Seven Questions for Retail Bank Executives: Customer Digital Transformation

Retail banks are in the business of gathering deposits and making loans. Through all of the changes the industry has undergone since the internet enabled new ways of executing these functions, the fundamental purpose – to act as trusted intermediaries facilitating the exchange of value between parties – endures.

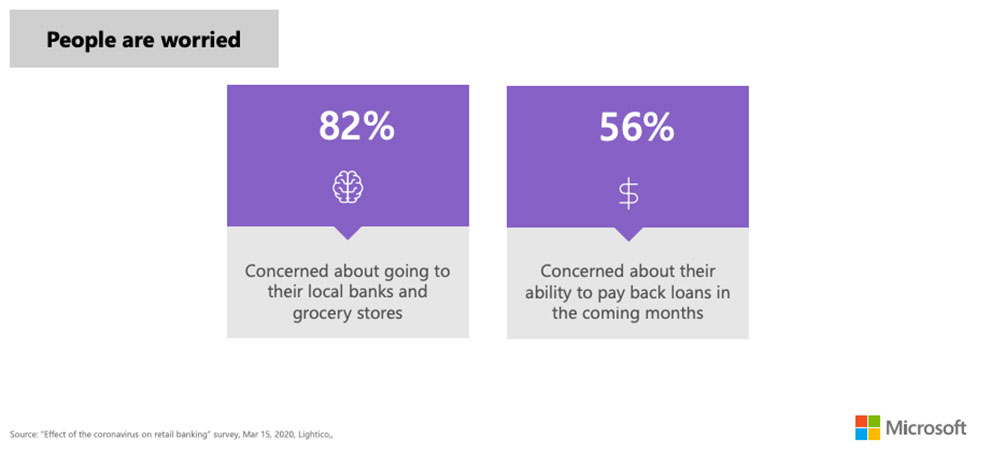

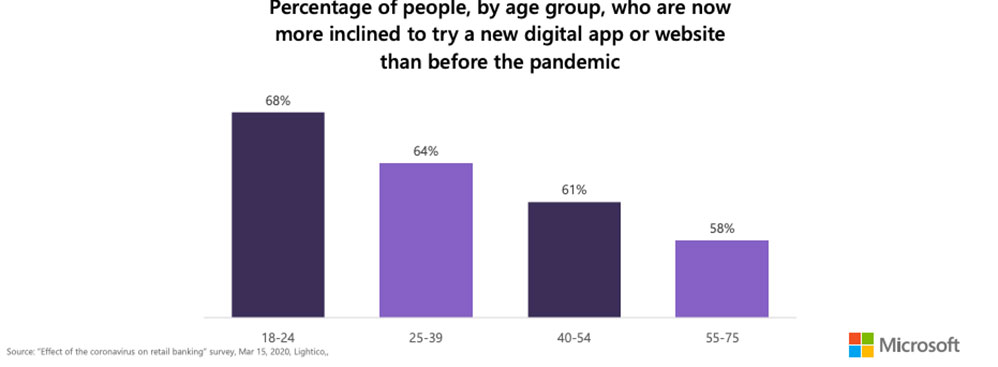

Across all demographics the pandemic is forcing “digital first” to become a way of life, and how customers engage with their banks is changing.

Trial and routine usage over just the course of a few months leads to enduring behavior changes. Banks that do not invigorate their digital transformation plans, making innovation part of how they operate will get left behind.

Recent research points to gaps.

What does it mean, in a digital-first world, to facilitate exchanges of value between parties?

Younger generations will be less and less familiar with the use of physical cash. Money is becoming an abstraction delivered in bits and bytes. With cryptocurrencies, even the basis to calculate value is changing from what has been familiar to Boomers and their elders.

A conversation about the future of money, how value will be exchanged, and what that means for the institution is input to defining short and long-term execution and investment priorities.

Is the traditional business model working, and if not, how should it evolve?

Strip away the complexities of added products and services and new channels, and retail banking at its core has always been driven by taking deposits at one rate, making loans at a higher rate, and managing the movement of the net interest margin through changing economic conditions.

The sector has benefited from tactical opportunities to add to the deposit base – e.g., supporting Health Savings Accounts – quickly capturing funds that are no longer going into direct deposit accounts, and has advanced online banking as a means to gather low-cost deposit dollars quickly. Advances in data and technology applications continue to provide new ways to assess, manage and reduce borrower risk.

We live in a world of unprecedented economic, social, environmental, political and other uncertainties, a wide range of non-traditional competitors, and fast-changing consumer expectations that collectively increase the pressure on business model assumptions.

What trends are on the horizon, and what innovations do they suggest for increasing business model resiliency?

What is the talent operating model that will enable an institution’s vision and strategy?

Much of the workforce conversation these days is focused on two topics: how to ensure employee safety, and the diminishing need for office space. But there is a profoundly deeper set of questions financial institutions should be asking about the talent operating model needed to drive ongoing transformation.

The old rules of HR won’t work to attract talent, and foster career development, productivity, and employee engagement. The skills required to deliver will keep changing, requiring financial institutions to become much more flexible around learning and development, mentorship, and constantly upskilling and reskilling employees.

What skills beyond the basics are critical to transformation?

Skills that foster creativity, curiosity, experimentation, and customer listening may not be top of the list in a traditional financial services organization, but all are enablers of digital transformation. These must exist in a culture that embraces failure as a natural part of the innovation process. Add to the list being able to:

- Turn data and knowledge into decisions and actions

- Balance conditions that are polar opposites – e.g., the need to move rapidly and the need to exercise control and manage risk.

- Exercise judgment to act under conditions of uncertainty, ambiguity and unpredictability

- Influence to shift mindsets internally and embrace change

How will data assets be managed as the core enablers of the customer relationship and business results?

All of the technology in the world won’t lead to a great user experience unless the bank can assemble, organize, clean, structure, make accessible, update and protect the data sources that feed the artificial intelligence systems and regression models enabling targeted content on the screens, voice response, chat and other channels now accessible across multiple devices. Data fuels relevant, timely, motivating customer experiences.

How will a seamless and integrated experience across channels be created?

Seamless and integrated experiences are the Holy Grail for any multichannel business. Digital first may mean digital only for a segment of the customer base. Reality is that while customers may tend to have a preferred channel, channel usage will vary depending upon the type of transaction, and even digital natives will not limit their access to digital channels.

For all segments the quality of the multichannel experience ends up mattering across segments.

And, because money is emotional, and for most of us is just a means to an end, great experiences must show humanity and empathy, including those that are automated.

An often-debated question: What is the future of the branch? The more helpful question is: what is the role of physical presence in the customer experience for the institution’s target audience? Reframe the question from one of branches as a mass market channel to one of physical presence that meets core needs of target segments. This reframing can open up fresh thinking about what having a physical footprint means, and how it adds value.

How will stakeholders – shareholders, employees, customers and regulators – be engaged in the strategy?

Strong innovation foundations are built with early stakeholder involvement. Most employees – especially those who see a career runway ahead — want to be part of an organization that has a vision for the future – so make sure they understand the plans and know their role in delivery. Help them build skills so they can be constructive participants and support colleagues.

Regulators are as eager as bank executives to ensure a stable and healthy future for the banking system. They see the need for innovation. They welcome a dialog to understand innovation priorities, particularly to see new concepts are advancing with risk mitigants in place.

Customers are demanding robust digital capabilities, and an integrated and seamless experience. These are no longer optional; they will ultimately be table stakes as engagement with digital experiences grows, in particular stimulated by this year’s events.

And of course, shareholders must hear the story of where the financial institution is heading, why digital transformation is essential, what that means for the bank’s customer segments and business goals, what the pathway looks like, and how and why it is different from the historical five-year plan.

Commentary by Amy J. Radin. Here’s what you’ve missed?

World’s Best Countries To visit In Your Lifetime.

World’s Best Countries For Women.

World’s Best Countries To Retire.

The World’s Best Luxury Superyacht Charters And Builders.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER