Here Is One Way to Deal With Risk

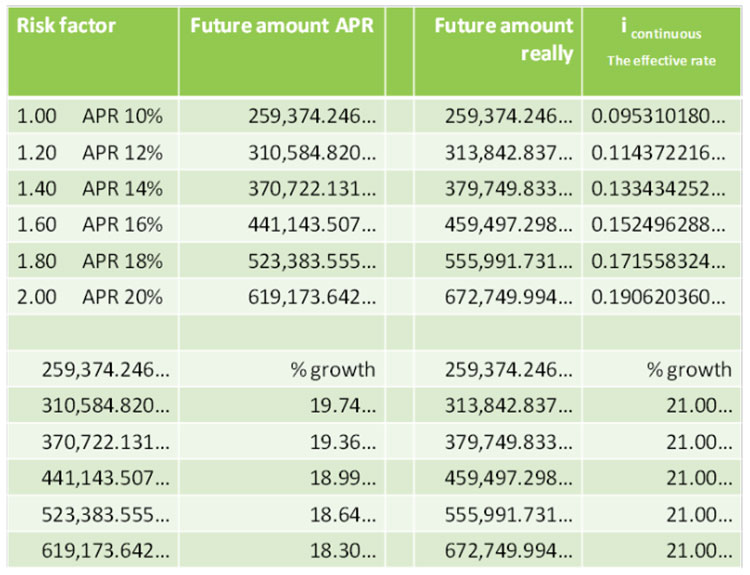

There are several ways to deal with risk. One of them is to include a risk factor into the capital costs. Starting with a risk-free rate some additions are made. Often only discrete rates are used, processing the basic rates and the additions. However, discrete rates do not give guaranteed answers. That is because discrete “rates” are not rates; re free downloadable Microsoft Excel, Financial Functions, Matter in Dispute and Accounting Real Interest. A rate is only a rate when it is indeed a rate. A higher rate must give a higher outcome. Guaranteed. Discrete rates do not give that guarantee. A discrete “rate” consequently is not a rate. For instance discrete rates 48 %, 50 % and 52 % higher and higher rates end up in lower and lower results:

- 48 %/year compounded monthly gives a growth factor 1.6010322…

- 50 %/year compounded each half year gives a growth factor 1.56250…

- 52 %/year compounded annually gives a growth factor 1.520…

APR (Annual Percentage Rate) is a one-off rate, announcing the extra pieces of money we will get after exact one year out of every 100 present value. APR does not say anything about what really is going on. APR gives only static information, about so to speak done distance. At a certain point in time. Unless you make a new start, it will never happen again and follow this same track. It is a snapshot. Look reality in the face. The growing capital is growing over the course of time, continuously. Time is a continuity. It does not matter how the booking is done. Compounding, book-keeping usually occurs at regular points in time. The books will match reality now and then. In between the books remain shut. It shows one does not care or need to know which discrete rate should be used or what the intervals should be. The frequency of the interest-addings as well as their sizes are irrelevant. The e-power function below does not contain these variables. The man in the street has only to push the e-key on any simple pocket-calculator to defeat the entire financial community that is clinging to old traditions. Who is afraid of the e-power? Busy with all kinds of financial tools. Neither effective (not doing right things) nor efficient (not doing things right).

The measuring-staff is i, the continuous interest rate. Function FV = PV . e^i.t

By making calculations with the e-power, the most precise answers on all money calculus can easily be found in the least necessary steps. Every step in calculations is dangerous because at each step accuracy may be lost. Moreover, i is a fraction, so i = 12 %/year ≡ 1 %/month. Discrete interest rates are not fractions and that is where all the misery starts. Using PPR (any period, Discrete Compound Interest) to deal with risk and to rank investments is often deceptive. See e.g. the scheme below. Financial tools using PPR are dangerous.

Suppose, 100,000 units of money at January 1, the beginning of year 1, and with an annual rate (APR) of 10 %, one will have 259,374.246… units of money at December 31, the end of year 10; risk factor 1.00 i.e. no special risk. What future amount instead, what is the aim, in case of another risk factor?

It applies FV at t = PV at 0 · e^i.t = PV at 0 · (1 + PPR · Δt)^t/Δt

Therefore via i · Δt = ln (1 + PPR · Δt)

for instance i · Δt = ln 1.10 i = 0.095310180…/year

Any continuous i can be converted in the corresponding discrete PPR and vice versa.

PPR 6 %/year * 1 year = 0.06 = R1 ln 1.06 = 0.058268908… = i1

PPR 4 %/year * 1 year = 0.04 = R2 ln 1.04 = 0.039220713… = i2

i = i1 + i2 = ln (1 + R) = 0.097489621… R = 0.1024 R ≠ R1 + R2

The message is: a “rate” that is arrived at by adding up discrete rates or multiplying a discrete rate by any number (re scheme) is not an appropriate measure. Much more about this matter is to be seen in Money Calculus, subtitle Undertaking money calculus is simple, the method is easy to learn and to put into practice; ISBN 978-90-423-0432-1 by Jan Jacobs, available at http://www.shaker.de/de/content/catalogue/index.asp?lang=de&ID=8&ISBN=978-90-423-0432-1&search=yes

Here the content of the book is given: https://www.youtube.com/watch?v=od-mfW5udR0&t=3s

Commentary by Jan Jacobs. Here’s what you’ve missed?

World’s Best Destinations For Business Travelers.

World’s Most (And Least) Expensive Cities For Taxis.

Luxury Superyacht Charter with Aegean Luxury Yachting.

World’s Best Cities For Food Lovers.

World’s Best Football Cities.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER