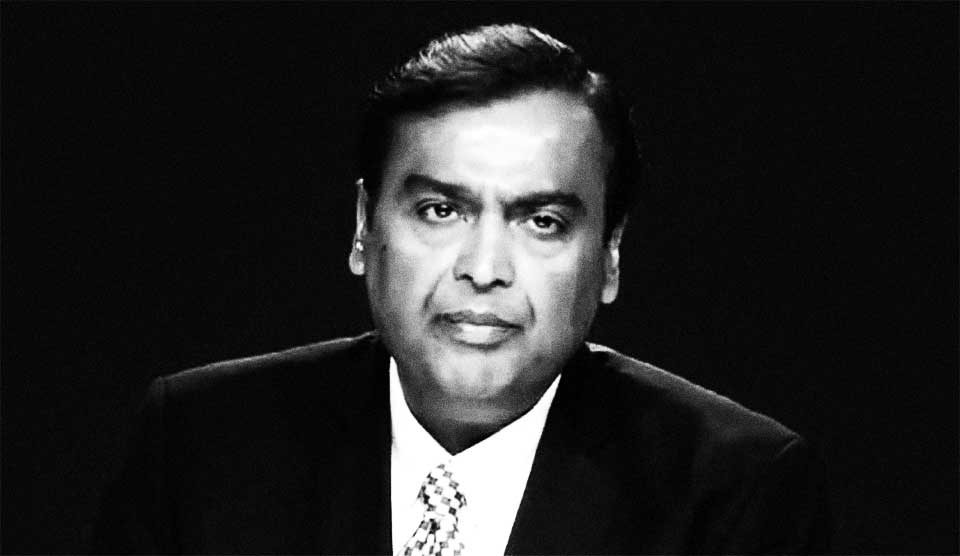

KKR will buy a $1.5 billion stake Billionaire Mukesh Ambani’s Reliance Jio

U.S. equity firm KKR announced it will invest $1.5 billion in Billionaire Mukesh Ambani’s Reliance Jio, joining fellow investors Facebook (invested $5.7 billion), Silver Lake, Vista Equity Partners, and General Atlantic that have made similar bets on Reliance Jio Platforms.

New York-based KKR values Reliance Jio Platforms at $65 billion. Reliance Jio Platforms currently has over 388 million subscribers, according to Reliance Industries’ most recent financials, which represents about 35% of market share. Jio is part of Mr. Ambani’s sprawling oil products-to-telecoms conglomerate Reliance Industries.

– Facebook invested Rs $5.7 billion for a 9.99% stake in Jio Platforms.

– General Atlantic said to invest $870 million for a 1.34% stake in Jio Platforms.

– Vista Equity Partners said to invest $1.5 billion for a 2.32% stake in Jio Platforms.

– Silver Lake said to invest Rs $750 million for a 1.15% stake in Jio Platforms.

“We are investing behind Jio Platforms’ impressive momentum, world-class innovation, and strong leadership team, and we view this landmark investment as a strong indicator of KKR’s commitment to supporting leading technology companies in India and the Asia Pacific,” said Henry R. Kravis, Co-Chairman and Co-Chief Executive Officer of KKR.

“It’s been no secret that India’s Reliance Industries has very big ambitions, but now it’s getting support from some of the biggest tech investors in the world,” said Dr. Amarendra Bhushan Dhiraj.

Over the past month, Reliance has attracted almost $9bn of investment from a string of top US investors. Reliance Industrie is currently led by Billionaire Mukesh Ambani, son of founder Dhirubhai Ambani, who took over part of the enterprise after his father’s death in 2002.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz