End of monetary policy has been reached

The US central bank has been particularly active in March in trying to curb the panic in the financial markets, while some actions have made good sense, others are no longer working.

It’s natural for central banks to react on economic crises and on turmoil in the financial markets. During this month, there has been very extreme activity, particularly where the American central bank, The Federal Reserve Bank (Fed), has been taking action. Some parts of the action undertaken by the Fed should really be praised. Those who remember the global financial crisis will also recognise some of the initiatives that Fed has taken lately. The US central bank is also faster in acting this time, as the experience from the global financial crisis is still present.

During the crisis in 2008 and 2009, the US dollar liquidity simply dried-out because the US banks cut all the lending to foreign banks and partly to foreign corporations. The consequence was that many corporations around the world couldn’t get the needed US dollar refinancing, thus, they simply had to buy dollars to repay the debt, which again resulted in large and undesired currency swings. It took some time before this unforeseen problem was identified, though it afterwards smoothened out as the Fed made USD swap agreements with other leading central banks around the world. Via these USD swap agreements, central banks in the large economies can provide their domestic banking system with dollar liquidity, which again is passed on to companies that have a need for USD funding. This USD swap agreement system remained intact for the next crisis- which is now, and was reconfirmed among the leading central banks on the 15th March.

During this month, Fed has further made sure that the commercial paper market works as a funding source for American companies. To avoid any squeeze in the domestic repo-market, the central bank now holds two auctions a day instead of one, also to ensure ample liquidity in the banking system.

In the perfect world, these initiatives should have been introduced a week earlier. Though it was pretty quick how these very important operational tools have been put in place, and a true praise at that, as it ensures that healthy corporations and banks don’t collapses due to a sudden liquidity squeeze. But the action taken is of operational character, and shows some of the important operational functions that a central bank cares about when turmoil hits the financial markets.

The central bank actions that many investors focus on are naturally the monetary policy steps that are conducted when turmoil hits the financial markets. Unfortunately, the monetary actions undertaken in the past weeks on the other hand, did not work out particularly well.

On the 3rd March, Fed cut the central bank rate with 50 basis points, which was the first time in more than a decade that the Fed took such a large step. The joy among investors in the stock market lasted exactly 15 minutes, then the sell-orders splashed into the market and the downturn simply continued.

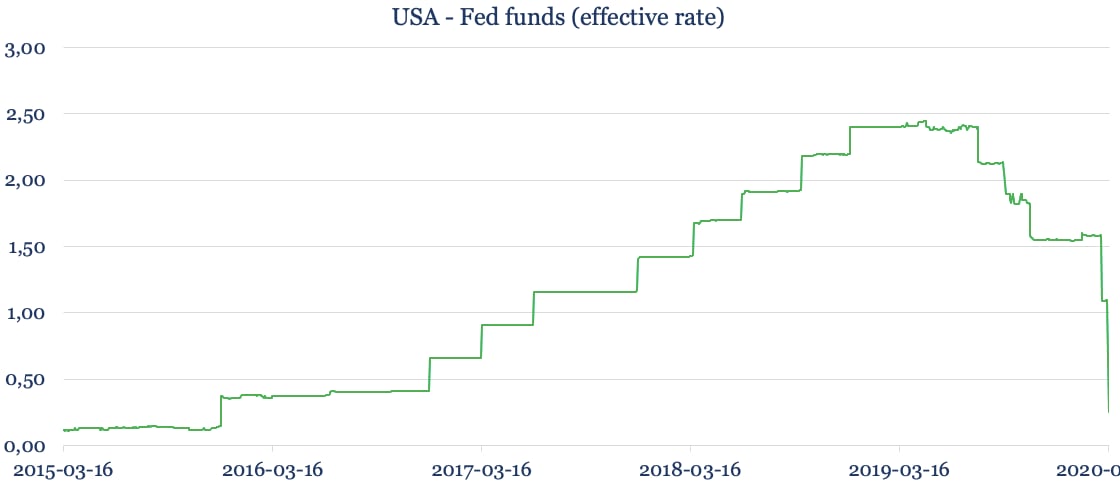

The second attempt from Fed came on the 15th March, where Fed cut the rates with 100 basis points- a whole percentage point in one go (graphic one). It is an extreme development, though investors just continued to hammer the stock markets. In my view, the current Fed Chairman has never really established a good communication with Wall Street, and it is about the same situation for his predecessor, Janet Yellen. It’s not a primary explanation for anything, but Fed should have known that even these extreme rate cuts would not stop the nosedive movements on Wall Street.

When Bank of England cut the rates with 50 basis points on the 11th March, it almost succeeded to turnaround the stock markets for a while, until WHO on the same day, declared the Covid-19 outbreak as a pandemic, and then the sell-orders just hit the markets once more.

The reason why Mark Carney from the Bank of England did a better job was because it was coordinated with fiscal spending initiatives from the British government. It remains my clear view, and I can only repeat, that the only rescue for economies is to introduce more fiscal spending every time a new precaution is taken against the spread of Covid-19.

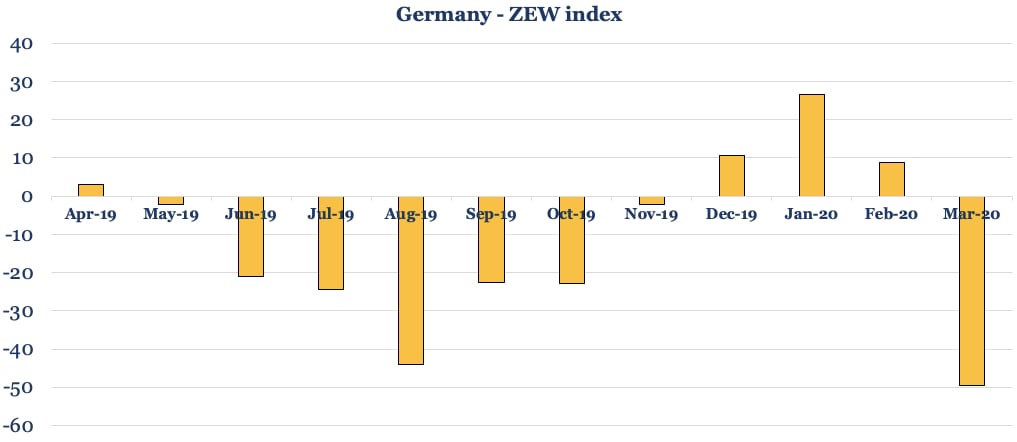

This dilemma is now being realised among governments around the world and that some governments might have “overlooked” the economic equalization when governments abruptly shut down businesses, everyday life, etc. (one of the first measurable reactions is shown in graphic two).

Even the American government is now really putting a big stake on the table to avoid a depression in the economy, and very rightly so, including handing money directly out to the citizens as many do not have any insurance against unemployment.

Even this fiscal bazooka in the US might not be enough in the first round, so President Trump could be forced to say that the American government opens the budget and will spend whatever it takes to keep the economic growth intact.

The full or partial lockdowns that have been put in place in some countries come with very high economic price tags, though to balance out the economic consequences, the right tools to use are the fiscal/government budgets, and not the monetary policy with wasted interest rate cuts as the Fed has done.

During an economic crisis, central banks will always ensure ample liquidity, which is certainly correct to provide. Classical monetary policy, such as the interest rate cuts in March cannot be used at all to balance huge economic interventions that are needed in the Covid-19 combat. But now, central banks in the US, Japan, the Eurozone and the UK have painted themselves up in a “zero-interest corner” so it feels like the end of the classic monetary policy has been reached, and the central banks have run out of ammunition.

Left is the so-called quantitative monetary policy, which the European Central Bank is now is making use of once more, as it announced on the 18th March a € 750 billion bond buying program. Of course, this is primarily to support countries such as Italy, as the country once again needs to significantly increase the government debt, and if the timing is wrong, it is uncertain whether investors have the necessary appetite for government debt issued in Rome- if that happens, the crisis will turn into a disaster.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER