Why OT and IT companies are investing in IIoT/Connected Applications

The industrial IoT market is of great interest to software developers and investors as it is growing so quickly. Cambashi’s analysis shows the route to market for industrial IoT is through Connected Applications that link real-world ‘things’ to information systems, and leverage AI (Artificial Intelligence), ML (Machine Learning) and other analytic capabilities to deliver business benefits. Connected Applications also help drive digital transformation, which almost always requires connected technology.

Findings and Analysis

Our findings show that, over the past three years, the IIoT/Connected Applications software market has shown consistently higher growth than that of traditional hardware technology (OT) or IT/enterprise software companies.

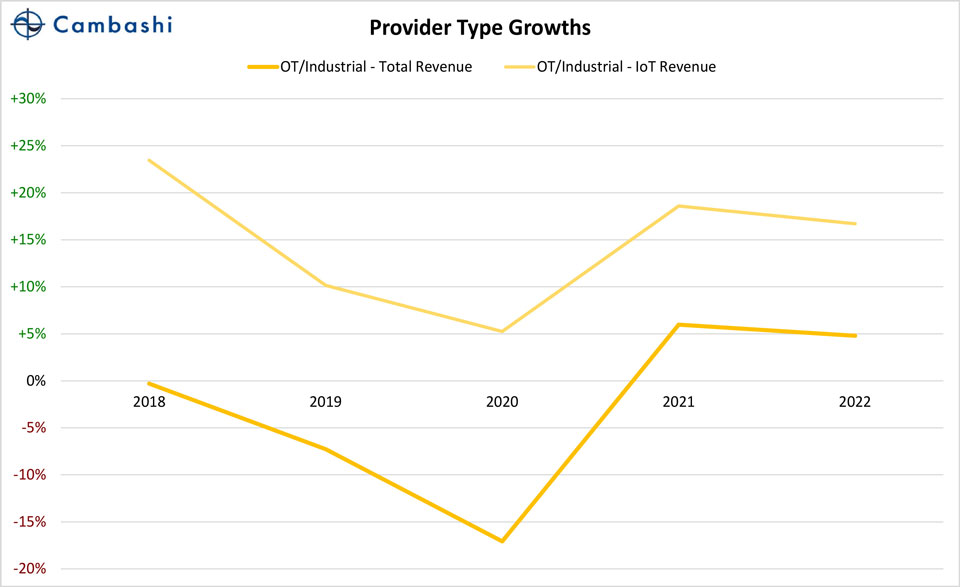

The first graph, below, shows that IoT-related software revenue growth in OT companies is significantly higher (between 10 and 20%) than the total revenue growth of those companies. (These graphs include the 2020 COVID-19 impact).

The main reasons for the higher growth are:

Once a software application has been developed, it can be sold instantly, on-line, without requiring any physical transfer medium. Unlike other products from OT companies such as sensors and actuators, a software application can be sold many times over without the need to keep stock or to use supply chains.

Software applications are increasingly sold on a subscription basis. This makes the business ‘stickier’; i.e. once a customer has subscribed to a valuable business application, they are very likely to continue subscribing year after year.

‘Connected’ software applications are usually in new, high-value markets that command higher prices. Being first to market further increases the potential price and revenue.

Graph 1: IoT revenue growth in OT companies is significantly higher than the total revenue growth of those companies¹

These findings are supported by research from Credit Suisse whose Industrials Equity Research team observes that the trend of “Industrial Hardware Buys Software” has become well established.

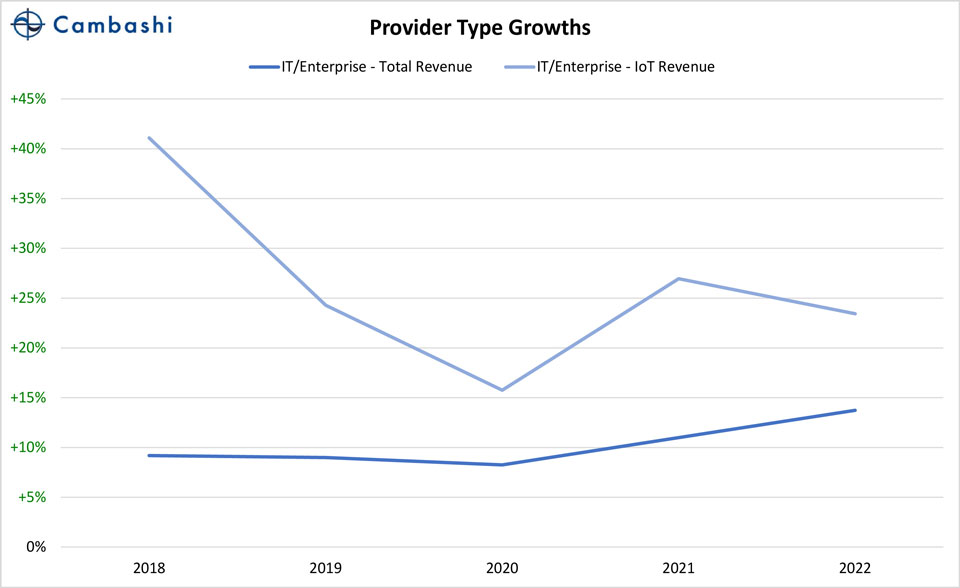

The second graph shows that IoT-related software revenue growth in IT or Enterprise software companies is significantly higher (between 10 and 30%) than the total revenue growth of those companies.

Graph 2: IoT revenue growth in IT/Enterprise companies is significantly higher than the total revenue growth of those companies²

Most IT/Enterprise software companies are already capitalizing on the advantages of software and subscription revenues (i.e. the first two reasons for higher growth given above for OT companies) so the main increase in growth is explained by the third reason; namely that ‘Connected’ software applications in new, high-value markets command higher prices, and being first to market further increases the potential price and revenue.

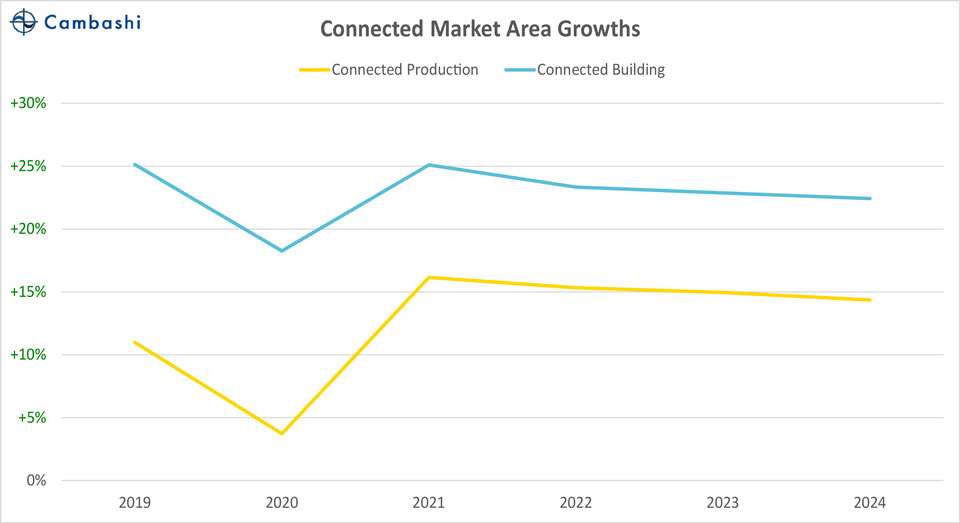

More detailed analysis using Cambashi’s IIoT/Connected Applications Observatory shows that some Connected market areas such as Connected Building are growing faster than others such as Connected Production. This is partly because Connected Production is large and well-established, whereas Connected Building is currently a smaller market but it is experiencing a great deal of attention and innovation. There are also differences in geographic areas. The faster-growing players are more focused in these fast-growing Connected or Geographic areas.

Graph 3: IoT revenue growth variation across Connected Market Areas³

The findings above show that, despite some concern about the ‘Trough of Disillusionment’, IoT technology is being included in many successful solutions. Industrial IoT is so complex that it takes many types of provider to achieve the higher levels of maturity now required; an ecosystem of providers is required to deliver and implement the most attractive, connected solutions, and industrial IoT and Connected Applications are increasingly delivered as part of a broader solution involving enterprise systems such as ERP, PLM/CAx, MOM and BIM.

Although not in the news so much these days, industrial IoT is alive and well in the form of Connected Applications and Digital Transformation initiatives, as measured by Cambashi’s quantitative research. When a Connected Application is developed it is often marketed with a new name that may not include the term ‘IoT’, and people may therefore not consider it an ‘IoT’ success. All the major management consultants and systems integrators have ‘Digital Transformation’ or ‘Digitalization’ practices and IoT is often placed within a Digital Transformation initiative which makes it hard to tease out how much of the success is attributable to IoT. This can conceal the true size of the market, which is shown in the examples above.⁴

1. Cambashi Connected Applications Observatory, August 2020

2. Cambashi Connected Applications Observatory, December 2020

3. Cambashi Connected Applications Observatory, December 2020

4. ERP – Enterprise Resource Planning; PLM/CAx – Product Lifecycle Management/Computer Aided ‘x’ (where x is Design, Engineering etc.); MOM – Manufacturing Operations Management; BIM – Building Information Modeling or Management.

Written by Alan Griffith.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz