The global economy is too strong to die from Covid-19

The Covid-19 virus is now spreading across the world, and so is the fear in the stock markets, but investors risk being caught in an irrational trap. I will allow myself to start with a warning to the stock markets. This season, 160 to 200 people in Germany alone are expected to pass away due to an infection from a virus- but not the Covid-19. This other virus will also infect 2 to 6 million people solely in France– it’s the flu.

In the whole Latin American continent, with a population of 672 million people, 2 cases of Covid-19 infections have been registered as of 1st March 2020. Just as a comparison, more than 200,000 people will die from drug abuse in the Latin American continent this year, same as last year and like next year. I regard the drug abuse in Latin America as a spreading disease that is a growing threat to several Latin American economies and represent a much bigger risk than Covid-19 will ever do. Yet, within the last 1½ weeks, the Brazilian stock index followed rest of the global indices down, losing more than 10 pct.

I am of course trying to illustrate the risk of investors being caught in an irrational trap. The reality is that it is completely impossible to quantify the global economic risk from the Covid-19 outbreak at all. This is also underlined by expert assessments that range from the need to wash hands more often, to half of the global population possibly getting infected by Covid-19. I argue that it is a hefty overreaction to sell down stock markets with 13 to 15 pct. based on the fear for the negative economic consequences linked to Covid-19.

With clients and colleagues, I have since long, been discussing if the stock markets were mature enough for a 15 pct. correction, that could be triggered by anything. Just a month ago, the stock market seemed very robust, but corrections always come as a surprise, which is what happened. If the sell-off is more of a correction than a Covid-19 assessment, then I would regard the drop as “natural”, as it had to come. Though, after such a correction, the first step for investors is to find the stocks that shouldn’t have been sold down at all.

I recognize that it remains unknown whether the global spreading of the virus attack has just begun, with possible unlimited negative economic effects, but reality is simply far from what is priced in the stock markets right now. Some business sectors will get hurt more than others. In the risk zone, one finds the airlines, hotel chains, as well as the restaurant and entertainment segment, but should the virus spread further, then the transportation industry could be squeezed.

Several companies have already announced that they expect lower earnings in the current quarter, and most companies even estimate the lost terrain. It gives investors the possibility to estimate how much the individual companies should be traded down in price. However, this is still only information at a single company level that again, can be used to estimate the negative impacts within some sectors. It’s natural that companies within these sectors will suffer on the stock exchange, though other positive developments tend to be neglected in a panic market like during the past 1½ weeks.

The statistical data coming from China about the development of Covid-19, which is also recognized by the WHO, indicates that the outbreak may have peaked in China. Furthermore, it is my expectation that a growing part of China is on its way back to a more normal level of activity.

I fully accept that the virus is spreading globally, and if it becomes an economic threat, then I will adjust my assessment of the impacts on the financial markets.

But my attention now increases just as much in the direction of “precautions”, as in new virus cases. It is still unknown whether it is too early to look at the post Covid-19 epidemic period, or when the world breathes in relief again, but it is possible that investors should already consider if some securities moved too much downwards.

I am convinced that global inflation will dive for a period, which could be positive for the stock markets. Otherwise, if the characteristic of the virus is that it often affects victims who are weak before the infection, then this could also be the case at macroeconomic level.

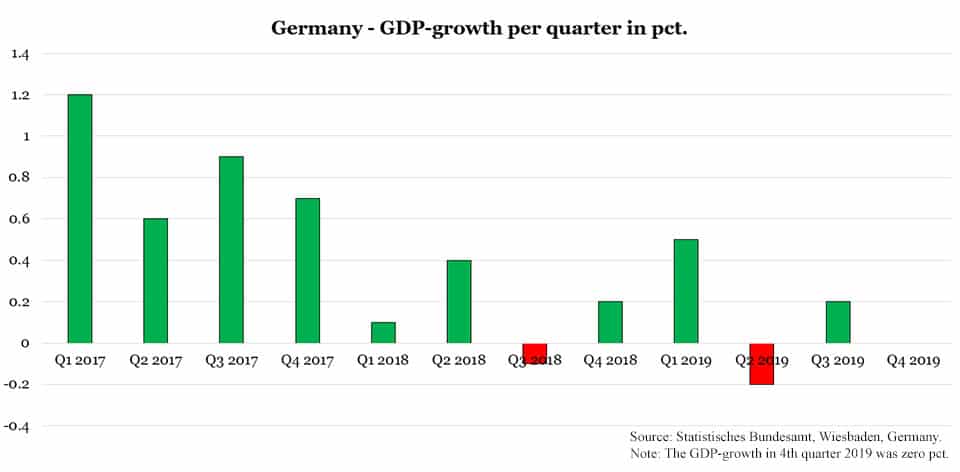

A country like Germany is an example of a country that is particularly vulnerable to negative effects from the Covid-19, since the zero economic growth situation was already a reality before the virus started to rattle the world (graphic one). The automotive industry and all suppliers have long experienced a heavy headwind, and the German export sector experienced a tough time due to the US-China trade war. Therefore, the GDP growth dropped to zero in the fourth quarter last year, but the virus has limited world trade once again, to the detriment of countries like Germany. In addition, the focus on the virus has overshadowed yet another catastrophic government crisis in Germany that risks burdening government work until the fall of 2021. This situation will be a challenge for investors post the Covid-19 outbreak.

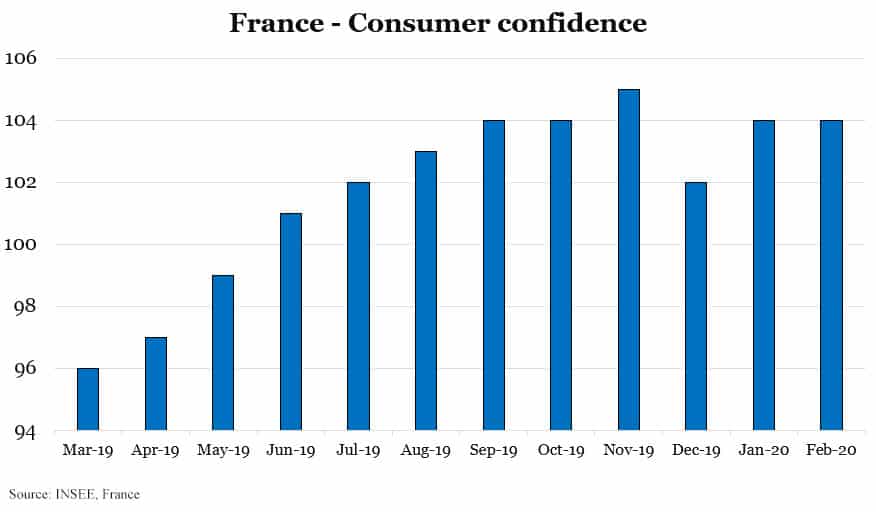

My assessment is that the global economy is still showing robustness right now and I believe that private consumption is an important source of growth. One of the most recently published figures on consumer confidence from France indicates that in France, the concern has not yet spread to private households. The index even reached 104 against expected 103 for the month of February, which was a positive surprise (graphic two). The coming data on consumer confidence from around the world, I consider as extraordinarily important during the next months, as good numbers will counterbalance the negative economic consequences of the Covid-19 outbreak.

Should Covid-19 spread aggressively across the globe and thereby hamper private consumption, then I expect governments to step-up by using fiscal policy in a very expansive manner to counterweight the negative effects from the virus. German Finance Minister Olaf Scholz has made the first hints about increasing fiscal spending, though not all countries have an equal fiscal manoeuvre room, and the weakest countries will be hurt if Covid-19 takes off. It will be essential that a possible fiscal counteraction is pumped directly into private consumption. It should not be allocated towards infrastructure spending, corporate tax reduction, etc. The solution might be fierce actions, like what is planned in Hong Kong, to simply handout money to the citizens, so they can spend it right away. So far, the global economy will repair the Covid-19 damage largely by itself, apart from in China, but even with the virus spreading significantly, the global economy will move on because it is too strong to die from Covid-19.

Germany: GDP-growth per quarter in pct.

- Q1 2017: 1.2%

- Q2 2017: 0.6%

- Q3 2017: 0.9%

- Q4 2017: 0.7%

- Q1 2018: 0.1%

- Q2 2018: 0.4%

- Q3 2018: -0.1%

- Q4 2018: 0.2%

- Q1 2019: 0.5%

- Q2 2019: -0.2%

- Q3 2019: 0.2%

- Q4 2019: 0%

France: Consumer confidence

- Mar-19: 96

- Apr-19: 97

- May-19: 99

- Jun-19: 101

- Jul-19: 102

- Aug-19: 103

- Sep-19: 104

- Oct-19: 104

- Nov-19: 105

- Dec-19: 102

- Jan-20: 104

- Feb-20: 104

Have you read?

# Richest Women In The World For 2020

# Africa’s Billionaires: Richest People In Africa, 2020

# Most economically influential cities in the world, 2020

# The World’s Best Cities For Luxury Shopping, 2020

# World’s Best Countries To Invest In Or Do Business For 2020

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER