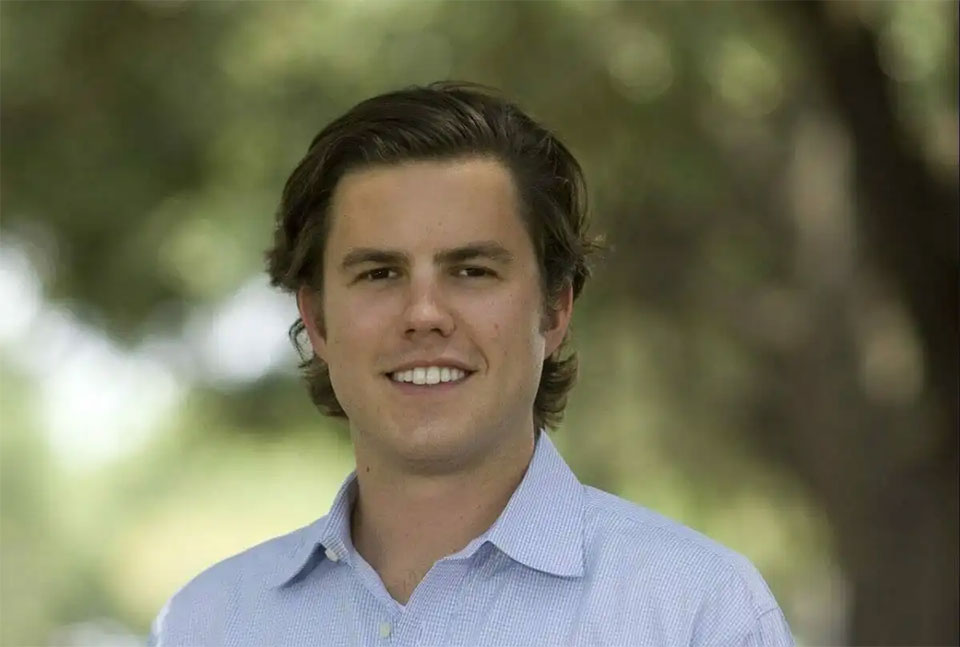

Joey Feste, Sr. Managing Partner of KM Capital Management, Addresses When to Invest

As the Senior Managing Partner of KM Capital Management, Joey Feste knows a thing or two about investing. Feste is also a financial manager, and he understands that portfolios and markets are one of the best ways to build value. The caveat, though, is that proper investing in those areas is required in order to develop wealth. One of the first things people who want to get started on wealth building need to do is actually get started. Planning matters, but action is what will really make things happen.

Joey Feste has over 30 years of experience in finance and uses that along with his bachelor of arts degree in economics from the University of Texas, to counsel people on the best ways they can invest and make their money work for them. A faith and finance-based approach to building people up is helping Feste and his son change and improve lives.

Joey Feste is a registered Investment Advisor Representative and focuses carefully on the needs of his clients. The types of experiences they want when building up their wealth matter. It is about the financial aspect of it, but there is so much more to the creation of a portfolio and the dedication that needs to come with the investment. Feste and his son, Joey Feste Jr., can both help people to make stronger financial choices, especially by helping people understand when they need to begin investing strategies.

Choose the Right Time to Invest

The best time to start with investments is now. In other words, people should start to invest in their portfolios and wealth-building activities as soon as they reasonably can. By starting early, it is much easier to build up wealth because they have more time to do that. However, there are some times when waiting to invest is better. Feste advises that anyone who has high levels of credit card debt, or other high-interest debt, should pay that off (or at least way down) before starting on investments.

Both Joey Feste and his son, Joey Feste Jr., know that people who invest when they have a lot of high-interest debt are not really making money or building wealth. Even if they see their portfolio grow, they are paying out more in interest charges than they are making on the money they have invested. Many investments pay a 10 percent return or less, and many credit cards can have interest rates that are 15 percent or higher. The math does not work out when investing while high-interest debt is still present.

It is also important to make sure that there is money put away for living expenses, before putting any money into investments. A good rule is to have at least three months worth of expenses saved up, in case of a loss of employment or other issue where extra money would be needed. Those kinds of problems can happen to anyone, and being able to cover the household’s basic bills matters. A financial cushion makes that easier, and reduces the worry and stress that would otherwise be present.

Having a good ROI (return on investment) is something that needs to be over and above anything a person is paying for or addressing in life. In other words, the money for investments should come from extra money, because having a cushion and getting rid of debt are actually more important to good financial health, at least as a first step. Once those things are taken care of, though, investing will feel easier and will also likely be much more successful as a wealth-building and portfolio-development strategy.

The Basics are What Matters, With Investment

Among the areas that Feste and his son see as very important for managing money is keeping things simple. There is no reason to complicate financial or wealth-building matters, when simple strategies are often the most valuable and effective. Choosing a trusted advisor is one of the best ways to go about getting started, but there is more to the issue than just that. Additionally, the way that advisor handles things should be worthy of consideration. If things feel complicated, making adjustments can be necessary.

First, focus on the payoff of high-interest debt. Second, develop a cushion to have an emergency fund. Third, start investing carefully and simply, with a trusted advisor at the helm. Those three steps are a recipe for success, because they reduce the need for someone to try to “juggle” too many financial concerns at one point in time. That makes long-term success easier, which can also make sticking with a plan for investment and wealth-building easier. It is those easier plans that people stick with over time.

Starting small, says Feste, is one of the best ways to gain traction. While it might not seem like a lot of wealth-building is happening that way, it is still possible to build a significant portfolio. As more money is invested, and more interest is earned on it, the ROI will continue to grow. There does not have to be huge amounts of money put into investments in order to see good returns, especially when starting early in life and allowing the investment plenty of time to grow into everything it can be.

By working with an employer who offers a match for 401(k) investments, for example, someone can start easily putting away money that they will really not even miss. It is easy to have it simply taken out of their check before they are even paid, so they do not see that money as something they have to set aside from their pay. Employees who have this option should take full advantage of it, and make sure they invest at least enough to get the full, matching contribution from their employer, for the biggest benefits.

Of course, there are also people who are self-employed, as well as those who do not receive the option for a 401(k) matching contribution from their employer. Both Feste and his son acknowledge that people in these situations may have a harder time building wealth as quickly, or may struggle to get traction. But that does not mean they cannot see a high level of success with their investing over time, as well. Having an employer match is not required, and there are plenty of other investing options.

For Joey Feste and his son, Joey Feste Jr., the goal is to help people understand how companies like KM Capital Management can help them build up wealth more quickly. Investing is a very individual process, and a unique journey for each person. However, the basic goals and ideas are the same. When trusted to professionals, success in those areas can come easier.

Have you read?

# Best CEOs In the World Of 2022.

# Best Citizenship and Residency by Investment Programs.

# These are the world’s most and least powerful passports, 2022.

# The World’s Richest People (Top 100 Billionaires, 2022).

# Case Study: Warren Buffett, LVMH’s Bernard Arnault, Apple’s Tim Cook, and Elon Musk.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER