Measuring Period Profit and CPP-Accounting

To measure the period profit of a company is not an economic problem but a technical one. In order to be able to measure, one first has to gauge. The core of measuring is the notion ‘calibration’, including gauging. In this article, the words ‘gauging’ and ‘measuring’ are distinguished from each other.

Here ‘gauging’ means everything that has to be done to establish values and standards prior to ‘measuring’ the results. Calibration is the whole procedure, what and how exactly; in technical science, these detailed procedures have been laid down in internationally accepted protocols. Without all the answers to all the gauging questions one just cannot make a start. C

PP-accounting, changing the measuring-staff (see below), is in flat contradiction with the basic need in order to measure: a well-defined measuring-staff, a fixed unit.

Profit must be measured to calculate the yield, in consecutive periods, one can trace for instance an increase or a decrease of the yield and proper action may follow. The economist who is busy with an organisation (organism) is so to speak a doctor caring for a patient. Measuring the profit is like measuring the blood-pressure. The Profit Formula® is a measuring instrument, no more, no less, to help economists – and those who run the firm – to perform their job better.

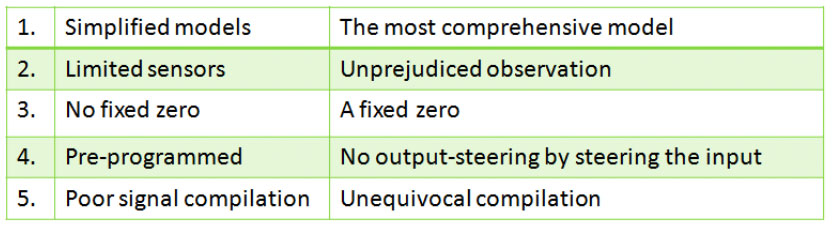

The several systems commonly used give more than ten widely divergent ‘solutions’ even in the case of a classic example. There is no proof, no single profit figure – emerging from these systems – which is incontestable. The situation at the end after appropriation of all profit is a duplicate (has to be a repeat) of the situation at the beginning, being gauged as normal i.e. a so-called zero measurement. The well-known way, the one and only way as far as acknowledged up to now, Profit = ‘Total Sales -/- Total Costs’, is not good enough. This is slippery ground. A far better way is now available. Profit measurement today versus what should happen:

“Een winstbepalingsstelsel is per definitie (…) ook een waarderingsstelsel i.e. A profit calculation system is by definition (…) also a valuation system (Epe/Koetzier, p. 183).” This is the crux of the matter. It implies that the measuring data is polluted.

re 1. There must be the possibility to enter all values and standards.

re 2. An unprejudiced observation of everything is of paramount importance.

re 3. A fixed zero i.e. the normal balance sheet in each and every detail.

re 4. In all systems so far, pre-arranged values and standards are to be found.

re 5. Any set of values and standards can be compiled in the same best way.

Everything around the measurement has to be indisputable, resulting in a transparent outcome. Profit figures should not be blindly accepted, always demand to see test and proof. CPP (Constant Purchasing Power)-accounting is about inflation (changes in the purchasing power of money) and we have to deal with it – no question about that – the point is, just how? By changing the measuring unit as CPP-accounting does? A change in some price index represents the ‘exchange rate’ between currency units of different dates.

The essence of CPP is to translate all measurements in currency units into units at a common date. The logic would be that CPP provides a stable measuring unit to measure profit, whilst an ‘unstabilised’ i.e. not indexed currency unit, fails to do so, as is stated in literature. After measuring period profit, it becomes a matter of judging the measuring result i.e. the size of the profit. First one needs to know that size, expressed in a fixed unit. Is the profit enough? Did the company make progress?

CPP goes beyond profit measurement and in doing so, it neglects the very essence of measuring. The first step in many CPP-calculations is to bring the opening balance sheet at t, which is expressed in U.S.-dollars at t, up to date into U.S.-dollars at (t + 1). CPP is trying to separate ‘real’ gains and losses (in constant U.S.-dollars) from ‘fictitious’ gains and losses (those due to changes in the value of the U.S.-dollars). The basic idea is a good one. Of course the diminishing value of money has to be incorporated into the measure of period profits. How? Not via CPP. CPP-accounting is re-writing history. All entries onto the starting balance sheet at t are Bt’s (expressed in U.S.-dollars at t) while any amount in the closing balance sheet is a B(t + 1), expressed in U.S.-dollars at (t + 1). They remain facts forever.

Suppose B(t + 1) is 550 [million U.S.-dollars], to compare with Bt being 500 [million U.S.-dollars], while in the meantime 10 % inflation (diminishing money value U.S.-dollars), then no progress has been made if these figures are supposed to be subsequent period profits. CPP-accounting, busy with ex-changing old dollars for new dollars, is trying to reach judgements like this one. That goes beyond profit measurement. Measurement is confined to get the facts, not to judge them.

Period profit, from t to t + 1, is an amount B(t + 1), expressed in the stated currency at the closing balance sheet date. The measured profit figure is an historical event. Judging the performance starts with a clear picture in view of the facts as they were, a series of proven period profits in bare form. CPP is covering up the facts. In my free downloadable paper’ Measuring, Indeed Measuring Period Profit and CPP-Accounting’ http://ssrn.com/abstract=360020 is to be seen that the very same CPP-outcome can be obtained quite easily by The Profit Formula® i.e. The Way to Easy Profit Measurement. Exactly, quickly and easily. A scientific breakthrough. The adage ‘profit is an opinion’ is no longer true. Read my two former articles at CEOWORLD about this whole matter. Go to your nearest Amazon website and in the general search screen, enter your desired ISBN 9781086333992 and then you will immediately see the wanted book. Here the content of the book is given:

Written by Jan Jacobs.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER