Introducing HSAs to Employees: Bring a Financial Advisor

As a species, human beings are very adaptable to changing circumstances; this is how we’ve survived the last 200,000 years. However, that does not mean, we, humans, like or embrace change. More so, when that difference is perceived as being less personally beneficial than the status quo. Now add a bunch of new terminology and confusing information about that change and you’ll most likely find a room full of unhappy employees that have just been told their traditional health insurance is switching to a high deductible heath plan (HDHP), which can be financially supplemented by a health savings account (HSA).

The HSA operates in conjunction with an HDHP. The high deductible health insurance plan premiums are often dramatically lower than traditional health insurance premiums. This allows both the employer and employee monthly savings on high premiums. As the name implies, the deductible on this type of plan is often far greater than an HMO or PPO. Deductibles vary, but can range from $1,300 to $6,550 for an individual and $2,600 to $13,100 for a family. Furthermore, many HDHPs will cover preventative care at 100%, which means routine exams, immunizations and screenings are free of charge. Since HDHPs typically don’t cover non-routine healthcare until the deductible is fulfilled, an HSA is a great way to fund unexpected medical costs.

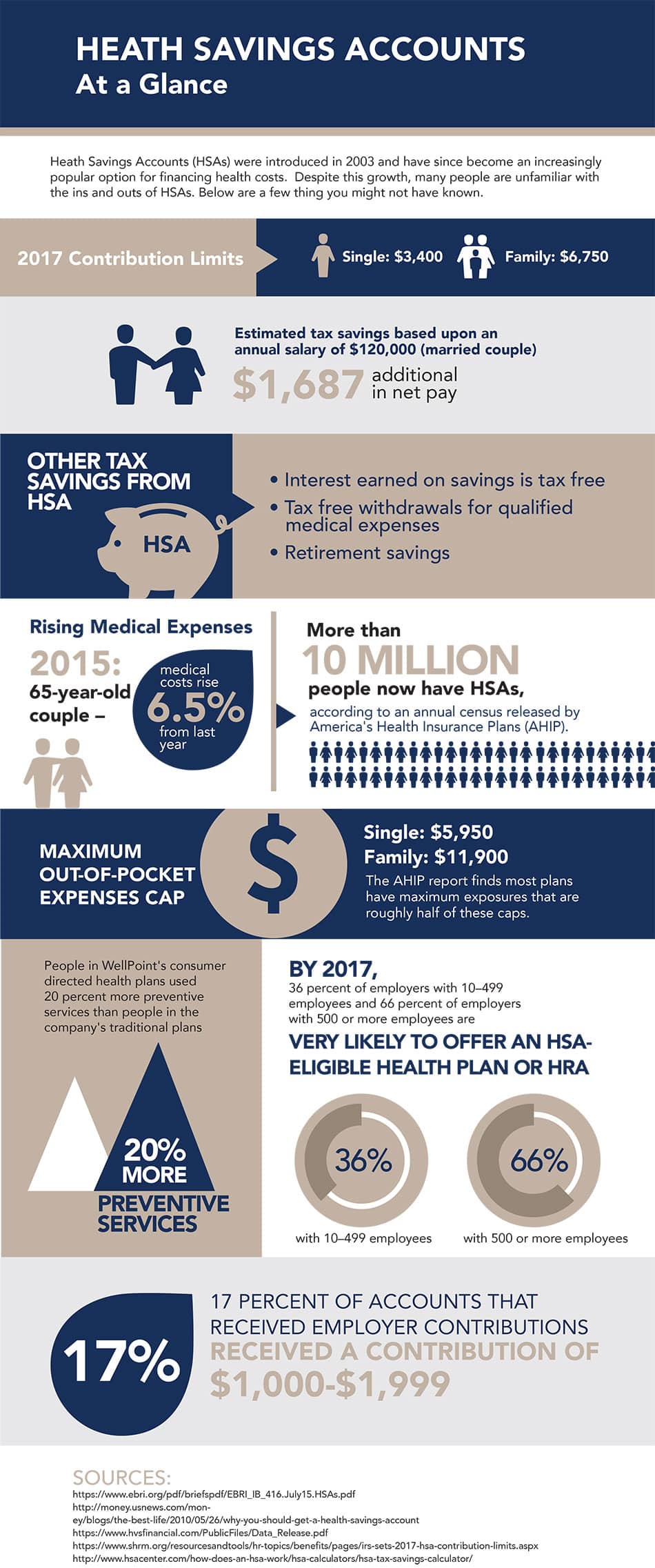

Before we explain how a financial advisor can transform the HSA-Employee introduction, let’s quickly recap how HSAs operate. HSAs were established in 2003 as part of the Medicare Prescription Drug, Improvement, and Modernization Act. HSAs work in conjunction with HDHPs, allowing employees or individuals to open an HSA. The funds, up to a predefined limit, are placed into the account are tax-free. The Internal Revenue Service (IRS) may adjust the tax-free limit on an annual basis. The employee tax-free contribution limit for 2016 is $3,400 for a single/individual and $6,750 for a family. Anyone over 55 may contribute an additional $1,000 to the HSA to aid building the account, in essence, to catch-up. Employers may also contribute to employee HSAs, which would be tax-free for the employee and a tax deduction for the employer up to the IRS’s established limit. The employer average contribution is $500 for an individual and $900 for a family. However, some companies give as much as $2,000. Investment gains made on the HSA are tax-free as are withdrawals when the funds are used for qualified medical expenses. Because the HSA remains with the employee, like a 401k does, regardless of changes in employment, the account is active until and even after retirement. Funds taken out for non-medical expenses after the age of 65 have no excise tax.

HDHPs and HSAs are quickly gaining prominence as a benefit offering for both large and small companies. This makes perfect sense because health insurance premiums tend to increase year after year, accounting for a significant portion of businesses operating expense. However, when introducing employees to an HDHP/HSA, the savings on corporate operating expenses probably won’t be the key to the warm-hearted reception the Human Resources (HR) team is aiming for. The typical employee only hears what used to be covered for a modest co-payment and a manageable deductible will now cost them a great deal of money. This is further exacerbated when the deductible is on the upper end of the threshold.

Now the time has arrived to present the HSA to employees. Of course, the HR team has been working hand-in-hand with a health insurance consultant to get all the proverbial ducks in a row. HR is ready to explain how great it will be for employees to take control of their healthcare. And that is true; employees will be able to go to the physician and pharmacy of their choice instead of going to an in-network provider. The presentation will most likely also mention the lower monthly premium as well as the tax-free contribution. If the employer is giving a subsidy to the HSAs, that too, will and should be touted, as it is essentially a cash gift that won’t incur income tax. The portability of an HSA and the ability to roll over funds each year are also noteworthy points of discussion, as are the advantages that the HDHP offers, such as no costs for preventative care. However, there is a good chance that all of these selling points will fall on deaf ears. This is because the average employee stopped listening and started doing the head math as soon as they heard they would have to fund 100% of their health care costs until the deductible has been met. That math probably includes a sincere concern about how to pay that high deductible.

At this point in the introduction that the presenter is facing down an audience filled with apprehension and a feeling that they’ve lost something. Remember, humans aren’t disposed to embrace change, and switching to an HSA can be a very impactful change. This is when that financial advisor comes in handy. A financial advisor will be able to hone in on and explain the amazing retirement benefit that HSAs offer.

First, the advisor will reiterate all the tax savings, not just on the contribution, but also on gains in investment from the HSA. They will be able to illustrate ways the HSA can be funded, like deferring the difference in the health insurance premiums to the account and employer contributions. Best of all, the advisor will give real world examples of how an HSA can make such a difference to future retirees.

Imagine the conversation taking this type of turn. To illustrate, let’s take a family of four in their early 30s. This family is in good health but has two toddlers. Kids need lots of immunizations; since those are covered at 100%, there is no out-of-pocket expense. The same is true of routine physicals and screenings. Now combine insurance premium savings that are diverted to the HSA with the employer contribution and it is easy to see how the account can begin to grow. Add in the tax savings and investment gains from the HSA and in just two years there may be enough in the account to almost entirely cover the highest deductible threshold. This healthy young family, in theory, shouldn’t need to make any major withdrawals from their HSA for decades. Assuming they steadily contribute to the HSA, by the time they retire the account can be worth over $185,000 – and that’s the big benefit of HSAs that seldom enters the conversation.

Below is an example of how the numbers may work out:

Family of four with an annual income of $120,000

• $1,200 – annual savings on lower premium

• $300 – savings on preventative care

• $1,687 – savings on federal income tax

• $500 – FICA

• $2,000 – employer contribution

• $341 – gain on investment – 6%

• $6,028 – saved and/or made in one year

As the adage goes, presentation is everything. Employees that were just feeling they lost something can now begin to focus on the long term gain. Not only will this shift of focus make for a better introduction, it should also act as a driver for employee engagement with their new HSA. So remember, before you introduce an HSA to your employees consider inviting a financial advisor to the meeting.

Have you read?

Want more impact with your clients? Say less

Speed Up to Slow Down. And Other Secrets of Great Coaches.

Are You Truly a Good Boss?

SMEs – Keep Calm and Carry on Through Brexit?

Written by: Barbara Delaney, principal and founder of StoneStreet Advisor Group, LLC.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz