What Is Your Import Tariff Strategy?

Are you leaving important tariff response strategy up to your import operations staff? It’s time for executives to lead. Nearly 6,000 Harmonized Tariff Schedule (HTS) item classifications have been identified for a 25% penalty tariff on imports from China. Even though some products have escaped the penalties so far, the future of new tariff classifications is uncertain. Will your products be next? What is your strategic response to new penalty tariffs?

Are you considering sourcing from other countries? Reshoring? Building inventories? Increasing prices to your customers? And what about your product exports? China and other countries are retaliating with tariffs of their own. Have you considered how foreign tariffs will affect your export sales?

It appears that trade wars aren’t going to end anytime soon. In fact, there is some discussion about targeting additional countries and additional classification categories. Section 232 tariffs apply to aluminum and steel as of June 1, 2018. Section 301 penalty tariffs on Chinese imports are in three tranches: Section 301 penalty tariffs on Chinese imports (List 1) July 6, 2018; Section 301 penalty tariffs on Chinese imports (List 2) August 23, 2018; Section 301 penalty tariffs on Chinese imports (List 3) September 6, 2018. What countries or what items might be next is uncertain.

Whether these tariffs will be effective in addressing long-term policies of foreign governments is anybody’s guess. In the meantime, tariffs are likely to affect your global supply chains.

Declare a New Country of Origin

It’s important to understand that if your goods are on the list of 6,000 items, you cannot avoid paying the penalty tariffs on importing these goods into the US. If the Country of Origin (COO) is China, the penalty tariffs apply. Period.

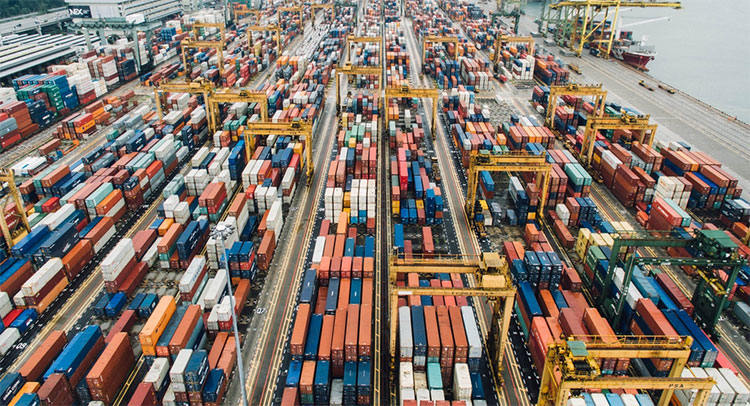

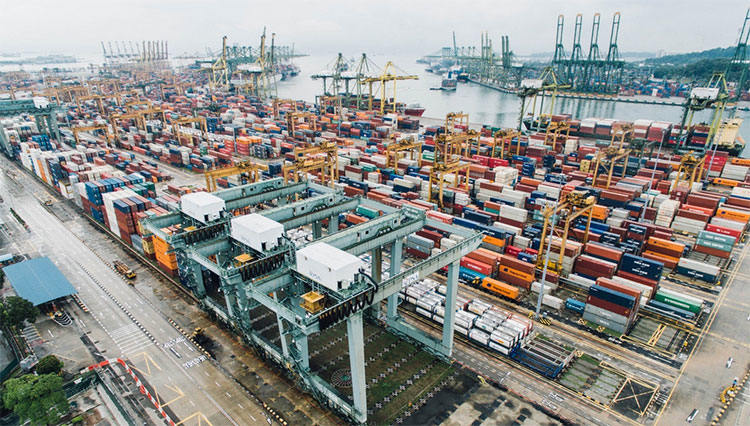

Trans-shipment via another country will not change the Country of Origin or help your company to avoid paying the penalties. We’ve heard tales of Chinese manufacturers suggesting that trans-shipping via Vietnam or Singapore and declaring these places as the COO will avoid the 401 tariffs. But this is illegal under U.S. Customs Regulations (CFR 19) as the COO must be the place where the goods are manufactured or substantially transformed, not where they are trans-shipped.

Build Inventory

Stockpiling inventory in advance of tariffs going into effect is another strategy. But the result will be worldwide shortages of parts and overstocking for you. Hoarding inventory ties up working capital which may put a stranglehold on your company’s ability to operate. In industries with rapid product development, seasonality, and trends, inventory may become quickly obsolete.

Move Sourcing or Manufacturing to an Alternate Country

Some companies are scrambling to move production to other sites in Vietnam, Indonesia, India, or other low-cost countries. While 301 tariffs don’t apply to importing from these countries so far, the future application of new tariffs on additional countries is uncertain. In addition, productivity rates in other low-cost countries can be as much as 20-30% lower than in China. In the final economic analysis, it may be more cost-effective to keep production in China and pay the penalty tariffs.

Return Manufacturing to the U.S.

Returning or establishing manufacturing in the U.S. is our favorite strategy at the Reshoring Institute. We are currently helping clients identify locations and determine the economic feasibility of manufacturing here. Over the long term, this is a good strategy, especially when your customers are in the U.S. But it takes time to reestablish manufacturing in America and could take as long as 12-18 months.

Use of American contract manufacturers is also a possibility, but keep in mind that if parts come from China, the 301 tariffs still apply to imports. If the CM is buying parts on your behalf, they will surely pass the increase in cost on to your company.

Pass Increased Costs to Your Customers

In the end, consumers always pay the price for increasing tariffs as these costs are passed-through. Economists tell us that sooner or later, consumers will balk at increased prices and stop buying or limit buying expensive goods. Most companies simply cannot or will not absorb the additional cost of goods sold that are burdened with 25% tariffs, and instead will tack on the increased costs to the selling price of finished goods. As long as all of your competitors are doing the same, this is no problem. But if some competitors can sell for less, you may see an unfortunate drop in demand, due to non-competitive pricing.

Exports

Exports to other countries are also affected. Trade wars mean that countries will retaliate with their own import tariffs on American goods. Unfortunately, retaliatory tariffs are often meant to hurt economic sectors unrelated to U.S. tariff categories. For example, U.S. 301 tariffs may apply to electronic goods imported from China, but Chinese import tariffs apply to soybeans or almonds.

Keep an eye on what is happening in export markets. It is difficult to predict how other countries will react to U.S. protectionist policies.

Develop Your Strategy

No matter what your opinion about trade wars, it’s in your best interest to develop a strategy that will work for your company as U.S. trade policy changes. Examine all of your options and be ready to make changes if necessary.

Have you read?

Rosemary Coates is a best-selling author of: 42 Rules for Sourcing and Manufacturing in China and Legal Blacksmith – How to Avoid and Defend Supply Chain Disputes.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz