M&A: An Orchestration Encompassing Multiple Unique Attributes

In an endeavour to assure shareholders who have soaring ROE aspirations, companies’ world over are looking at M&A as a panacea to ensure a sustainable top-line growth. Does this inorganic growth strategy always generate intended results?

Rationale Driving M&As

You have just been appointed a CSO of an industrial product company for Asian countries. The board of directors has given you an ambitious target of expanding business with company’s existing product offering to Indian market and of launching a new product range to be offered in Japan. What strategic decisions should you undertake to achieve the intended corporate growth strategy?

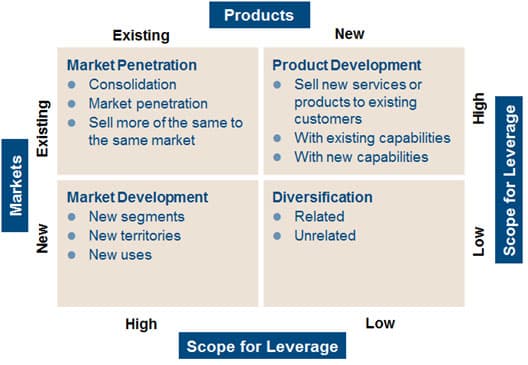

Let’s analyse such growth strategy scenarios with Ansoff’s Matrix [1].

Exhibit 1: Ansoff Matrix

Market Penetration

With an aim to increase the market share with existing product offerings and in existing markets, this is perceived as being a least risky proposition. Here the familiarity with the product offering and markets can be leveraged. However, the company is likely to face rigorous competition in this domain. To outperform the competitors, the company can implement targeted marketing communication strategy across physical and digital space. Various price based, non-price based and/or loyalty based promotions can be used to penetrate the existing markets. In scenario of consolidation due to overcapacity, companies may want to explore M&As to achieve competitive advantages of scale, cost savings and branding etc.

New Product Development

In case where the company has an established set of loyal customers, the company can strategize for growth by:

- Launching new related products

- Leveraging incremental changes through initiating variations in existing products

- Undertaking quality initiatives to enhance the customer perceived value for its product lines

This may be achieved by exploring M&As for carrying out extensive R&D projects to develop value-laden product offering based on well-researched customer insights.

Market Development

In case of market saturation, the companies can achieve growth by entering new markets/geographies and by increasing sales channels. A feasibility analysis to comprehend the impact of increase in sales channels on increasing the target market size can be studied before deciding on the types of sales channels. This can be implemented by re-engineering the delivery processes. Also, an acquisition can be initiated to leverage the sales and distribution channels of the company so acquired.

Diversification

It is the riskiest growth strategy wherein the company aspires to launch new products in new/uncharted markets. For this, M&As have the potential to enable the company towards creating a distinctly new value proposition for its prospective customers. Entirely new markets/geographies can be invaded where the strategic alliance has an experience that can be leveraged.

Hence, M&A can be perceived as a strategic juncture at which the compelling need for growth gets intertwined with an opportunity to leverage alliances to achieve the same.

Strategic Decisions that M&As Entails

Under the aegis of an informed leadership that can clearly envision the resultant synergies well aligned to the corporate growth strategy of the company, M&A is a structured process. The M&A should be objectively articulated as a strategic step along the long-term growth trajectory of the company. Backed by full confidence of the stakeholders, the team administering M&A should follow a rigorous valuation methodology at each stage of its execution. The acquisition targets need to be diligently scrutinized in the light of the customer value propositions decided by the company. The team should be able to beautifully orchestrate the disparate functional domains into an integrated set of deliberations with consistent focus on filtering/monitoring for potential risks and returns. There is a need to explore the synergies of the prospective alliance and align them to the strategic growth aspirations of both the companies involved in the deal. This would also include weeding out any differences pertaining to culture, human resources and vendor contracts to name a few. The team under the mentorship of the leader (may be the CSO) is not only responsible for strategic planning, but also should be able to ensure that it meets strategic execution, while deploying robust all- encompassing change management systems in both the companies.

The Importance of Strategy Execution in M&As

As mentioned earlier, an ambitious strategic planning around M&A needs to meet a robust strategic execution of the same, to enable the companies reap the benefits of the transaction fully. However, the execution of the transaction should be timely. There is a compelling need for an in-depth due diligence to validate the inherent assumptions. Since negotiations play a key role in deciding the future of the prospective M&A deal, there is a need to substantiate the benefits emanating out of synergies based on vigorous information systems. The envisaged growth, profitability and financial metrics should be deliberated upon and clearly mapped before any stint on the negotiation tables. The need to monitor the transaction closely does not end up with closure of the deal. Post-M&A issues needs to be rigorously monitored at regular intervals to affirm the success for those involved.

“Ideally, you would start planning as soon as you decide to buy something. If you have no plan for the target company, you are going to pay the wrong price and you are not going to be ready to handle the integration. I would do a couple of days planning right at the start. At latest, I would start building a full integration plan around 100 days before you believe the deal will take place.” – Danny A. Davis

[image: Jerry King]

Note: Ansoff, H. I. (1957). Strategies for Diversification. Harvard Business Review.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz