As Temp Agencies Surge, Access to Staffing Financing Becomes Crucial

More than any other time in recent history, people looking for work today are much more likely to find it as contingency staff workers rather than full-time employees. Though the numbers and statistics vary by city, profession, and experience level, there’s little dispute that staffing and employment firms have experienced unprecedented growth since the Great Recession. To sustain this seemingly never-ending development, employment firms have turn to alternative commercial financing such as invoice factoring and payroll factoring for revolving capital or credit.

Staffing Agencies, for Both Specialty and General Workers, Thrive

This growth in staffing is true for both high-skilled professionals and rank-and-file employees. On one end of the spectrum, there are high tech, engineering, medical, health care and finance professionals with advanced degrees filling out high paying and very competitive contingency positions.

On the other end, there are low-skilled office workers, assistants, coordinators, manufacturing workers and others that fill the role of the traditional temporary worker. For both sets of employees, employers have adopted a let’s-take-this-slowly approach to adding staff to their payroll. They are taking advantage of the just-in-time hiring model that today’s staffing agencies can provide.

Consider the Following Recent Statistics on Hiring and Staffing Trends:

- In the Dallas-Fort Worth area from 2013 to 2014, nearly one in five employees for private firms was a contingency staff worker. Many of these jobs were for high-tech contractors and general oil and gas laborers.

- In August 2014, temporary workers accounted for 2 percent of all workers across the nation, a record high in the staffing industry. Those temp firms employed an average of 3 million contract workers per week in 2013.

- Sales for temporary and contract staffing totaled $109.2 billion in 2013, an increase of four percent from 2012.

- Turnover, a considerable expense in the staffing business, is normally around 300%. In 2013 turnover was 263%, a record low for the industry. This means staffing agencies are employing workers for longer periods of time.

Main Hurdle to Staffing Growth is Insufficient Payroll Financing

Given these recent statistics and trends, the industry of staffing is growing at an unprecedented rate and shows no signs of decelerating. According to reports by the American Staffing Association, the only real slow-down seems to come from within. Lack of capital, insufficient payroll funding, not enough qualified workers and logistical limits are the only things slowing down industry growth. It certainly isn’t lack of demand.

While pure logistics and timeframes limit growth for some agencies, the largest blockage is insufficient staffing financing, particularly payroll financing. Regardless of industry or specialization, temporary employment firms require considerable startup costs. In addition to advanced payroll financing costs, which comprises at least half of all expenses, staffing firms must pay for:

- Marketing, advertising, and promotions costs

- On-going sourcing, recruiting, retaining and hiring costs

- Healthcare and benefits costs

- Business office space, utilities, telecommunications, etc.

Incongruent Payment Terms Can Hurt Burgeoning Temp Agencies

There is a financial mismatch in the contractual agreement between the employer (the client) and the temporary staffing agency. Temp employees must be paid in two weeks for the work they have performed (even though the staffing firm doesn’t collect payment for four weeks). Because payroll financing costs are so high, a temporary staffing firm must be able to cover this financial discrepancy between incoming and outgoing funds.

And while it’s true that many industries and companies must contend with cash flow differences due to incompatible payment terms, few are as impacted by them as the staffing industry. This is in part because the cost of payroll financing is so high, but also because payroll financing simply cannot be paid late.

Though it is ill-advised for any business to pay a supplier or vendor late, it is unacceptable for a temp agency to neglect its payroll funding obligations. Simply put: Payroll payments are not the same as other vendor payments.

What Happens to a Temp Agency that Can’t Meet Its Payroll Funding Requirements?

- It could be sued by the workers. When it comes to payroll financing, it isn’t just a bad business practice to not meet payroll obligations, it is also against the law. Though the specifics vary by state, the temp agency can expect to have legal claims filed against it for not paying its employees.

- It could be heavily penalized by the U.S. Department of Labor. It’s actually a federal crime not to pay workers, and it’s an offense the government takes seriously.

- It could be fined by the IRS. Call this the icing on the cake but the IRS will severely penalize a firm for issuing payroll late because this means it is falling behind on its payroll taxes.

For all of these reasons and more, being unable to meet payroll obligations is widely viewed as “the” most urgent situation a business can face. This is doubly so if the business is a staffing firm. No employer will want to hire a temp staffing firm that can’t cover payroll expenses, and no personnel will want to work for a firm that can’t pay them.

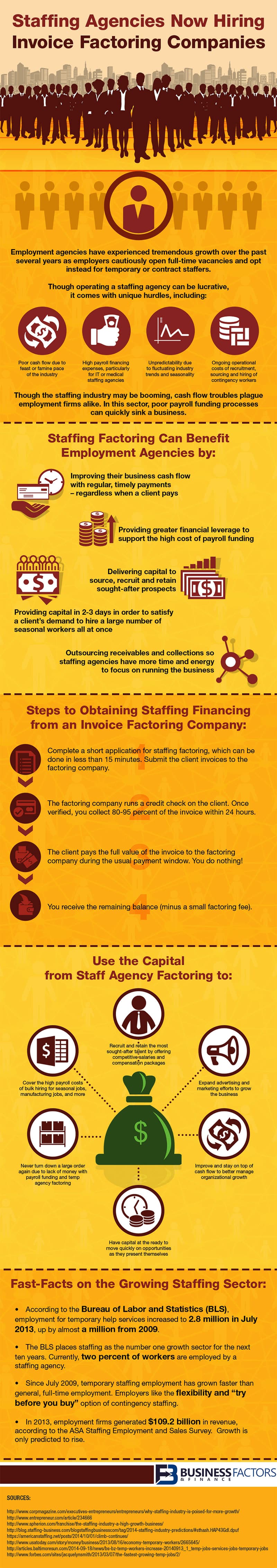

Our latest infographic explains how staffing agencies are using factoring for reliable and steady cash flow to cover the many costs related to employment firms.

Payroll Factoring Becomes Attractive Option to Staffing Firms

For all of these reasons and more, many general and specialized staffing firms have opted to partner with invoice factoring companies rather than banks to secure their revolving payroll financing needs. Unlike banks that can take several weeks to process a business loan application, factoring companies can process – and issue – payroll factoring in 2-3 days.

Because factoring companies provide cash or credit so quickly their rates tend to be higher than bank lending fees. But when you are talking about something as crucial as payroll financing to a staffing company, the higher costs are of little consequence. Advance payroll factoring allows new and growing temp agencies to meet their current and upcoming payroll obligations, and that’s the most important thing to such a business.

Fast-moving Factoring Pairs Well with Fast-growing Staffing Firms

Growing employment agencies seeking staffing financing quickly have a number of options to turn to instead of traditional banks (which might take too long and have too restrictive terms). One such option is staffing factoring or payroll factoring, which provides an advance on existing receivables thereby bridging the payment gap between the sale and the collection period. Though factoring receivables is used by a wide variety of industries, its expedited services are particularly useful for businesses experiencing rapid growth.

***********************

Written by Peter Amundson, since 1991 I specialize in Invoice Factoring, PO financing and ABL facilities. I currently work internationally with companies in the US and Canada via our internet marketing division. Specialties: Accounts Receivable Factoring and Payroll Funding for Manufacturing, Oil & Gas, Telecommunications, Wholesale Trade Distribution, Staffing and Transportation. I always enjoy helping companies rise to the next level of success. For more information businessfactors.com.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz