Revealing the New Horizon of Customer Growth for the Life Insurance Sector

The life insurance sector’s growth has been fading – but serving customers better in a middle-market and mass-market could contribute in billions in annual premiums.

The life insurance industry along with the annuities industry has thrashed about in search of growth in the past few decades. Insurance providers have progressively focused on the requirements of well-heeled individual, who aim at more profitable –but mounting competition from adjoining sectors has cut into the market share of the most successful insurance providers. Also, insurance providers have been real slow in integrating digital avenues and have to resolve the challenges of an ageing manpower familiarised with the traditional modes of selling. In search of growth where must insurance providers, especially the ones with captive distribution, focus on the efforts?

As per the research by New McKinsey, a huge and under-penetrated customer segments electrifying the growth. Until last year, traditional wisdom in this sector has held that the segments are not interested in retirement products and protection or would not produce enough profits to warrant the efforts. As per an anonymous research, middle-market and mass-market customers are seeking to buy protection products – specifically at the chief life milestones like the birth of a child and buying home. Besides, while the products sold to such customers are not much profitable, the sections feature a higher growth than the others, frequently with lesser competition.

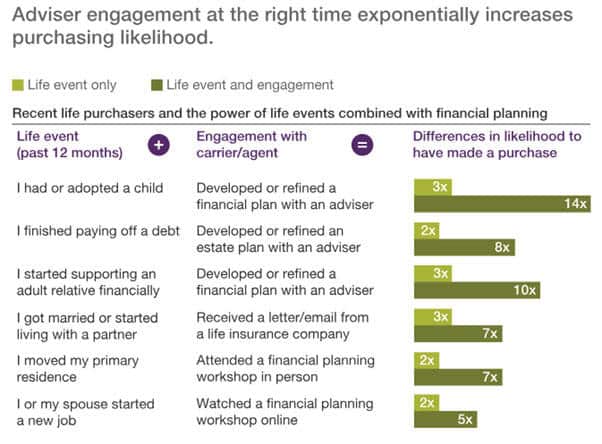

In order to comprehend this potential, it’ll be crucial for the insurance providers to assemble their outreach capabilities, both with the remote capabilities and traditional advisors, around the trigger events. It was found that the financial whizzes outreach, at the time of any trigger event, is up to 14 times probably to produce a sale than increasing the outreach outside of the trigger event. Insurance provider must, therefore, re-imagine that how they serve, engage, and communicate with the current and potential consumers, with a prominence on a digital-first planning that can meet rising and changing customer expectations – both, in these sections and beyond. Customer engagement is not only a recommended strategy but also a necessity, which can earn significantly profitable benefits. Data along with analytic capabilities can encourage captive distribution for reaching out to the consumers at the most correct time or sanctioning third-party distributions to do so.

In order to make such transition, it is recommended that the carriers make bigger and bold capability investment in four key options:

- Catalyse the demand via targeted outreach during the trigger events.

- Leading with advice and redefining the value proposition as “Living” insurance, highlighting the advantages of life insurance while the insured is alive.

- Creating a seamless and dynamic customer experience, which includes multi-channel engagement and distribution that doesn’t rely only on a human advisor.

- Embedding the brand at the most correct time in the consumer decision journey.

The future of the life insurance sector depends on the adaptation. While well-off individuals will remain the most vital consumer section, the middle-market and mass-market sections are going to be significant to realise growth in the upcoming years –and the research by McKinsey found that they’re willing and ready to participate. Insurance providers simply have to meet them at the preferred platform and time.

A case to pursue the middle-market and the mass-market customers:

The life insurance segment – including both longevity products (group annuities, individual annuities, individual life, and accident and health) and mortality – has been increasing gradually for more than 10 years. The minimal compound annual growth rate (CAGR) from the year 2005 to the year 2015 was approximately 2 per cent. Although returns recoiled slightly after the worldwide financial recession of the year 2008-09, industry returns knock down below the equity cost in the year 2016. Amongst 68 million households in the US, 57 per cent don’t own individual life insurance policy.

On the contrary to this industry’s traditional wisdom, the middle-market and mass-market customers are interested in the products to safeguard their long-term fiscal securities; in fact, customers frequently take prioritizing these expenses over the near-term outlays into consideration. Such individuals are usually aiming at saving money, and two out of three financially at risk (Image 1). To cut the long story short –these customers have long-term fiscal needs, which protection products can aid them to meet.

[Image Source: McKinsey&Company]

Lessons to reach the middle-market and the mass-market:

Unfortunately, the life insurance providers aren’t currently located to unlock this demand in the middle and mass markets. As per McKinsey’s research, only 52 per cent of the product owners has a belief their carrier is not a difficult task to do business with. Moreover, a mere 42% have a feeling that their carrier agents care about aiding them in achieving their financial goals and treat them just like a valued consumer, not a ‘policy number’. Such results reflect the mass and the middle market sections have been overlooked by the life insurance sector on the whole.

Indeed, these customers have a constricted view of the value that can be delivered by the life insurance providers across the top fiscal priorities. Life insurance firms are the preferred providers to take care of the loved ones and cover expenses in case of demise. Nevertheless, many customers seldom think of the insurers within the milieu of their complete financial planning. Moreover, the research shows that the middle-market and the mass-market customers frequently feel dubious towards and doubt life insurance brokers and agents.

Four Approaches to Spur the Growth:

The main challenge for the life insurance providers is to tailor outreach to certain customer sections, better make preparations to aid customers in responding to life’s milestone affairs, make sure that their firm is a part of the ICS, and enable the procedure to evaluate and purchase insurance. On all the counts, insurance providers, as an industry, have work to do. In order to capture the other horizon of progression for the industry, insurance companies must pursue the four key interlocking strategies that we discussed above.

Catalyse the demand via targeted outreach during the trigger events:

The research, evidently, demonstrates that the engagement at life trigger events is crucial for both the middle and mass market customers –and financial whizzes are vital to boost the purchasing rates. Activities carried out by a financial guru, like performing a fiscal check-up or devising a fiscal advisor, can amplify the probability of sales to the non-owners of endurance products by 1.7 to 2.4 times. Concurrently, blending trigger with the targeted outreach and the engagement with a financial consultant amplifies the probability of the purchase significantly. The second thing likely trigger affair with the agent interaction amplifies buying possibility by 10 times (Image 3).

[Image Source: McKinsey&Company]

Leading with advice and redefining the value proposition as “Living” insurance:

For the mass and middle market consumers, safeguard in the event of demise or injury isn’t on the list of the top priorities. Instead, their key concerns are to achieve good fiscal health (for instance, to pay off their debts or to maintain their standard of living). In order to appeal largely to customers and implant themselves at the centre of clienteles’ fiscal lives, insurance agents have to redefine their value proposals around a universal set of fiscal solutions focused on the ongoing ‘living’ advantages.

Creating a seamless and dynamic customer experience, which includes multi-channel engagement and distribution that doesn’t rely only on a human advisor:

Brokers and agents have a chance to both the delight customers and produce superior economics via a multi-channel engagement model, which trims down reliance on personal communications by binding digital along with the remote capabilities to offer similarly review solutions. A research found that 2/3rds of customers wish to be able to chart map journeys across personally, virtual modes of communication and online. Customers are progressively comfortable collecting information from the remote as well as online: more defendants prefer online and remote source (35 and 36 per cent respectively) as compared to that of personal advice (29 per cent).

Embedding the brand at the most correct time in the consumer decision journey:

Agents and brokers have to make sure that they’re involved in the ICS for the middle-market and mass-market customers – which means that they should prioritize the digital market avenues that can reach out to customers where they use information, there increasing their market report and creating their brand.

In a Nutshell!

Growth – it has always been an abiding challenge for life insurance providers, and changing consumer preferences – namely towards a digital-enabled and multi-channel experiences – have proved to be any stumbling block. Nevertheless, such changing behaviours represent a chance to re-think and re-consider the distribution in ways which meet the requirements and needs of customers and address the fiscal challenges linked to the conventional agent-based distribution. Agents and brokers who succeed will, obviously, well-positioned to apprehend remarkable growth, enhance profitability, and offer a comprehensive solution to customers, a lot of whom are not served well today.

Have you read?

# Top 20 Richest Sports Team Owners In The World, 2018.

# India Rich List For 2018: Richest Indian Billionaires.

# China Rich List For 2018: Richest Chinese Billionaires .

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz