From Project Inception to Completion

Period profit is a result. It starts with an investment generating cash. After deduction of value differences and taxes, net profit remains. Analogous to the law of conservation of energy in physics, the law of preservation of value holds true in economics, a natural law. Laws of nature hold true independent of time and place. Management is in continuous need of up to date financial accounts, that are clear and complete, speak for themselves, contain proven numbers, and unravel the future. Ex ante accounts are signposts on the road to the future. Walking down the road, ex post accounts are made regarding past time periods and new data will generate new signposts for the road ahead. Nothing is able to replace thorough financial statements, not even the most extensive balanced scorecard/performance-review. This article refers to uniform metrics that are capable of handling both risk and time value of money to the fullest extent. No more is necessary than a simple and easy procedure, which provides a check at any point in time against stipulated project value. Performance measurement, monitoring and control, from project inception to completion. Assessing NVA (Net Value Added) is transparent, it eases the tension among multiple interest groups and it makes the decision-making less complex, costly and subjective. This is compared to the disparity of metrics (between project appraisal and subsequent evaluation) so far applied to measure and control project performances.

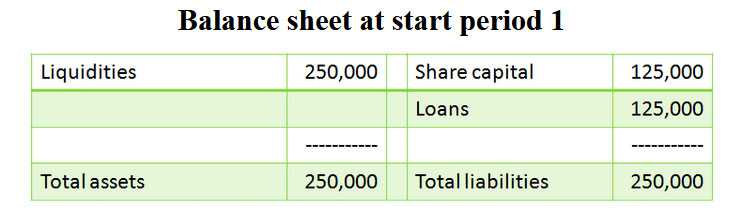

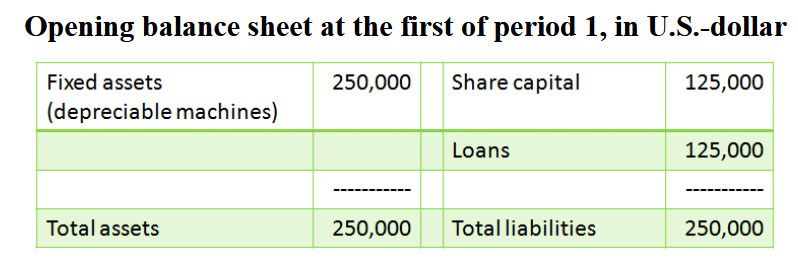

According to many in the field, the best method (at least a good one) to evaluate investment proposals is the present value method or (a variant) the method of the internal rate of return. It is indeed by far a better measure of investment worth than a lot of really bad methods, but nevertheless it does not have a general validity. Normal depreciation is included, but the whole area of possible price increases, necessary re-investments, and backlog depreciation, is disregarded by the present value method. The classical NPV/IRR-method meets only nominalism. A real good method contains everything. The starting balance sheet, in money units, reads as follows:

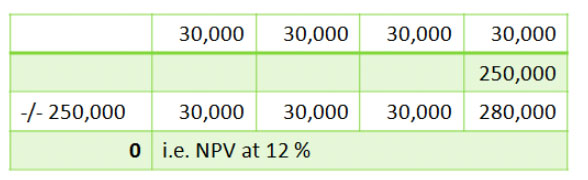

One opportunity is to invest the liquidities into bonds; another one is to buy a machine logically followed by producing/selling products. The bonds are giving a net periodical interest of 12 %. One earns (interest income i.e. net profit) 30,000 money units at the end of each of four consecutive periods and finally the bonds are paid off. A number of present values altogether is called NPV, Net Present Value. NPV at 12 % (i.e. net cost of capital) is zero; this investment does not add any value.

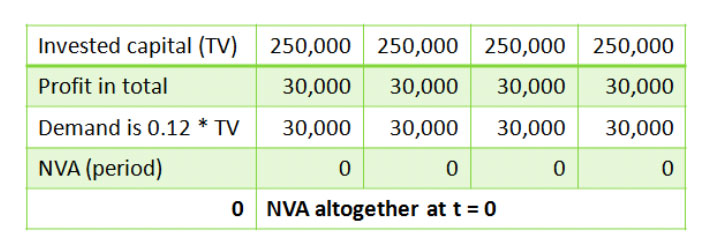

Alternative representation whereas NVA is Net Value Added:

Quite often demands – and the requested cost of equity pre-eminently – are not scientific affairs. They will depend on a lot of things, namely the risk of the investment, the level of output, the results from alternative investments, the state of the general economy, the level of interest rates, and so on and so forth. It all ends up in what must be regarded as the NORMAL demand, for the time being, in this firm. So far no inflation whilst taxes as well as interest on loans are not visible either. Nevertheless, the above-mentioned schemes are basically correct and these schemes are always repeated – as calculations are exercised regarding an investment into depreciable assets – including interest on loans, tax, inflation; of course the diminishing value of money has to be incorporated into thorough calculations, likewise literally everything.

The future is unknown. What/if calculations, of ‘the successive incomes’ promised by an investment, result in projected periodical accounts; altogether these are a flight plan. Next it becomes a matter of careful monitoring. All calculations are subject to the dynamics of business. At any point in time management opinion on product life cycles will change, thus the expected useful life of assets will vary over time. As soon as one piece of data changes, all calculations should be thrown away. On the basis of the new set of data, new calculations must be made. Management is in continuous need of up to date financial accounts, that are clear and complete, speak for themselves, contain proven numbers, and unravel the future. These ex ante accounts are signposts on the road to the future. Walking down the road, ex post accounts are made regarding past time periods and new data will generate new signposts for the road ahead. If, as and when all given data become truly true, the ex post accounts will be equal to the ex ante accounts. Balance sheets, P/L-accounts, cash flow statements in conjunction with NPV calculations, presenting the bridge between on the one hand the accountant’s accrual accounting perspective and on the other the investor’s cash flow based perspective.

The fixed assets, they are NORMAL in the present new state. One will have to replace them eventually, no more, no less. These assets are to be depreciated fiscally over a three-period life cycle by the ‘straight-line’ method (i.e. at 1/3 of cost per period); at any moment, the residual value fiscally is € 40,000. The geared proportion, as mentioned above, is NORMAL. The production/selling facts and the complementary costs in each period as well as the residual values, and much more is given.

Everything fits together seamlessly. From start to finish, from project inception to completion, all amounts of money are inter-related. NVA whether periodical or altogether, is the ultimate financial performance measure that meets the natural law of preservation of value. One cannot miss a single money unit.

Re free downloadable The Quest for Value Revisited http://ssrn.com/abstract=440100 for the original working-out, dated 2014. The ‘Go/No Go’ Decision Regarding Strategic Investments is the title of Appendix 10.2 from the book The Profit Formula® The Way to Easy Profit Measurement ISBN 9781086333992 available at www.amazon.com. In Appendix 10.2 it is about what is said in this article and fully explaining all of it in a completely worked out numerical example from start to finish.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER