters include:

GPS trackers: The installation of GPS trackers allows you to track the location of vehicles in real time. This helps in responding quickly to incidents of theft and controlling the movement of vehicles.

Anti-theft systems: The use of advanced anti-theft systems makes car theft much more difficult and risky for potential attackers.

Driving monitoring systems: These systems help to monitor driver behavior, alerting you to potential dangerous situations.

The integrated use of these methods and technologies ensures that the car rental fleet and customers are well protected, reducing risks and preventing negative situations.

Risk management in the car rental industry is a complex and important process that contributes to the stability and success of companies in this dynamic and competitive industry. Implementing effective risk management techniques and strategies allows lessors to minimize potential threats and increase the safety and security of their business. Analyzing and improving your risk management system is becoming an integral part of the successful operation of an automobile rental business. It is especially important to realize that in an environment of constant change and uncertainty, companies that actively develop and implement risk mitigation measures gain an additional competitive advantage and guarantee the preservation of stability and reliability in their operations. This approach not only provides protection from negative consequences, but also contributes to the development and growth of companies, making them more resilient to changes in the market and helping them achieve a high degree of professionalism in service delivery.

Sources

A Game of Rides: Who’s Playing (and Winning) the Ride-hailing Battle, Mapbox, published May 10, 2018; Car rental market, Transparencymarketresearch; Statistics, Facts, and Trends [2023] (https://passport-photo.online

Article written by Nikita Legkov, founder of RTK-Zapad LLC, founder of the largest taxi fleet in Rostov – the first to completely switch to environmental fuel.

Have you read?

Revealed: These Are The Countries with Highest Rates of Infant Mortality.

Report: Austria Citizenship by Investment Programme, 2023.

Report: Cambodia Citizenship by Investment Programme, 2023.

Report: Dominica Citizenship by Investment Programme, 2023.

Report: Egypt Citizenship by Investment Programme, 2023.

Report: Grenada Citizenship by Investment Programme, 2023.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER