The Gold Rush is On: Rollups in the Amazon Marketplace

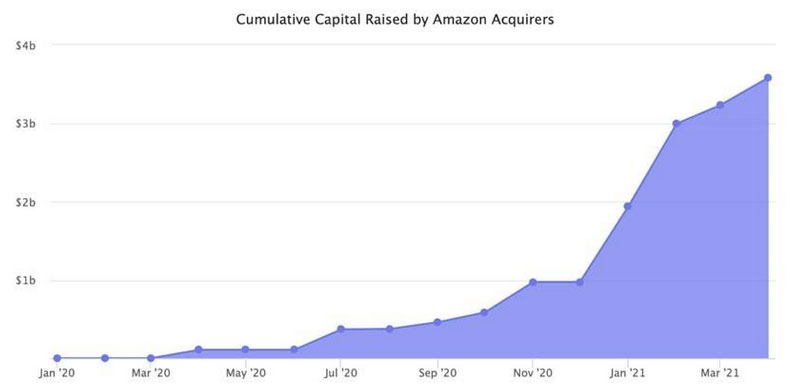

The Marketplace Gold Rush is on! According to Marketplace Pulse, $4 billion has now been raised in private finds to purchase companies that have built successful products on the Amazon Marketplace. That’s a staggering amount for what businesses that could quickly dissolve in the face of new competitors or indeed Amazon’s own entry into a product category.

These figures do however say, loud and clear, that there is money – lots of money – to be made on the Amazon Marketplace. The platform is to big that being the top pick in a reasonably popular category even for a short period of time can be immensely lucrative. And on Amazon, success reinforces success. Being the top pick adds further benefits like a shiny “Best Seller” label that drives up sales, and better organic placement on search pages from Amazon (which both knows what customers like and helps position selected products so they are more likely to win the Buy Box – the default option for potential customers). For the seller, it’s a virtuous circle. Private investors understand all this. Hence the massive investments in companies like Thrasio.

These investments are not like traditional VC investments, even though the purchased companies are often (usually) startups. These are, as Ken Kubec, (VP at Thrasio), told me, companies with products “that already have leadership positioning, with thousands of reviews, highly positive review ratings, and a strong ranking on Amazon.” Market testing has in effect already been completed: Thrasio is investing to get from initial success to scaled success.

A key question remains, though: what’s the secret sauce? Can Thrasio and its peers unlock additional value? Do they have real expertise to boost their acquisitions? Traditionally, roll-ups are based on specific scale advantages ad synergies from agglomeration. How does that work on the Amazon Marketplace? There are seven possible areas where scale and expertise could matter:

- Managing ad buys. Although there are third-party consultants who can offer similar services, Thrasio and its peers have surely developed some solid expertise here, since advertising has become such a central component of marketing on the Amazon platform. Knowing how and when to use advertising, and at what price, could be a significant competitive advantage.

- Tracking and monitoring the competition. The Amazon Marketplace is a feeding frenzy, where customers are surrounded by invisible sharks all seeking to take their bite, and where the competitive environment changes in a heartbeat. Effective monitoring systems and automated pricing strategies are a necessary element. Economies of scale are likely important, and Thrasio for example is well placed to improve those capabilities for its acquisitions.

- Navigating Amazon’s platform rules and justice system successfully. This has three components: knowing and following the rules (which are sometimes complex and can easily trip inexperienced sellers; fending off bad actor attacks, which can take a variety of forms including counterfeit products, fake reviews, and fake customers; and managing Amazon’s own efforts to block bad actors, which can sweep up legitimate sellers by accident. All require expertise, and scale may help especially with the latter.

- Improving listings. According to Kubec, Thrasio has a full-stack in house creative team that has videographers, photographers, copywriters. Corporate expertise includes an understanding of what improves a product page on Amazon and what doesn’t. Again, there are potentially economies of scale here.

- Supply chain management. It’s extremely challenging to manage the supply chains for hundreds of products for which demand can change in a heartbeat, and roll-up companies could have more and better contacts among manufacturers, and understand the intricacies of international shipping and fulfillment better. Kubec said that Thrasio has 50 people working on sourcing, and that scale gives opportunities to buy in greater volume, which reduces costs.

- Avoiding Fulfillment by Amazon (FBA). Amazon is driving sellers into FBA by imposing tighter and tighter shipping deadlines. But a big rollup like Thrasio might be able to generate enough volume to create its own logistics channel using third-party logistics providers, who are now becoming more prominent. That could save money, and also offers Thrasio the chance to connect directly to its customers directly, bypassing Amazon’s efforts to wall customers off from sellers.

- Product development and acquisition. Again, scale matters, as Thrasio can afford to spend research dollars to identify yet more promising opportunities. This is brand development solely via acquisition, and given there are 6 million sellers on the Amazon platform, and close to half a billion products for sale, there are substantial opportunities. And some rollups, like Thrasio, make a point of sourcing products in ways that make them harder to duplicate.

All this sounds pretty good. And there are 3.5 billion reasons to suggest that big money is ready to place substantial bets. But on the flip side, these acquisitions are not brands in the traditional sense: they are not designed to create long-term emotional connections to customers, and they don’t expect to leverage those connections to sell more easily, service repeat customers, or attract a brand premium in the form of higher prices – all key objective for real brands.

Instead, these companies have become experts in the anti-brand world of the Amazon platform, where customers find products through search, instead of brand identity. Seventy percent of searches on Amazon are not branded – people at looking for underwear, not Hanes. These acquisitions, in general, will never become successful brands like Hanes. They could become successful sellers of underwear on Amazon, but with brand names that exist only for convenience.

So in the long run, Thrasio and its peers face a world filled with potential competitors, where the comforting moat created by a successful brand identity is not available. They will be swimming with the sharks, using their expertise and scale to win in the incredibly nutrient-rich ecology of the Amazon Marketplace. Will they be successful? Will Thrasio’s portfolio-based approach find enough big winners, as VC’s try to do elsewhere? The jury will be out for a while on that one.

Written by Dr. Robin Gaster.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz