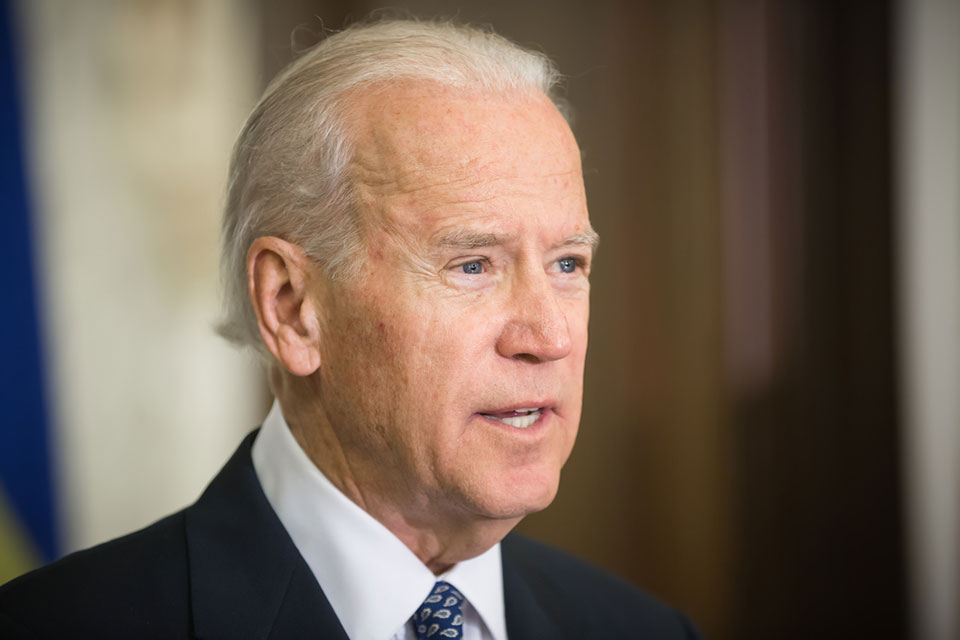

What’s at stake for Biden and Merkel

It is the most important geopolitical meeting of the year. Joe Biden will receive German Chancellor Angela Merkel at the White House this Thursday, July 15, 2021. It will be the Chancellor’s first visit to Washington since the Biden administration took office. Merkel arrives with the issue that she will leave office after 16 years in October and although Germany continues to be the economic engine in Europe, there are deep domestic challenges such as demography, digitalization and economic growth still evident.

The main objective is to deepen the alliance within the western world. Biden, as in his time with Barack Obama, perceives Germany as a true ally in facing global challenges such as climate change, economic recovery and the fight against the coronavirus.

Merkel and Biden have had very deep ties since the Obama administration when the former president mentioned that, “If I were German, I would vote for her”. Merkel’s relations with Trump had been less profound during his four years in office. Since Joe Biden’s entry to the White House the German Chancellor has said that there is a wider scope to work together with Washington. They will surely show and reaffirm a new force in the transatlantic union, which will allow Merkel to lead over to Armin Laschet, the possible successor of the Chancellery in Germany from the Christian Democratic Party.

This May Laschet received John Kerry declaring that the United States is back on the world stage as a partner. The two allies do so out of necessity. There are signs of belief that the relationship between Europe and the United States is the basis of security and world stability, especially on economic aspects where Germany and the US increasingly depend on one another to stay competitive with China. Because China has undoubtedly achieved a new economic leadership where the Germans and Americans can no longer deny that they somehow depend on the Asian giant as well.

It is fascinating to understand how these three countries compete with different strategies and practices. Three distinct approaches, in which the sayings “The US is the land of consumption having the most innovative business models taking bold growth risks, Germany develops and exports best engineering products and industrial 4.0 innovation, and China produces for the world” are still true, although with increasingly competitive shifts in the midst of digital and financial disruption.

At the end of the day, the economic issue is most importantly to Biden and Merkel, where China has surpassed Germany and the United States in export value (USD) during the past decade. 30 percent of the global GDP has to do with exports and international trade. In 2010, China overtook Germany and in 2013 China surpassed the US to become the leading export economy. Germany still bases its business and economic model on exports with more than 45 percent of its GDP dependent on the sale of its high value-added goods and services (quality and innovation) abroad. The SME segment, especially the so-called “Mittelstand” companies, accounts for around 70 percent of total exports. In 2020, Germany exported 104 billion euros to the US and 96 billion euros to China.

In this sense, Merkel will seek, politically correct before Biden, to follow commercial and political ties with China. But at the same time, Germany sees in China not only a commercial ally, but an increasingly modern rival due to its advanced manufacturing capabilities. This is due to China’s successful competitiveness strategy, which focuses no longer just on a cost-advantage approach. The strategic acquisition of the German company Kuka, one of the world’s leading robotics firms, by the Chinese Midea Group attracted attention in Germany.

In addition, China has been the only large economy in the world that had growth in 2020 all while coping with a devastating pandemic. It seems that since the 2009 economic crisis China understood that it cannot predominantly depend on external consumption as an engine of growth and developed domestic consumer markets and oriented its production towards them.

What is definitely striking is the agility and speed at which multinational companies such as ICBC, Ping An, Huawei, WeChat, China Mobile, Tencent, Taoboa, Tmall, and the SME segment in China are advancing. They are companies from different industries that today appear in the most valuable brands in the world. Several wake-up calls and so Joe Biden put a sense of urgency on the issue of the rapid production with Pfizer of the German BioNTech vaccine and last week signed an executive order on promoting the competitiveness and innovation of the US economy.

Historically, America’s competitive advantage has been its outstanding ability to penetrate markets with strong strategies, products, and brands. It seems that Biden is understanding that his country must take even more risk to build and lead the future. At the level of GDP per capita and prosperity, the US and Germany can surely continue to outperform China for the next 3-4 decades. Likewise, the United States still has an advantage of having an economy 42 percent larger than China, but it is estimated that by 2026 this advantage will decrease to only 14 percent. By 2028, China could achieve the milestone of surpassing the total GDP of the United States by the simple fact of the size of its population that is more than four times larger, with an increasingly prosperous middle class.

Something that these three mega-economies have in common are: competitiveness, SME development, and fast access to investment, reserves or credit. It is more than crystal clear that the competition at political, business, innovation, sustainability and development levels is becoming increasingly fierce. Agility in decision making and the ability to implement sound policies will define future success and failure more than ever.

That will be true for Biden, Merkel, Laschet or Xi Jinping. Likewise, for enterprises and businesses, the environment will become even more competitive, demanding them relevant, innovative, and sustainable business models. Political and business leadership is on trial and definitely occupies a greater sense of urgency in these times.

*Thomas Michael Hogg, author of Profitable Growth Strategy, is a consultant and mentor with more than 20 years of market and work experience in Germany, Switzerland, the US, and Mexico. Thomas has been an advisor to global companies such as PepsiCo, Adidas, Campbell’s Soup, Johnson Controls, Bulkmatic, among other multinational companies, SMEs and nonprofit organizations.

He is author of “Profitable Growth Strategy – 7 proven best practices from German companies” and a columnist at El Financiero. Thomas has been interviewed and featured in CNN, Bloomberg TV, Forbes, Business Insider, CEOworld Magazine, SalesTech Star, Recruiter, Global Finances, EE Times, The Entrepreneur Way, El Economista, Reforma, Cluster Industrial among others. Furthermore, he has been a speaker at the Mercedes-Benz innovation week, Hannover Messe, SAP, and Oracle events.

Written by Thomas Michael Hogg.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz