Debt-free, Tax-free Way to Grow your Business

Your next capital injection could come from an unlikely place – one that does not involve a loan of any kind, or asking for outside help

Your company is running well, but you know you could ramp up efficiencies, and broaden your market much more quickly with an injection of capital. Time to hit the banks, cap in hand? Spend an enormous amount of time sourcing alternative funding? Remortgage the family home?

There lies the rub… how to source capital that spurs, not hinders, growth. Let’s take a deeper look at your options.

Other People’s Money

Private equity/venture capital

Getting on the radar of a VC or PE firm is a long, difficult process. Even then, many projects under consideration don’t get funding in the end. Ideally, you’ll need to align with the ‘angel investors’ or equity firm’s favored lines of business/personal interests, and if you’re not in technology or bioscience, that could be a long shot.

Crowdfunding

Again, a hot topic and very appealing concept: putting your new venture/project online in communities (crowdfunder, kickstarter, indiegogo, and others) to raise funds. Your product/service and your reason for needing the money will need to appeal to a very wide audience. You’ll have to elicit an emotional response to a universal problem (e.g. medical research) to garner crowd donations. Like PE/VC, you could put in a fair bit of effort, and end up with little or no funds.

Loans

SBA loans have become almost as rare as the dodo bird, and banks have tightened their access to business loans more than ever in recent years – if you want to go the route of loans, that is. After all, debt servicing costs will drain your cash flow and impede growth as you are saddled with monthly payments.

Your Own Money

If you’ve tapped out your personal savings and you’re not interested in remortgaging your house or selling off (more) assets, you may think you’ve exhausted your own money as a source of capital. Think again… what about those retirement dollars you’ve been tucking away for years?

Your retirement plan may qualify for a type of financing called Rollover for Business Startup (ROBS). Eligible employer retirement plans include 401(k), 403b, 457, ESOP, profit sharing and pension plans. You may also rollover funds from your IRA or a deceased spouse’s IRA.

The process, which involves rolling over your retirement money into your own C-corporation, is known in the marketplace as a Self-Directed 401(k). It’s not a well-known financing option, even though the federal government has made it available to small business owners for almost 15 years.

If you haven’t heard about a Self-Directed 401(k) from your banker or financial advisor, it’s not really surprising. Lending institutions and brokerage houses have a vested interest in ensuring that you invest your retirement dollars in stocks, bonds, and mutual funds versus non-traditional investments like personal businesses.

Despite it being called Rollover for Business Startup, the process is equally accessible to business leaders who want to access capital to grow their existing company as it is to CEOs of startups. As well, a business owner can refinance his/her operation with Self-Directed 401(k). Case in point…

Froyo CEO Refinances with Self-Directed 401(k)

When Dave Christianson opened his startup frozen treat store, Frogurt, in Santa Fe, New Mexico, he learned the hard way that debt can cripple a new business. Originally paying almost $3,000 a month in combined loan payments, he watched a painful percentage of his profits go out the door. Then the off-season hit, with its significant drop in tourism in his region. Dave needed a solution, and fast, to get out of his cash flow woes. He logged into a business forum where he learned about a Self-Directed 401(k) and that it would allow him to pay off his SBA loan and provide the working capital he needed to stay in business.

“The Self-Directed 401(k) is a good way to make your money work for you – you’re basically being your own bank,” says Dave, who worked with a small business financing expert to rollover his 401(k)) to his own C-corporation. “You still have your retirement fund that you can control yourself rather than someone else controlling that money… I knew there was no way I wanted to keep that money in my 401(k) because I just don’t feel good about the economy.” Dave lost nearly $65,000 in the stock market in 2008.

He had enough faith in himself and his business to know that he would be able to pay back his retirement funds, and do a good job of making that money grow over time. It’s going well. As Dave and his wife enter their third year of business, they are considering opening a second location.

Benefits of a Self-Directed 401(k)

When you use a Self-Directed 401(k) to invest in your business, you are investing pre-tax dollars. You’re not borrowing it; you’re not withdrawing it. Think of it this way: when you began contributing to your current 401(k), you were likely investing in your employer’s stock, giving you company shares in return for your cash. It’s the same concept when you invest in the stock of your own business with a Self-Directed 401(k). Some other benefits include:

Approve yourself

You can skip the embarrassment of groveling in front of your banker for a loan, and effectively approve yourself.

No debt, taxes or penalties

With no interest to pay and no time schedule to repay your retirement funds, your business benefits from improved cash flow – the lifeblood of any business.

Minimal paperwork

Setting up a Self-Directed 401(k) requires far less paperwork than a loan application, and there is no business plan required to get your funding.

Get funding fast

On average, it takes about three weeks for entrepreneurs to receive their money from the rollover of their current retirement plan and to purchase stock in their own company.

Open-ended use

You can use the money for salaries, equipment, inventory purchases, or any other legitimate business expense, including a down payment on another loan.

Access to more capital

Should you need it, a Self-Directed 401(k) can help you qualify for an SBA loan, and possibly a bank loan. Since you’re bringing a substantial amount of your own retirement dollars to your enterprise, you’re less of a risk.

Retirement planning & tax deferral

A Self-Directed 401(k) can help you continue to save for retirement by allowing you to contribute a portion of your entrepreneurial salary back to the plan. The plan also allows for normal employer-matching and profit-sharing contributions. Taxes on all these contributions are deferred until the funds are withdrawn during retirement.

Working with a professional who knows the ins and outs of ROBS is well advised; even beyond the initial rollover to your C-corporation, you want to be sure that you stay on top of the complicated, ongoing compliance and administrative requirements. No one wants trouble with the IRS.

*************

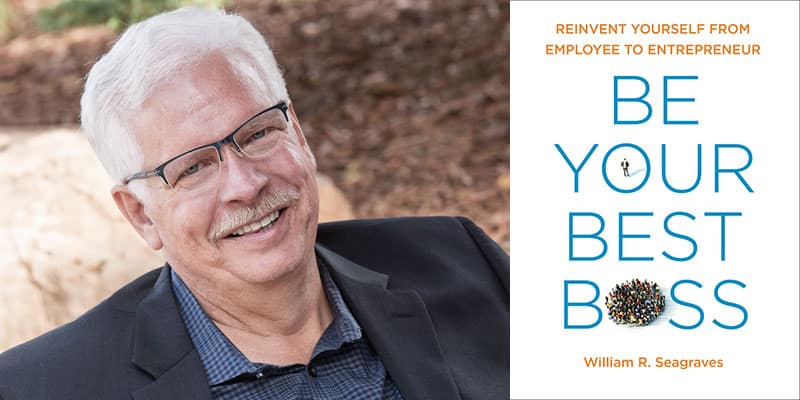

By – William R. (Bill) Seagraves is the author of Be Your Best Boss: Reinvent Yourself From Employee to Entrepreneur (a TarcherPerigee paperback; on sale February 2016) (yourbestboss.com). The president and founder of CatchFire Funding, based in Parker, CO, Bill is a serial entrepreneur who coaches mid-career Americans on the best route to starting and growing successful businesses.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz