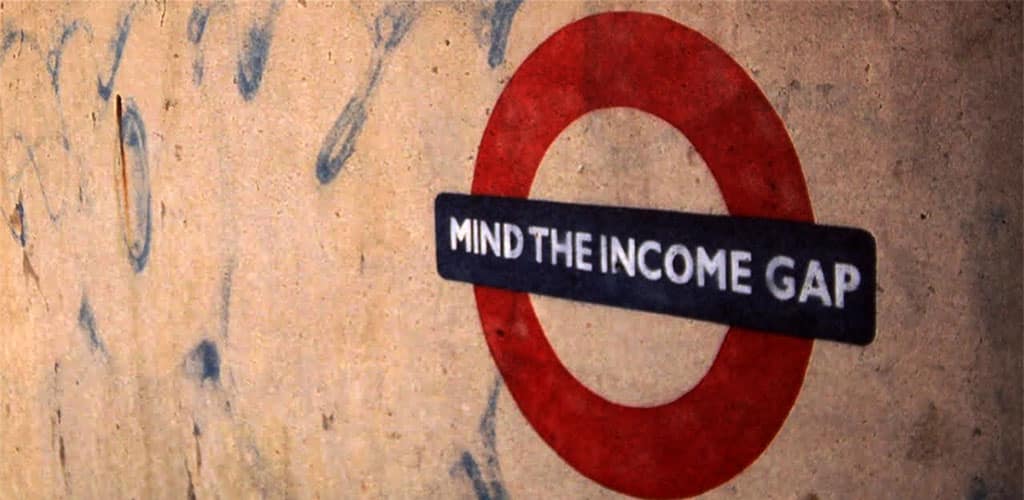

Meaningless Measures of Corporate Income Inequality are a Missed Opportunity

Among the many uncertainties facing public companies in 2017 will be figuring out how to calculate –and how investors may interpret– one of the most radical disclosures ever required, the ratio of the CEO’s compensation to that of the median employee, or the CEO pay ratio.

Unlike most dictates handed down from the Securities and Exchange Commission, which attempt to prevent companies from doing bad, this new measure is designed only to encourage companies to do good. There is no penalty for a wrong measure, nor even any guidance as to what a wrong measure might be.

It is this nebulousness that has drawn scorn from many corners of the financial world. Although the pay ratio rule author Senator Robert Menendez says the new measure is meant to help employees and investors understand the fairness of a company’s compensation structure, there is little explanation of what Menendez means by “fair.”

Is it fair that a retail employee makes $25,000 a year while a software engineer makes $125,000? The engineer has likely invested many more years in education to develop a specific set of skills which warrant the higher salary.

This question is relevant for companies like Apple when it finally comes time to peek under the hood of non-executive compensation. By many standards, Apple’s CEO, Tim Cook, is underpaid for his industry. At the same time, Apple’s employees are overpaid. Still, Apple’s pay ratio is likely to be many times that of competitors like Microsoft solely because of the thousands of the retail employees in its Apple Store, one of whom will certainly be the median employee.

Anyone who has been the victim of unfair pay practices, whether it’s a woman who finds out her male colleagues are paid more than she does, or an employee who sees friends laid off while the CEO gets a bonus for cost-cutting, knows that pay practices matter for performance.

It is refreshing to see U.S. lawmakers beginning to realize what economists and psychologists have known for decades: it’s not just how much a person earns but also how much those around him earn that determines a worker’s satisfaction and effort.

These findings and the fact that compensation is the largest expense for many companies mean that any insights into the wage bill and inequality could be useful for investors as well.

Unfortunately, a number comparing the CEO’s pay to that of an employee down the corporate ladder is simplistic at best and befuddling at worst. Compensation decisions are complex and involve factors that have to do with fairness (like discrimination and effort) and those that don’t (like the cost of living). To truly understand how compensation structure creates income inequality, measures of inequality must be accompanied by context to make these measures interpretable.

Therefore, companies that have confidence in their treatment of employees can offer narrative explanations of their pay ratios. They can report how they determine compensation and how their pay practices compare to those within their industries. Those that don’t share this information risk letting their silence speak for itself.

More importantly, lawmakers and regulators should rethink how they should require companies to measure pay fairness if they believe it is relevant to investors and other stakeholders. Many large companies devote dozens of web pages to explaining their commitment to diversity but report few actual facts.

Income inequality is driven not just by bosses and underlings. It is driven by deep prejudices and exploitation of people who have been told that they lack the power to demand more. By requiring companies to report detailed information about diversity, including the difference in compensation between traditionally oppressed groups and the rest of the workforce, we may come closer to capturing the unfairness of income inequality that Sen. Menendez said the pay ratio would measure.

The pay gap between the CEO and the average employee of a large company may sound outrageous, but that a gap even exists between two people of equal ability solely because of gender or race is objectively appalling.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz