Trends That Will Drive Online Spending In 2019

From online shopping to all sorts of financial transactions, the internet has completely transformed the way we spend our hard-earned money. Yet the digital revolution is far from over, as every year, new trends push online spending in new directions – and we take a look at how the landscape will develop in 2019.

Online Spending Will Grow and Diversify

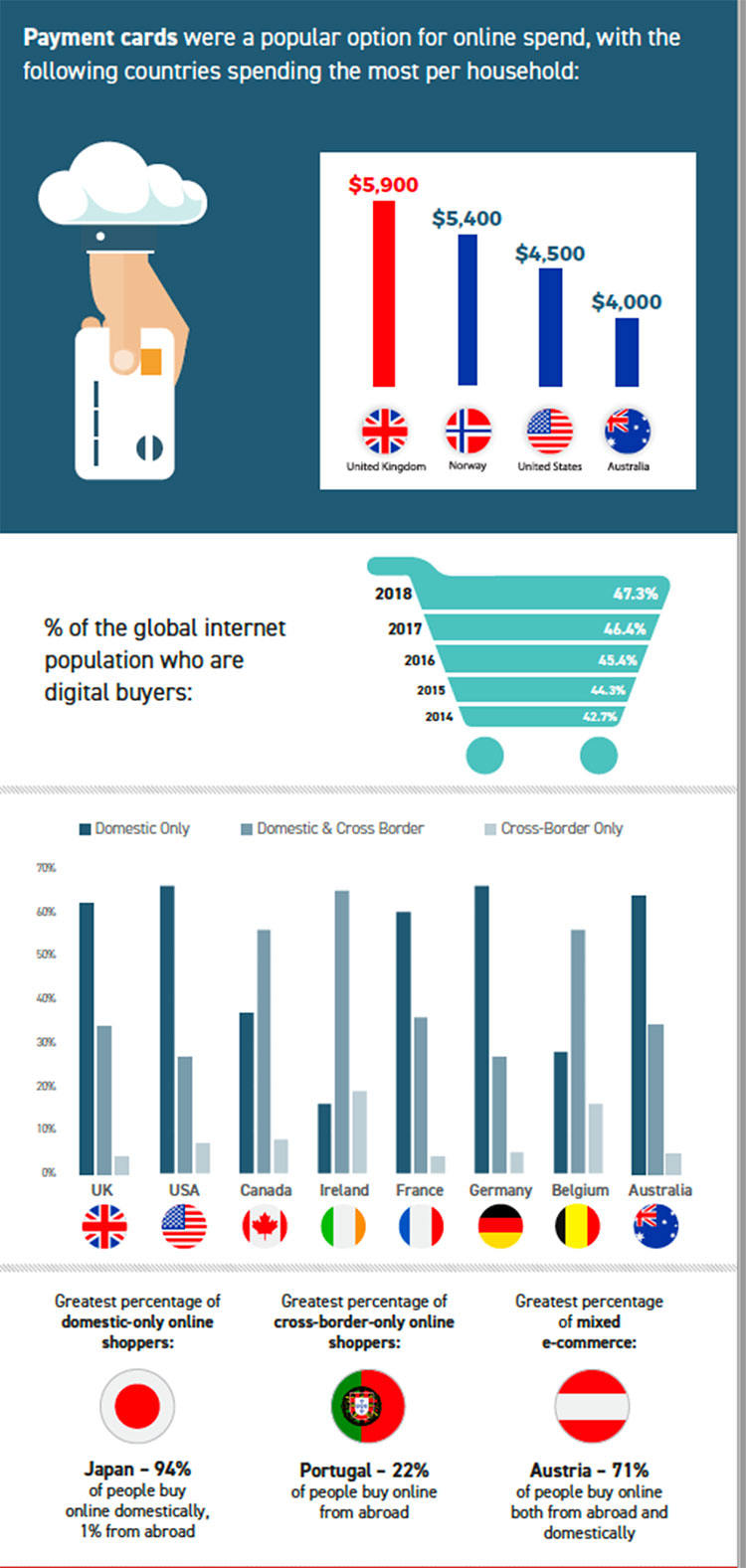

Online shopping is here to stay, as more and more consumers turn to online retailers. In 2014, 42.7% of global internet users were shopping online, a figure which grew to 45.4% in 2016 and then to 46.4% in 2017. In 2018, the number is set to reach an impressive 47.3%, which means that we might just see half of the world’s population with internet access purchase goods online in 2019. In fact, Aussies spent a record $21.3 billion in online shopping in 2017, a whopping 18.7% rise from 2016 – and by 2019, the total amount for online good purchases is projected to rise to $US2.16 trillion ($A2.86 trillion).

According to the same source, domestic retailers made up roughly 80% of 2017 spending, as Australia remains very fond of local firms. As the infographic suggests, roughly 65% of Aussie online shoppers buy from domestic only retailers, with around 35% purchasing from both domestic and foreign, and less than 10% going only for cross-border merchants. But it is not only online shopping from retailers that drives online spending: online services such as online streaming or gaming providers also contribute to the industry’s meteoric rise. Financial trading has also taken over the digital world, with dedicated apps teaching digital users how to trade in forex and shares online with step-by-step courses. Last but not least, informal online marketplaces have also enabled users to spend their money on niche products or services.

Will Social Media Spending Finally Take Off?

While alternative online payment methods are growing in popularity, payment cards remain a favorite option for online buyers, with UK households spending an average $5,900, followed by Norway at $5,400 and the US at $4,500 – Australia ranks fourth at $4,000. Payment cards are set to remain strong in 2019 and also drive a trend that is projected to take off during the year: social media spending. Social platforms such as Pinterest and Snapchat have started embracing retail experiences, while Facebook and Instagram have incorporated ads that can lead the user directly to the retailer’s website.

According to industry professionals, the option to load credit or debit card details into the user’s social media account will be the key to releasing the potential of social media online purchases. For online shoppers who prefer the convenience of digital spending, being able to check out hassle-free or even with just one click will be a game-changer for the way they approach social media. Convenience is the name of the game in other 2019 trends, too, like the expected growth of online grocery shopping, while augmented reality is set to be further developed – and 2019 just might be its milestone year for connecting with younger audiences.

Whatever 2019 may bring in online retail, one thing is for certain: digital spending is constantly growing, and consumers are always discovering new advantages for buying online instead of in brick and mortar shops.

Have you read?

# The 100 Most Influential People In History.

# Top CEOs And Business Leaders On Twitter: You Should Be Following.

# Must Read Books Recommended By Billionaires.

# The World’s Top 20 Most Charitable Billionaires.

# Richest Families In The World, 2018.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER