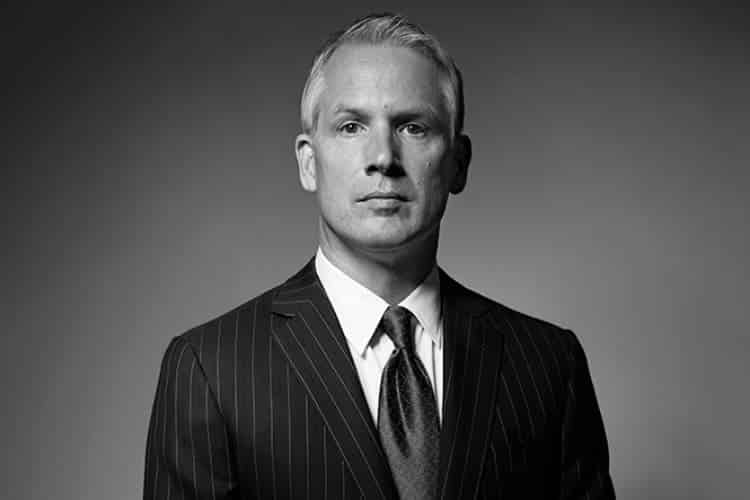

Midas Touch: The Evolution of Greg Boland

Toronto executive Greg Boland has paved his own path to success by doing something other investment managers were not – realizing he could identify and unlock the potential in underexploited markets through due diligence and proprietary analytics.

Greg Boland has been quoted as saying: “You have to find your own way. You have to do something others aren’t doing. One of the few ways you can get an edge is to get involved in a contrarian situation, do a lot of work and really understand the outcomes.”

As a prominent investor on Bay Street, Greg Boland has been an active participant on several Canadian corporate boards. His investment management firm, West Face Capital Inc. (West Face), specializes in event-oriented investments where its ability to navigate complex investment processes is the most significant determinant of returns. As the Founding Principal, CEO and Co-Chief Investment Officer, Greg Boland started West Face in 2006.

Boland’s rise on Bay Street began after graduating from the University of British Columbia with a degree in BComm. After graduation, Boland went on to work for Roland Keiper, the leader of a group that traded RBC Dominion Securities’ capital, known as the High Yield / Arbitrage Group. From 1993 to 1998, Boland served as one of three partners in RBC Dominion Securities’ proprietary investment group. In his role at RBC Dominion, he concentrated on the areas of distressed debt, convertible bonds, equities and derivatives.

In 1998, Greg Boland left RBC for a Connecticut-based hedge fund group called Paloma Partners. There, he managed a Canadian portfolio of distressed investments and special situations for Paloma Partners at Enterprise Capital Management until 2006.

With experience in tow, Boland would start his own firm, West Face Capital, in 2006, with a signature of taking ambitious positions in troubled companies. Most notably, in 2010, Boland publicly took an 11.4% stake in Maple Leaf Foods, which resulted in a seat on the Maple Leaf board and marking a decisive victory for shareholder rights in Canada. West Face Capital has also invested in companies such as Hudson’s Bay Co., SNC-Lavalin Group and UTS Energy. In 2015, Greg Boland led a group of shareholders in a deal to sell Wind Mobile to Shaw Communications for $1.6-billion.

“Our most successful ones (investments) have been large, concentrated investments in companies that have fallen on hard times for reasons that are maybe misunderstood by the broad market and where there is a reasonable amount of complexity.” Greg Boland told the Globe and Mail.

Indeed, Boland isn’t afraid to go against the grain, enhance stakeholder value, and demand results by holding management and board members feet to the fire.

“Investor activism is a shareholder right; it’s only newsworthy because investors were quite lazy for so long,” he says.

With the ability to find and invest in undervalued companies, Greg Boland’s independent thinking and gut instinct have distinguished him from his more traditional counterparts.

Boland adds, “Being a contrarian and buying at the nadir of investor confidence has always appealed to me psychologically, I don’t know why. The result is you often get some bumpy rides at the beginning. If you’re trying to catch a falling knife, you can get a few nicks on the way down.”

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz