US election campaign will rock markets

In the US, the primary election race has begun, which normally doesn’t affect the financial markets significantly, but this time, Wall Street will react stronger than normal on the election campaigns.

The US presidential election race has now really kicked-off, with the Democrats’ primary elections in the first two states already done, and the race finishing with the Milwaukee convention in Wisconsin on 13th to 16th July. The start of the Democrats’ marathon race has been tumultuous in several ways, but for investors, one of the challenges is that it might take a long time before the financial markets have a clear feeling for whom the candidates will win the necessary 1,990 delegates in Milwaukee.

For decades, the US presidential elections meant relatively little to the financial markets, and even on Wall Street, there was typically only a slight concern the last few weeks ahead of the elections. But as one often is reminded about, also in the financial markets, the world does not repeat itself anymore. Instead, there are new cycles and ongoing developments arising. This time, the entire election battle in the US can risk affecting the stock and bond markets more than usual.

I am fully aware that President Trump will have to set a political agenda while the primary elections are going on in the Democratic camp, otherwise, the Democrats get all the attention during the next four months. I suppose that this is the reason why Trump presented a 10-year fiscal budget plan some days ago.

It’s a very early stage for investors to take the US presidential election into account when pricing the different risks for this year. When American investors return from holiday in late August, then they will fine-tune the focus on the election in November. Though at that time in August, it might be too late for the rest of the financial market participants to start understanding which political direction the US is heading.

The budget plan from President Trump actually caught my attention the other day. Very interesting is if President Trump manages to get the US budget and the general economic situation on the agenda already by now. In the next couple of months, the Democrats will most likely continue their primary election infight, but thereafter, the remaining candidates in the Democratic run-up will start to position themselves against Trump. At that time, maybe in April, it already becomes interesting by which economic policy the candidates will counter President Trump. How they will deal with the tremendous government budget where some of the ideas might hit the stock market seriously.

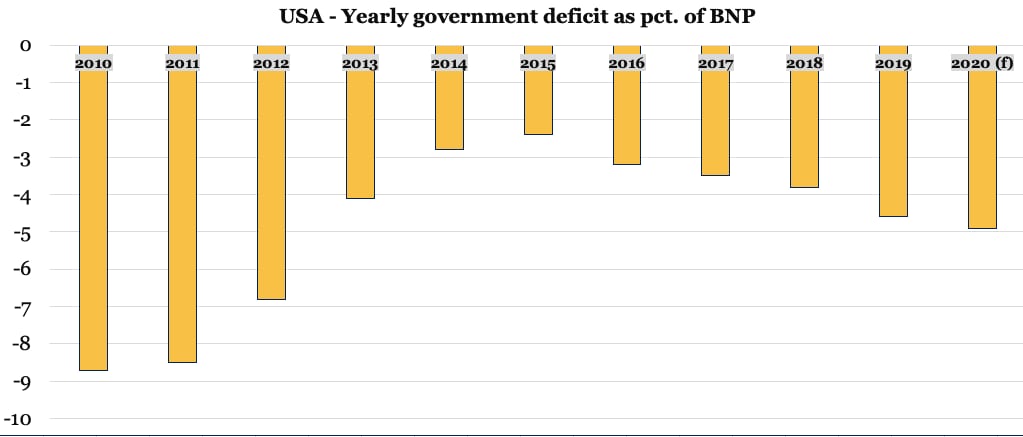

Right after the global financial crisis, the American government budget deficit stood at -8.7 pct. of GDP, though it was reduced to a respectable -2,4 pct. in 2015 (graphic one). In the election year 2016, the fiscal discipline got a bit laxer, which is normal in an election year, even in the USA. But with Trump in the Oval Office, the budget deficit has grown bigger every year again and is now expected to reach -4,9 pct. of GDP this year. As investors now and then become anxious about the debt levels in the world, then just a strong focus on this issue in the presidential election campaign could cause some jitters in the US bond market.

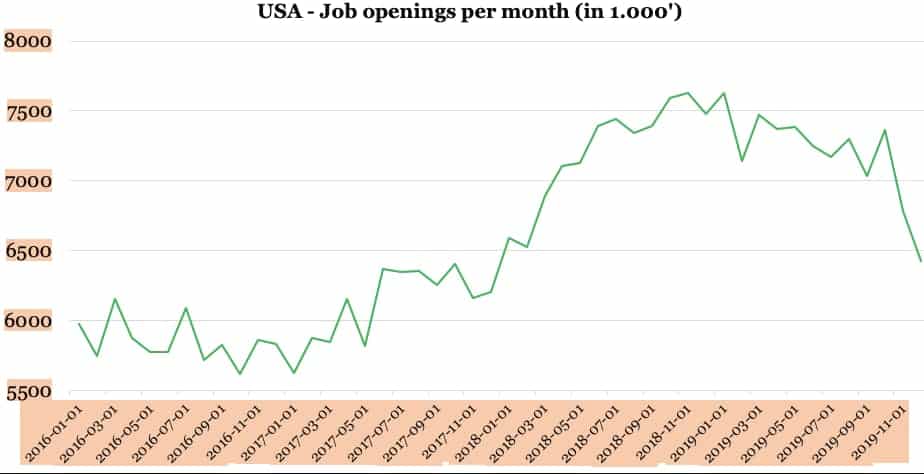

In Trump’s plan, a reduction of the deficit to 0,7 pct. of GDP is foreseen, though in 10 years, when President Trump is out of the office for long. But the key is that Trump seems to understand that he is forced to deal with the deficit, as economic growth alone can’t balance-out the heavy deficit. This indicates contractive initiatives that could dampen growth at a time when the American economy is already entering a slower growth modus. One example of economic data that indicates a slower growth is shown in graphic two, with a current steep dive in new job openings in the American economy.

The suggested spending cuts will hit foreign aid and domestic social care, though Trump tries to safeguard the tax cuts that he got approved from a couple of years ago. Already, in year one, i.e. this year, the plan is to build on an unrealistic base, as the plan assumes a 3.1 pct. GDP growth, where almost any economist would point at 2.0 pct. in 2020. My main take from the plan is that regardless of the end result, and if Trump stays in office, then contractive elements will be introduced, which will hurt economic growth in the US.

For a Democratic presidential candidate, it’s pretty easy to shoot Trump’s plan down, but the fact is that a Democratic president will inherit the same 4.9 pct. of GDP in government budget deficit this year, along with a ballooning public deficit. Surely, debt-anxious bond investors would also like action on this issue from a Democratic President. Higher taxation on high earners is an obviously expected income-generating plan to avoid cuts in social welfare. One further option for a Democrat could be to roll-back the tax cuts for the American corporations that Trump got approved. In this context, one should not forget how the tax cuts lifted Wall Street, but if the prior corporate taxation level is reintroduced, combined with pressured GDP growth rates, there is no doubt where Wall Street will head– I wouldn’t be surprised if all these options become a more outspoken part of the election campaign in the US, and there is a high risk that all these elements will generate higher volatility in the financial markets already from April and onwards.

USA Yearly government deficit as pct. of BNP

- 2010: -8,7%

- 2011: -8,5%

- 2012: -6,8%

- 2013: -4,1%

- 2014: -2,8%

- 2015: -2,4%

- 2016: -3,2%

- 2017: -3,5%

- 2018: -3,8%

- 2019: -4,6%

- 2020 (f): -4,9%

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz