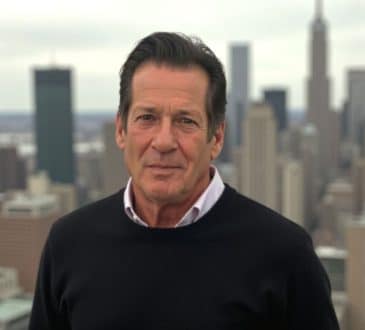

Kazakhstan’s youth will ‘drive our business activity’, says Freedom Holding CEO Timur Turlov

Kazakhstan’s youth will ‘drive our business activity’ and encourage its entrepreneurs to ‘take more risks’, said CEO and Founder of Nasdaq-listed conglomerate Freedom Holding Corp Timur Turlov.

His comments were made on the second and final day of the inaugural Kazakhstan Economic Freedom High-Level Conference, which has gathered representatives from Central Banks, financial regulators and leading international businesses to the nation’s capital Astana to debate macroeconomic trends.

The day’s panel convened to discuss monetary policy in a new world, and featured an impressive roster of speakers who debated the economic prospects of emerging markets after the global inflationary spike of 2022.

Timur Turlov, CEO of a global financial conglomerate headquartered in Kazakhstan’s financial capital Almaty, expressed his optimism that young demographics point to a bright long-term economic future for the Central Asian nation.

‘We are getting younger and younger in Kazakhstan’, Turlov said, citing statistics that show the nation’s average age hovers around 30. ‘Economics is behavioural science and it’s interesting to see how every country reacts to different stimuli differently’, continued Freedom’s CEO, affirming his belief that Kazakhstan’s youthful creativity will allow entrepreneurs to thrive in an environment that enjoys government support.

Turlov’s faith in the exuberance of youth will come as no surprise to observers of Kazakhstan’s business scene. Alongside several leading Kazakh businessmen, the entrepreneur is a benefactor of iQanat, a project that aims to reduce educational inequality between Kazakhstan’s cities and rural areas by offering free schooling to highly talented students.

Alongside Turlov spoke Akylzhan Baimagambeyov, Deputy Governor of the National Bank of Kazakhstan, who was similarly upbeat about the Central Asian nation’s economic prospects.

Baimagambeyov praised the ‘drastic measures’ the bank took to protect the economy from inflation during the pandemic, an example of the nimble response demonstrated in many emerging markets which has meant inflation in these states ‘is decreasing in a balanced way’.

Natia Turnava, Acting Governor of the Central Bank of Georgia, expressed similar praise that the Bank has ‘managed to normalise the economy successfully’.

Sandwiched between Russia, Turkey and Iran in the heart of the Caucasus, Georgia has been vulnerable to the three-pronged threat of supply chain disruption, commodity market disruption and geopolitical tensions. But despite these shocks, Turnava’s prognosis for Georgia was unequivocally optimistic: ‘We have high economic growth and low inflation. The economic outlook for Georgia is positive’, she told delegates.

Nor Shamiah Mohd Yunus, former Central Bank Governor of Malaysia, completed the panel’s contingent of speakers from the world of national monetary policy. Identifying similar causes of economic disruption during the pandemic, including ‘supply disruption, geopolitical tensions and a weaker currency’, Shamsiah explained from her experience that novel approaches towards public communications are necessary to defend economies from turbulent periods.

‘In the age of social media, communicating with the public takes on a new important role during times of volatility and uncertainty’, she told delegates. ‘Effective public communication plays a key role in normalising monetary policy’, she continued, ‘it is a complex process, but essential for achieving stability’.

The panellists were also joined by Nicolas Blancher, Central Asia Division Chief at the International Monetary Fund, who cautioned delegates that ‘investing in credibility takes time and effort’.

Stressing the importance of strong institutions to build policy credibility, Blancher told the conference that ‘establishing clear mandates through price stability and financial sector stability, protecting institutional independence, clarifying division of labour and communication mechanisms and eliminating quasi-fiscal roles’ were the essential ingredients of long-term economic stability.

The High-Level Conference is the result of a partnership between Timur Turlov’s Freedom Holding Corp and the Reinventing Bretton Woods Committee, a not-for-profit organisation that facilitates dialogue between high-level stakeholders to redefine global financial and monetary systems to better respond to a changing economic landscape.

Reinventing Bretton Woods were represented on the panel by the Committee’s Executive Director and Founder Mark Uzan, who observed that emerging markets have ‘showed resilience’ against wider global volatility.

For its part, Freedom Holding Corp have grown rapidly from a Kazakhstan-based brokerage service to an international conglomerate spanning investment, retail banking and telecommunications arms, whose market capitalisation had reached close to $6 billion at the time of writing.

Under the sponsorship of a leading global financial services company and with Reinventing Bretton Woods’ expertise in facilitating high-level dialogue, the inaugural Kazakhstan Economic Freedom High-Level Conference impressed delegates with its roster of high-profile speakers, establishing its reputation as an exciting newcomer on the global financial calendar.

Have you read?

Karri Alameri Appointed as New CEO of Oma Savings Bank Plc.

Crypto Billionaire Zhao Changpeng Eyes New Ventures After Release.

Sharjah is the Rising Haven for Expats Amid Dubai’s Soaring Rents.

Qonto Expands Across Europe to Support SMEs and Freelancers.

Robert Gilby Steps Down as Dentsu APAC CEO.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz