Last Call For The Bangko Sentral ng Pilipinas (BSP)

The Philippines is one of the economically well-founded emerging markets countries – therefore it gives reason to raise more than an eyebrow when the monetary policy plays with fire.

On Thursday, the 15th of February, the Philippine Central Bank, Bangko Sentral ng Pilipinas (BSP), eased the monetary policy by cutting the reserve requirements for banks. These sorts of things have happened an infinite number of times in history, so it should hardly excite anyone.

But the Philippines has the fastest growing economy in the world, and as the government increases the budget deficit this year, then furthermore does the country’s currency slide in value every month. At the same time, the global trend among central banks is currently to hike interest rates or to tighten monetary in other ways.

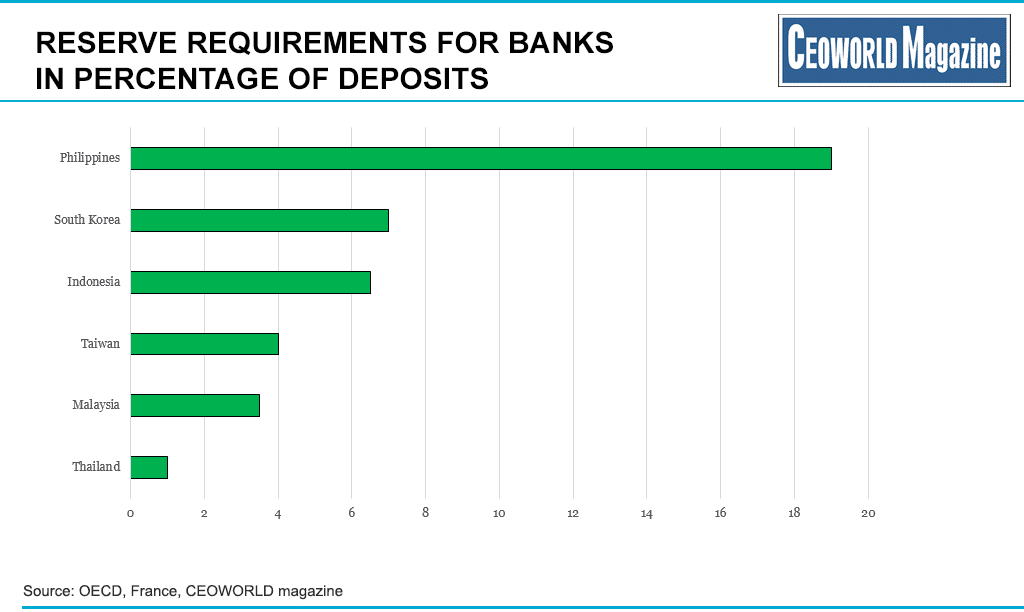

The BSP has very professionally communicated about its plan to cut the reserve requirements to even lower than 10 pct. over time. As graph one shows, the reserve requirements in the Philippines are far higher than the surrounding countries, even after the reduction from 20 to 19 pct. The wish of BSP is to pursue monetary policy similar to the country’s peers as well as to follow the general approach among central banks which is to make use of interest rate changes instead of regulating the cash reserve requirements.

I think this is a sensible move, and hopefully it will act as one of several steps in opening up the country’s overall financial system for further capital movements in and out of the country.

Reserve requirements for banks in percentage of deposits

- Thailand: 1%

- Malaysia: 3.5%

- Taiwan: 4%

- Indonesia: 6.5%

- South Korea: 7%

- Philippines: 19%

Regardless of the monetary policy measures, the Philippine economy continues to be incredibly strong and investors should still be attracted to the extremely robust domestic demand. Combined with the government’s ambitious infrastructure investment plans, the economic adventure continues for several years.

But high growth also poses a risk of rising inflation, excessive public budget deficits and, for example, an increasing pressure on the current account. It is precisely in situations with these potential risks that a central bank has an extremely important function in the economy.

For any government it’s always tempting to fuel the economy by public spending, which a central bank cannot hinder. However, if a central bank estimates that the macroeconomic risks become excessive, action is required. Any responsible central bank will steer the country far away from risks and nervousness in the financial markets. But an unknown factor is always how sensitive investors and the financial market in general are to macroeconomic risks? And thus, how grave is the nervousness in market?

This is one of the famous very good questions, as a central bank will of course not test the market in how nervous it can get – on the contrary. However, I think that this challenging question can be assessed – in my view the situation has interestingly changed over the past six to nine months.

For more than five years, the global financial market has been in a sweet spot with high returns and an easy-going life. The enormous liquidity in the financial system globally has led to an investor hunt on yielding financial assets. If, for example, the bond market in an emerging market economy was under pressure then after only a few months investors were ready to buy the bonds again because the entire financial world was optimistic about all assets.

In my opinion, this very positive basic assessment changed already well over six months ago. One of several reasons is that it became clear to all that the U.S. central bank (Fed) was serious with the interest rate hikes. At the same time, inflation has been higher in many countries for a longer period than the bond market had foreseen.

But there are further reasons why investors’ nervousness about the Philippines has grown higher. In particular, the country has let its currency slide, which again is provoked by BSP not hiking the interest rates already last year – that should have come in the wake of the U.S. monetary tightening. As fuel to the fire, the Philippine inflation rose to four pct. in January, though the development can partly be explained- and I’m actually not so nervous about this development yet.

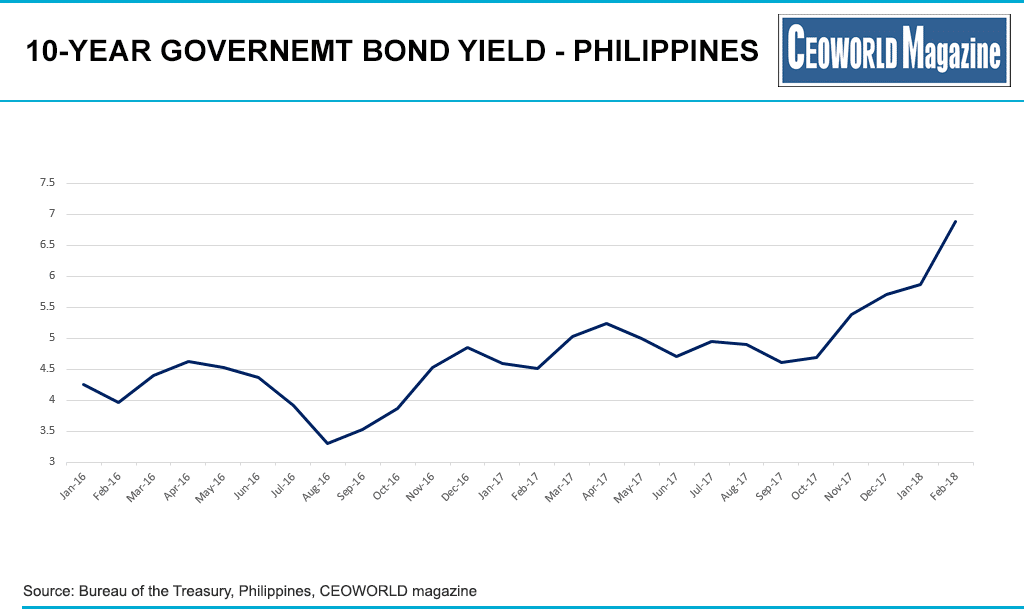

However, it is significant that the Philippine 10-year bond yield has shot up from 4.5 pct. in October to the current 7 pct. (graphic two). I view the development as investors assessing that the interest rate hikes in the Philippines are overdue and thus pricing in the missing rate hikes in the bond yield already. But the rise in bond yields also reflects a concern about a continued decline in the value of the peso.

Perhaps some may argue that the interest rate rise in the domestic bond market does not matter, as it is only for speculators. However, investors who invest in the government’s ambitious infrastructure projects will relate their returns to a reference where the 10-year bond yield is a possible choice. This yield is now higher and therefore the return from the infrastructure projects must also be higher. If it is a user-paid project (like a highway), this could mean that users have to pay a higher toll as a consequence.

In January, the Philippines issued government bonds in U.S. dollars with 10 years maturity. It was at an interest rate of only 0.378 pct. above the similar U.S. treasury bonds which confirms the investor confidence in the Philippines’ fundamental economy. But just during the month since the bond issue the peso has lost 3.5 pct. against the dollar thus the financing has already become expensive.

These are good examples of why it is better for the Philippines to pursue a firmer, or even hawkish, monetary policy. It would give comfort to those investors who find the current bond yields and peso level attractive, which I believe many investors do – but the central bank has a last call to prove a firm hand at the next monetary policy meeting in March.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz