Changing How You View Your Workforce

In late March 2019, the Investor Advisory Committee (IAC) of the SEC approved the disclosure of human capital metrics for selected public companies. That would seem an innocuous event, but the ramifications could be far-reaching – not just for public companies but for virtually all organizations.

Why is this development so important and not just another “rule” requiring some level of compliance? It is precisely because this isn’t just another rule – it is a fundamental shift in the way the SEC views human capital. Up until now, human resource expense was viewed as a “cost” to the company and treated accordingly. The SEC is now signaling that human capital is an intangible asset (like goodwill, brand recognition and intellectual property) and should be “conceptualized as an investable asset.” This has profound implications not just for disclosure, but also for accounting and tax purposes, which means it will be on the minds of management and board directors.

In addition to the SEC move, two other disclosure events have occurred since January 2019 – 1) ISO released their standard on human capital disclosure governance which conceivably could impact more than one million companies worldwide and requires the disclosure of human capital metrics to both internal and external stakeholders; and 2) something that will impact all US companies with more than 100 employees – EEO-1 Pay. This compliance requirement will force companies to disclose pay practices to the government to determine if there are discriminatory practices at play.

What This Means for Your Organization – Expanding the Role for the CFO

We have seen the role of the CFO evolve over the last several years, and the new developments will drive further changes to CFO-role expectations. According to a recent article published in the Harvard Business Review, in addition to the traditional role of “stewards to protect and preserve the organization’s critical assets and ensure accurate reporting, and fulfilling the finance function’s core responsibilities efficiently and effectively”, two new roles are added to accountabilities of CFOs – that of “strategist and catalyst.” As a strategist, the CFO provides “financial leadership in determining the organization’s overall direction” and as a catalyst, the CFO “instills a financial approach and mindset throughout the organization while creating a risk-intelligent culture.” This catalyst role may be the most important contribution to the organization in that, in promoting a new mindset, the fundamental approach to evaluating business efficiencies is highlighted. This role becomes easier with the accelerated adoption of data analytics as a business intelligence tool. According to Chris Mazzei, Global Chief Analytics Officer at EY, “there’s no doubt that CFOs need to be a champion and driver for the use of analytics in all current core financial processes under his or her remit today.” In another report, EY claims that organizational success will depend on the CFO and other management being able to combine the “intelligence of smart technologies with the brains, emotional intelligence and interpersonal skills of talented people.”

Equipped with financial competencies, data analytics skills and technology, the CFO will be called upon to explore where efficiencies can be found in the organization – and given that human capital investment is typically the largest line item expense (upwards of 50% of gross profit for most organizations), this is the area with the greatest opportunity to leverage the returns on this large investment.

Three Things Your Company Can Do

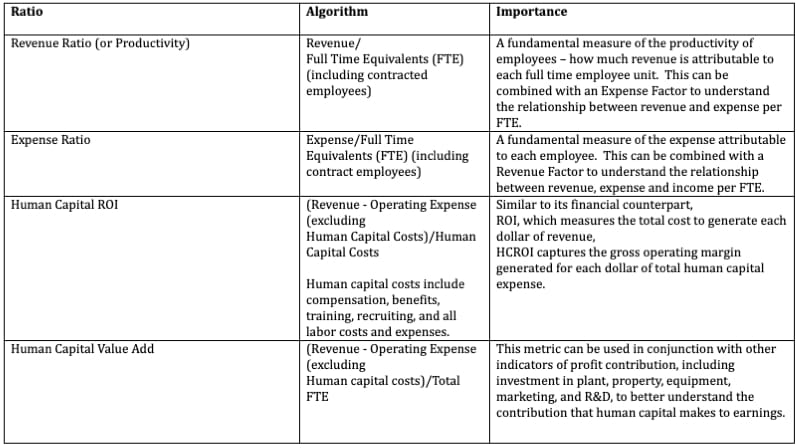

The first initiative should be to baseline current human capital efficiencies over the last one to two years to understand the basic trends for your organization. The top four measures should include: revenue ratio, expense ratio, human capital ROI and human capital value add. These are all easy-to-calculate ratios. Are you getting a return on your investment in human capital spend? What is the trend – upwards, downwards? How are human capital ratios moving in relation to other selected financial ratios like ROI, EBITDA, etc. and other business indicators like market share, net promoter score, etc.?

Second, where possible, you should benchmark your organization’s performance to competitor performance. SEC filings prove a good source to understand HR costs – often detailed in the financial statement footnotes. You will have to calculate the ratios for your competitors as you do for yourself. How is your performance compared to your closest competitors? Are you out- or under-performing?

Third, once you understand your organic performance and your performance benchmarked to competitors, it should be an easy exercise to prioritize your focus to improve programs with the lowest level of efficiency and highest negative impact on financial outcomes. Focusing on the low-hanging fruit will reap big financial rewards for the organization. The four ratios that you calculated will let you know where to look. To give you a “head start”, academic research shows that the three biggest human capital drivers of economic value creation include: a.) retention/attrition performance; b.) investment in training and development; and c.) level of diversity in the organization.

The Bottom Line

With a new focus on human capital as an organization’s competitive advantage and the move to categorize this “spend” as investment rather than expense, it is incumbent on organizations to renew their focus on optimizing human capital “utility.” Getting a jump start on understanding your organization’s performance in this area gives you several benefits including being able to enhance efficiencies in this area as well as anticipate strategies to manage the messaging and optics of your performance now and in the future.

Sidebar:

Calculating Ratios

Have you read?

# The World’s Best Performing Companies 2019.

# World’s Most Luxurious Hotels, 2019.

# Best Music Schools In The World For 2019.

# Best Fashion Schools In The World For 2019.

# Best Business Schools In The World For 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz