The Way to Easy Profit Measurement

See how you can solve the problem that is presented below. You need to have the scientifically correct P/L-account, with a view to managing a company. Who only knows unproven period profit and yield figures – at least for internal use – he / she is walking in the fog. People steer in the fog, not said that they are fooling themselves.

It is not just about the group profit for a whole year, but especially about the detail profit of a part, your department, your project, for every desired, short period. Proven correct internal profit and equity figures. People will firstly have to know for themselves before they can meaningfully report a patch of it to the outside world. What does someone, who does not really know it him or herself, really have to say?

The criticism of the Dutch textbook ‘Jaarverslaggeving’ by Epe/Koetzier is not confined to merely this book. In fact it concerns more rendered out of date books and pure bad education at many Business Schools, institutes and universities all over the world.

None of the various profit calculation systems, which are described by Epe/Koetzier around one and the same problem definition, do see justice done to the given data. One system this way, another system that way, all of them make selective choices out of the data. Everyone can easily see that no system meets all the data which should be expected to be quite normal. If such a simple sum cannot be solved thoroughly, what hopes are there of a real company getting its books correct?

The several systems currently used, lead to more than ten widely divergent ‘solutions’ even in the case of a classic example. Epe/Koetzier set out in detail what in economic literature is defended by advocates of several so-called profit calculation systems.

The actual solution to the problem of profit measurement is The Profit Formula®. Anyone can learn to put it into practice. It is a piece of cake. To write down the problem definition cost more time, space and effort than the working-out of it. One can ask everything and demand any outcome according to this or that system, the fiscal profit or whatever (with the exception of a few pure illogical systems). And of course the proven one and only real profit figure. All can be done easily by means of The Profit Formula®.

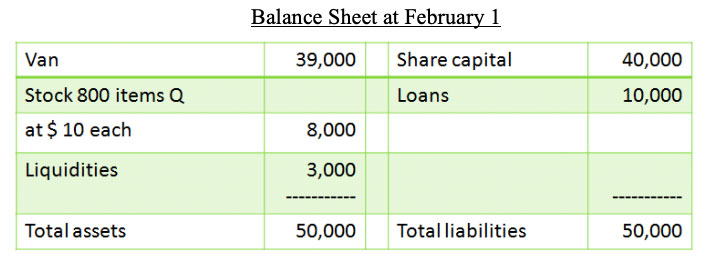

Central Problem (Epe/Koetzier, ISBN 9001304109): A trading company has been formed at January 1. The balance sheet at February 1, reads as follows.

A new van is bought at January 1 for $ 40,000 in cash. This van is to be depreciated over a 40-months life cycle by the ‘straight-line’-method. The residual value is zero. In January the original price (New Value) of the van did not change, but on February 2 it rose to $ 50,000.

800 items Q have been purchased at February 1 for $ 10 cash each.

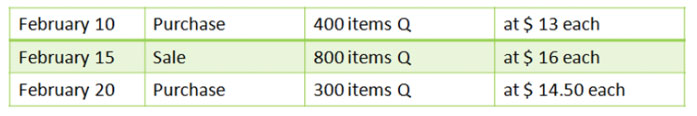

Interest on loans is neglected. No repayments on loans in January or February. In February the following selling and purchasing activities take place:

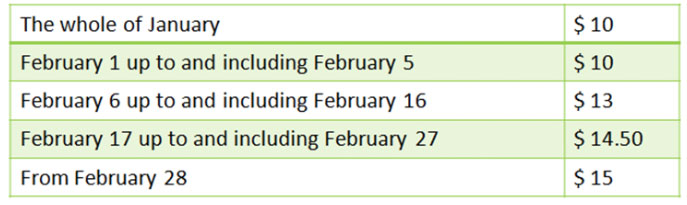

The cycle of the purchase price of the items Q is as follows:

All transactions are settled in cash before the end of February.

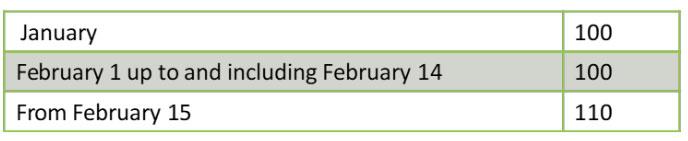

The level of the general price index is as follows:

The so-called iron stock c.q. NORMAL stock is 800 items Q.

Get started, make from this a profitable time for you!

Calculate the net profit February (after taxation) at tax-rate 35 %.

The Way to Easy Profit Measurement_2 EXAMPLES (fully elaborated)

The systems as described by Epe/Koetzier do not deal with the given data firmly. HC-systems simply ignore what is NORMAL. HC-systems in fact state zero items Q is NORMAL. Quite contrary to the given data. Zero working-units with regard to the van too. Is it possible to continue operations without a van? HC-systems take matters into their own hands.

Epe/Koetzier declare a pro rata gearing to be NORMAL. The same percentage equity and loans for all the assets. Profit is the surplus. After appropriation of profit, there must still remain exactly what was gauged at the beginning. We had ‘de facto’ at the beginning:

– 4/5 of a new van

– 4/5 of 800 items Q

– 4/5 of 2,000 markers liquidities and all of this was, still is and will be NORMAL until further notice.

Furthermore purchasing power equity $ 40,000 was in force. The NORMAL situation has to be restored. Nothing more, nothing less. Epe/Koetzier present various “profit”-figures without any proof. TEST and PROOF, proving the sum, restoration of the normal situation, do not believe any (profit) figure. In the end, you can easily check everything, re free downloadable The Way to Easy Profit Measurement http://ssrn.com/abstract=365100

The Profit Formula® i.e. The Way to Easy Profit Measurement. Exactly, quickly and easily.

A scientific breakthrough. The adage ‘profit is an opinion’ is no longer true. ISBN 9781086333992 amazon.com and enter the ISBN number there.

Here the content of the book is given:

The scientific substantiation of The Profit Formula® is explained in this book; scientific evidence as well as practical application. Even professors can learn a lot from it and each manager will improve performance.

Profit determination is one of the main subjects in the field of business economics. Within business economics a lot is currently badly taught worldwide by Business Schools and it entails the danger that wrong policy decisions will be taken by companies.

This article presents 8 Main Items described in Business Economics VI Groundbreaking ISBN 9781086355635. This book starts with exact money calculus, and ends with the measurement of period profit, exactly, quickly and easily. For both beginners and professionals. Here the content of the book is given:

Commentary by Jan Jacobs. Here’s what you’ve missed?

World’s Best Cities For Business Travel.

World’s Best Football Cities.

World’s Best Cities For Food Lovers.

Luxury Superyacht Charter with Aegean Luxury Yachting.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER