Strategic Pricing for Deeper and Enduring Gains

The Self Devastating Spiral

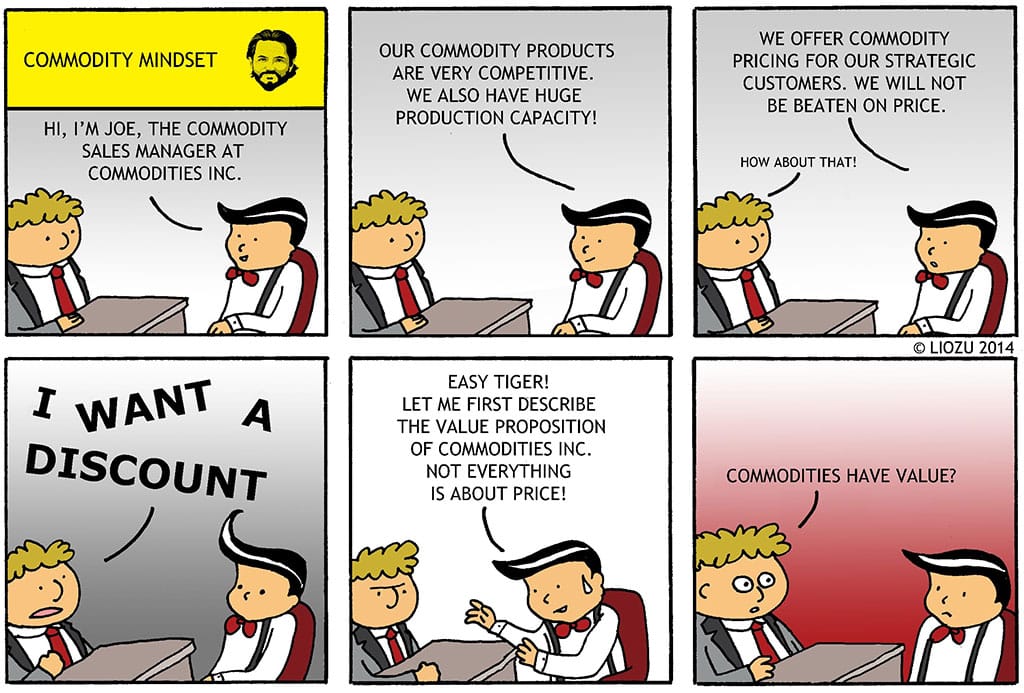

The ingrained and self-destructive beliefs about them as price takers who are selling a ‘Commodity’, have created inhibitions for B2B pricing managers to fight out their battles on negotiation tables. This belief is so percolated down the organization fabric that the salesperson has learnt to frame his conversations only around price. With the self-generated apprehension of losing a customer, he is perplexed to believe that there are differentiated aspects of the offerings, which can actually sell on premium based on ‘Value’.

Data Reflects Contradictory Perceptions

As per a qualitative study conducted by Bain & Company[1] which majorly involved interactions with over 400 purchasing executives in bulk raw material industry (metals, chemicals, agricultural commodity and paper goods) and enterprise hardware and software industry, it was established that ‘Price’ is rarely the most important decision criterion. In case of bulk raw material, customers were actually willing to pay a 4.2% premium for higher quality; a 3.1% premium for reliability and 88% of them were ready to pay at least 2.5% more to avoid switching suppliers. Also in computer hardware, software and allied services; customers were willing to pay 8.4% more for better integration with other technical systems, 7.2% more for the ability to customize the product and 7.0% more for ease of use. However, there are some price sensitive un-differentiated commodity industries like grains and oilseeds. But even in such industries, discriminating behaviour of customer segments can be leveraged to increase prices without putting the volume at risk based on rigorous analytical tools gauging their purchase behaviour.

Disruption creates unsolicited fears

With the booming start-up landscape and related dynamic priorities of customers, the perception of losing customers have created ungrounded fears for B2B pricing teams. Start-up customers believe in postponing the large up-front investments by demanding per-output pricing meters. Since many B2B firms have internal systems and constraints that are not aligned to support evolving pricing meters, their long standing experience and stringent structures make them irrelevant and they succumb to discounts and low pricing to manage their volumes. The need of the hour is to address these issues by re-focusing the lens towards comprehending the wider needs and changing priorities of customers. This shall require re-orienting the products’ pricing model around those evolving needs rather than established product categories of the firm.

The Misplaced Permeated Belief

The sales team of B2B firms irrespective of the economic value of their offerings, often leave lot of money on negotiation tables in their haste to close the deal. By approving different discounts for the same product offerings by different sales reps, the sales managers not only hampers the profitability for the firm, but also leave the customers deal prone for all times to come. There is an urgent need to equip the sales force with business intelligence appropriately aligned to customer lifetime value analytics in order to build and nurture profitable long-standing B2B partnerships. This requires revisiting the compensation structures and discount management by systematically linking them to the company’s long term economics, not short-term value gains.

Promotions Proliferates, Profitability Mutilates

The varied channel partner initiated and negotiated in-store promotions and other discount programs in aggregation, might be detrimental for the profitability of the B2B supplier firm. It not only carries a potential of creating undue profits for the channel partners, but also may lead to confused positioning through varying price cues. The B2B firms should be more vigilant while approving channel partner initiated promotions with a clear focus on increasing the ROI for the firm. Rather, performance-related and customer acquisition discounts which balances revenue growth and margins should be encouraged.

Vulnerability Increases in Downturn

In a lure of immediate payback, the B2B pricing managers get entrenched into cost-cutting and short-term initiatives underestimating the power of rightfully pricing, jeopardizing the profitability for the firm. During an economic downturn, the belief that pricing would exhibit a deflationary trend gets further strengthened amidst embattled customers and aggressive competitors. B2B contracts are generally for long term and any haste action based on misleading perceptions of trade-offs (the firm may overestimate buyer price sensitivity) can have detrimental enduring effects for the B2B firm. However, a well-structured and well informed plan for pricing in such downturn situation can actually strengthen not just the relationships with customers but can also ensure profitability for the firm.

Strategic Pricing- A Saving Armour

Driven by pricing objectives, there is a need of margin-maximizing pricing analysis for each standard offering across the customer segments, followed by the permeated ‘value of the offering’ communication both upstream and downstream the supply chain.

Margin Analysis

As per Arthur D. Little[2], the differentiation in margin drivers can be driven by two factors of the degree of product commoditization (PC) and the degree of price transparency (PT). The four possible scenarios can be:

- High PC with Low PT: Segment specific pricing can be blended with discounting of Value-added services to improve overall margins

- Low PC with High PT: Price optimization post volume/price/margin relationships analysis together with understanding differences in willingness-to-pay to improve margins

- Low PC with Low PT: value pricing at the individual customer level and strong negotiating tactics are the primary margin drivers

- High PC with High PT: Proactive market management, reactive pricing tactics, intelligent pricing and discounting of value-added services to improve margins

In highly contested and mature markets, where it is difficult to capture cost advantages over rivals and breakthrough innovation, a smart pricing strategy “manage for profits and not market share” can increase overall profits for the firm. These strategic pricing driven firms compete more peacefully and strategically by only defending select customer segments on price when and where they can add the most value. The vision is to build lasting B2B partnerships to guard against retaliatory actions. Such price leaders do not indulge in retaliatory actions often and when they do, it is more targeted and deliberate. The key of strategic pricing is in being proactive (anticipatory and visionary to equip themselves to face dynamic customer currents) and value driven (to align what the firm offers to different customer segments with what they value and are willing to pay for) with focus on increasing profitability for sustainable leadership in the market.

Implementing strategic pricing requires structural changes both inside and outside the firm. Leading B2B companies across industries have undertaken structural changes that accounts for external factors, such as the behaviour of customers and competitors, as well as internal factors, such as costs, processes and IT systems.

The firm should structure and define the target price waterfall for each product or service[3] and it should be able to establish a cause-effect relationship between pricing strategies and business, portfolio and customer strategies of the firm. The firm should ensure effective discounting on a deal-to-deal basis to achieve the target waterfall. This entails detailed business intelligence to comprehend the customers’ willingness to pay for the offerings. List prices should serve as an anchor that must correspond to the customer’s view of reality and must be rigorously assessed for profitability.

Many B2B executives understand that pricing has a more powerful impact on the bottom line than other means such as gaining market share. As per Bain & Company research across B2B firms in varied industry verticals; companies earn an 8% increase in operating profit for every 1% of improvement in realized price[4] that is roughly twice the benefit as a 1% improvement in market share, variable costs or fixed-cost utilization.

Finally…

Pricing is an inherently cross-functional discipline and it needs to be woven that ways in the fabric of the firm. The practical challenges strive for someone who can assemble the pieces strewn throughout the organization into a coherent whole by actively collaborating and working across the functional areas. Even amidst challenging times, best-in-class companies create opportunity out of turmoil. The firms need to deploy rigorous data driven (quantitative and qualitative) methodologies towards pricing, through sophisticated segmentation techniques and structured pricing steps. There is an inevitable need to create an intelligent pricing system that can safeguard revenue ensured through enduring customer satisfaction so as to create and maximise profitability for the firm.

“Perhaps the reason price is all your customers care about is because you haven’t given them anything else to care about” – Seth Godin

Written by:

Dr Jyoti Kainth, Assistant Professor, Institute of Management Technology Ghaziabad, India

Dr Anuja Mathur, Associate Professor, Shaheed Sukhdev College of Business Studies, University of Delhi, India

[1] “Clearing the roadblocks to better B2B pricing”, Bain & Company, 2014

[2] Arthur D Little, “Pricing in a downturn”, Strategy & Organization Viewpoint, 2009

[3] The price waterfall provides a measure of the achieved net and pocket prices and not just the price that is printed on the invoice, against defined target prices. This includes determining the list, net and final prices the company wants to realize, as well as the types of discounts it will use to achieve those price points.

[4] Price Realization refers to final prices the products or services are sold. Realized Prices are calculated by deducting all applicable discounts, rebates, shopper rewards, coupon discounts from list price. The left amount is called Pocket Price or real revenue generated from each product or service.

Image [Pricing Comic: Commodity Mindset] by Stephan Liozu.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz