Growth in the new normal: CEO’s Looking past crisis for opportunities

Executives have grown accustomed to operating in an ongoing environment of global crisis, with the daily challenge of unlocking growth and profitability while standing on uneven ground. That persistent uncertainty is unlikely to dissipate in the coming quarters.

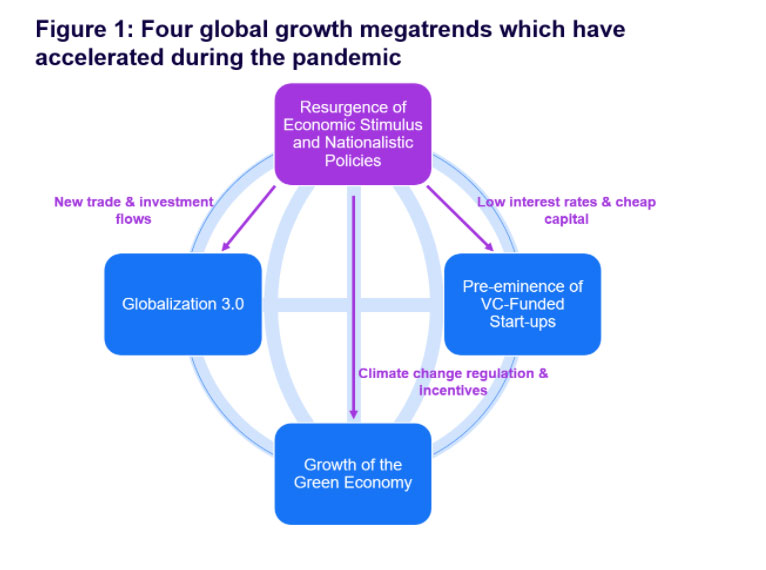

Short term volatility will continue, however longer-term “mega-trends” are emerging that will empower CEOs to pursue new opportunities. Corporate leaders can better position their companies by considering the impact of next-generation globalization, the resurgence of economic stimulus and nationalistic policies, the growth of the green economy, and venture capital injections into innovation.

Globalization 3.0

The COVID-19 pandemic did not cause globalization to collapse. In fact, the DHL Global Connectedness Index 2021 Update signals that globalization is recovering from the pandemic setback. The proportions of trade, capital, information, and people flows crossing national borders have all increased significantly, on pace to match pre-pandemic global flows by 2022. Use of artificial intelligence and automation around the globe is hyper-fueling globalization, and will remain a fundamental cornerstone of the global economy for decades to come, making these tools essential issues for executives to manage successfully.

True global competition is diversifying. Previous emerging-market tech leaders came predominantly from China, but increased connectivity, investment, and growth in emerging markets is shifting the balance to other parts of Asia, Africa, Latin America, and the Middle East. Around 30% of global unicorns are currently outside of China and the US, per CB Insights data. This means business leaders must look beyond traditional markets for new opportunities and prepare for competitive threats from a growing list of countries and geographies.

The resurgence of nationalistic policies and fiscal stimulus

Since March 2020, CNBC reports that $11 trillion has been deployed by G20 governments on fiscal stimulus packages, which equates to more than $2,200 of increased government spend for every man, woman, and child in these countries. According to a study by Rabobank, expansionary monetary policies injected an additional $8 trillion of cash into the money supply, bringing negative interest rates to several European countries for the first time in modern history.

The passage of the billion-dollar-plus infrastructure bill is the largest appropriation of its kind in the US since the Eisenhower Congress gave America its interstate highways system in the 1950s. Several Western governments have declared industries such as semiconductors, energy storage, ICT technologies, and pharmaceutical ingredients as sectors of national interest and imposed trade restrictions on their supply chains.

The clearest benefit of government intervention has been the sheer speed of the economic recovery. The current COVID-19 recovery regained its pre-pandemic level of GDP in a year and a half.

The long-term impacts of these interventions are yet to be determined. We believe that more national policies will continue to create opportunities and challenges for companies. Thus, companies should take advantage of these fiscal changes and prepare for any negative impacts, such as the potential for rising inflation.

The growing green economy

We are in the midst of a growing climate crisis. According to Climate Central, the US has been experiencing an average of 17 climate disasters causing at least US $1 billion in damage per year since 2017.

While governments have enacted strict emissions standards and environmental regulations, consumers have acted with their wallets. As reported by CNBC, new car sales across the globe dropped 15% during 2020. The decline in new auto sales was especially severe early in the year; the National Automobile Dealers Association (NADA) reported that US auto sales in March 2020 were nearly 40% lower than March 2021. Global sales of electric vehicles, however, increased over 41% in 2020, as reported by Scotiabank, and 168% in the first half of 2021, according to EV-Volumes. Tesla has seen valuations over $1 trillion, making Elon Musk the world’s richest man, 12 years after founding the company.

According to Allied Market Research, the market for global renewable energy derived from natural sources was valued at $881.7 billion in 2020 and is projected to reach $1,977.6 billion by 2030, growing at a CAGR of 8.4% from 2021 to 2030. A proliferation of government mandates around renewables and stronger climate agreements between major economies to limit emissions are likely to fuel stronger growth in the next few years.

Sustainable investments driven by the screening criteria of institutional investors and asset managers represent more than a third of the global total assets under management in 2020, as reported by Global Sustainable Investment Alliance.

NYU Stern’s Center for Sustainable Business estimates that sustainability-marketed consumer packaged goods brands have grown seven times faster than conventional brands and have garnered a nearly 40% price premium over traditional competitors.

We believe that all management teams — even those outside of the energy industry — need a strategy for both customers and investors based on unambiguous objectives and measurable results. Sustainable business practices are becoming fundamental, and companies that lack clear plans will become more marginalized. Strategic plans should consider climate-related factors as a whole, including energy consumption and the transition to a low-/no-carbon economy.

The preeminence of VC-fueled startups

Despite uncertainties created by the global pandemic, venture capital investment has continued to grow at an exponential rate. According to the National Venture Capital Association (NVCA), by the end of 2020 over 10,000 startups had received venture funding, with close to 2,000 VC firms managing $548 billion in assets under management. These numbers do not begin to capture the full scale of venture investing, as groups like pension funds, sovereign wealth funds, private equity, and even hedge funds are investing substantial capital in startups.

The growth in venture funding has had two profound influences on innovation: dramatically increasing the scope of technology development and accelerating the speed at which startups reach scale. There are more than 10 startups that have reached a $1 billion valuation in less than two years. In 2020, US venture-backed start-ups represented about 2.5 million employees, as reported by NVCA.

New ventures are progressing from startup to established market challenger and industry dominance at a startling pace. Companies that were considered unviable startups just a few years ago have made incredible gains in business model improvement, market share gains, and financial strength. A growing number of global tech startups are now serious competition for legacy companies.

Consider electric vehicle startup Rivian, which had one of the largest IPOs of the year with initial valuations beyond $100 billion (nearly the same as Volkswagen), achieving this while the company has delivered barely any vehicles.

VC funding is enabling an unprecedented number of new entrants to challenge nearly every global company and industry faster than ever before. The long-held strategy of waiting to see the winners and then acquiring them is no longer sufficient (or often possible).

How to prepare for the “new normal”

As economic growth stabilizes in 2022, the opportunities and threats created by these mega-trends will become more evident. The pandemic “new normal” will likely be a period of accelerated change, heightened competition, and business model disruption. To thrive, organizations must embrace the dual challenge of building future business platforms while delivering profitable growth in their core businesses. They must rapidly adopt new approaches to how they invest, grow, and operate.

Transformation often requires two distinct and separate strategies – sometimes even distinct management systems. Organizations that successfully navigate periods of transformative change apply a deliberate management discipline toward building future growth businesses. Business transformation also requires a CEO-driven strategic vision that clearly communicates the magnitude and pace of business change the organization will embrace.

The importance of pushing beyond the normal processes and routines of operating the core business to build future growth businesses cannot be overstated. It requires agile, fail-fast/fail-forward processes, and an open ecosystem approach to innovation supported by partnerships, ventures, and acquisitions.

A dramatic example of this approach was demonstrated by Pfizer in developing its COVID-19 vaccine. Under the stewardship of its CEO, Pfizer acted quickly and decisively to mobilize its resources and bet on an unproven mRNA technology, which promised faster time-to-market than live vaccines but had never before been clinically used. Merck, on the other hand, kept to its existing vaccine technologies and maintained a conservative development approach and timeline before discontinuing its efforts in January 2021.

CEOs are at a unique point in time: they have an urgent focus on navigating the COVID-19 economy, while still looking ahead to prepare for the mega-trends impacting every corner of the global marketplace. No longer is it sufficient to simply treat these as matters for another day. Industry winners and losers will be determined by the actions of CEOs to reorient their business to meet the challenges of these mega-trends.

Written by Alan Martinovich, Partner, Arthur D. Little.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER