In June EU meets Italy’s debt mountain

It’s now likely that Italy’s new government is ready for the EU summit in Brussels on the 28th and 29th June, but the rhetoric already gets the full attention from the financial markets.

Ahead of the summit, the coming weeks will bring several proposals where the intention is to increase the confidence and stability in the Eurozone’s financial sector. The EU Commission has announced its own initiative called Sovereign Bond-Backed Securities (SBBS). The idea is that investors will buy a package of different government bonds issued by the Eurozone members. The rich member states like Austria, Finland, Germany and the Netherlands fear that they will have to guarantee other member states with a poorer credit quality such as Greece, and suddenly, the common Eurozone bond is introduced by the back door.

According to the EU Commission, this is not the intention, as the investors must bear the losses if a bond in the package defaults. In my view, the proposal seems unattractive as the credit rating of an SBBS bond will most likely be a weighted average of the individual credit ratings. In this package, any investor can create an own portfolio, so the suggestion almost seems like noise ahead of the summit. Something suggests that several leaders in the Eurozone countries have a similar opinion. The political leadership has its own proposal to stabilize, in particular the banking sector in the Eurozone, though there is no backing to the model preferred by economically weaker countries.

The southern European dream is named the European Deposit Insurance Scheme (EDIS), which is a real mutual guarantee scheme for all banks in the Eurozone. This means that Germany, for example, should guarantee for all the debt-burdened Italian banks. One doesn’t need much fantasy to imagine how the German parliament building would explode if the parliament should seriously discuss this idea – so it won’t materialize in the next decade or two.

Instead, Germany seems to accept that the European Stability Mechanism (ESM) rescue fund will be granted an automatic right to rescue troubled banks by providing up to EUR 60 Billion in credit lines per rescue. This proposal is getting prepared by the unit called “The Eurogroup Working Group”, also shortened “EWG”, just to mention the last abbreviation in this comment. Prior to the summit, I expect that more information about this proposal will be released and finally celebrated towards the further integration of the financial system in the Eurozone. It can undoubtedly contribute a sense of comfort in countries with too many weak banks. But it is not an initiative that creates growth nor impresses investors, so President Macron will have to give his idea about a common Eurozone fiscal policy another try.

All these proposals any Italian government would accept and applaud to, which also happens this time. But the two new Italian government coalition partners have EU critical DNA. I expect this fact to add the summit some economic / political spice, which will be closely followed by the financial markets.

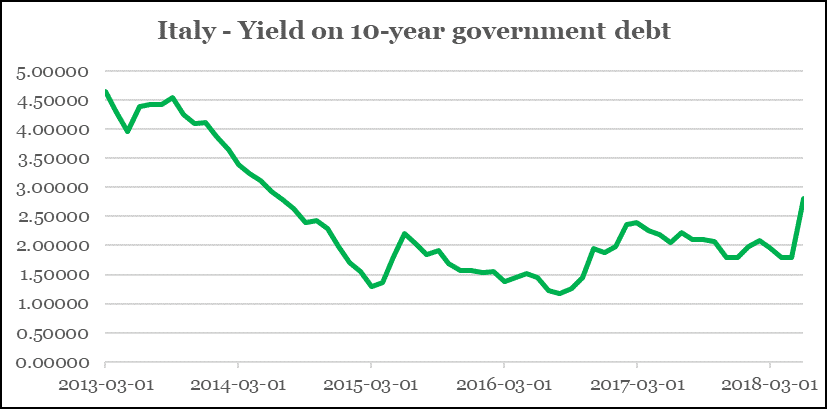

The Italian 10-year rate is already on the way up (graphic 1), especially after statements that the expected new government will borrow more, increase public spending, and going forward won’t accept the EU Commission’s budget and spending limitations. There will be more of these comments, though it is important to know who has the say.

The biggest partner in the coalition is the “Five Star Movement” led by Luigi Di Maio, who teams up with the “League” and its party leader Matteo Salvini. However, neither of the two could point at each other as prime minister, and therefore the law professor and non-politician, Giuseppe Conte got the job. I do not expect the prime minister to have a huge decision power, but instead, the two party leaders will strongly interfere in the debate – remember that Matteo Salvini has the same fondness for Twitter as a well-known president has.

Since Professor Conte is connected with the Five Star Movement, the League got control of the important ministries that controls Italy’s economy. Of the two parties the League is by far the most EU sceptical party and it will simply be a challenge for the entire EU system, including the European Central Bank (ECB).

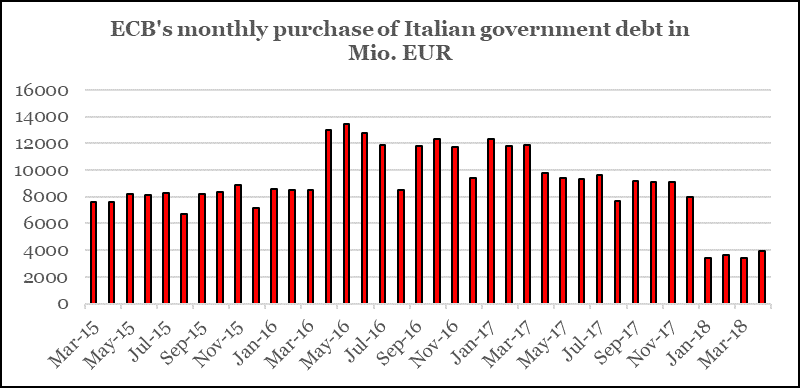

The ECB has purchased government bonds issued by all countries in the Eurozone as part of the quantitative monetary policy. Graphic 2 shows the buying of Italian sovereign debt where the ECB in total has bought Italian government bonds worth EUR 342 billion which is 15 pct. of Italy’s sovereign debt. Since the start of the year, the ECB has bought fewer bonds which also applies for Italy. For this reason, there is a greater supply in the Italian government bond market at an inconvenient time with uncertainty about the future Italian government budget.

But in mid-May, the ECB might have wished that it had never bought a single Italian bond. Suddenly, rumours have circulated that the coming government in Rome would ask the ECB to write-off Italian debt for about EUR 250 Billion. A media has gained insight into a draft government agreement where the debt cancellation was included. However, this is no longer relevant, but I am convinced that such thoughts can very well be mentioned again.

I expect that the 10-year Italian bond yield will continue to go higher, though by how much, will depend on the political rhetoric that comes from Rome. But with the right tweets from Matteo Salvini, a renewed discussion about the future of the euro can easily flare up during the summer, thus sending the euro three to five percent down on that account alone.

But these are just mild ripples compared to some very fundamental directions, which I think investors should keep in mind. Italy as well as a number of other southern European countries continue their walk in the economic desert where increased public debt is no solution. I don’t expect that the EU Summit will convince investors that there are economic growth pulses in the Eurozone which argue for increasing investment. Some companies are always interesting, but overall, I see myself confirmed by underweighting investments in southern Europe. At the same time, I expect that sooner or later, doubts arise about the credit quality of, for example Italian government bonds.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER