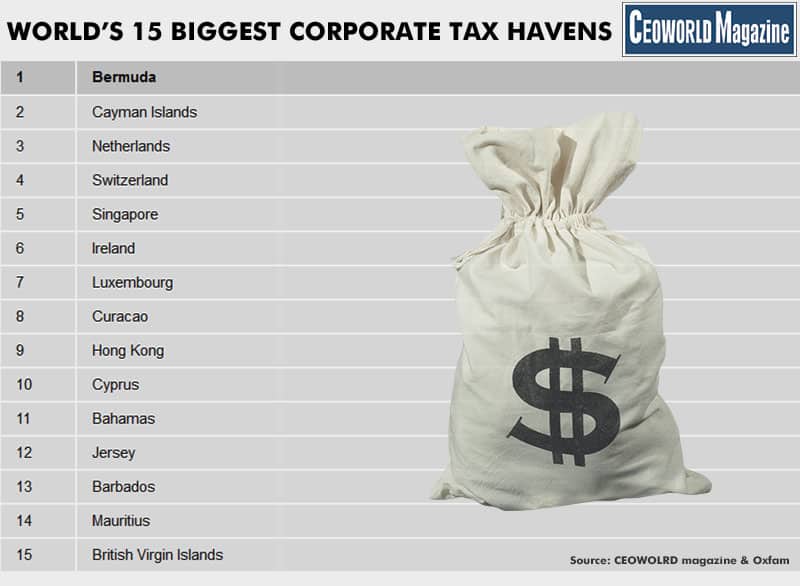

15 biggest corporate tax havens in the world, 2016

he Bermuda has been branded as the biggest corporate tax haven in the world, according to Oxfam list. The Cayman Islands, the Netherlands, Switzerland, and Singapore were also named in the top 5. Ireland and Luxembourg were ranked in 6th and 7th place followed by Curacao, with Hong Kong and Cyprus making up the rest of the top 10.

The report, titled “Tax Battles: the dangerous race to the bottom on corporate tax,” defines a “Tax Haven” as a low-tax or no-tax nation with generous tax incentives.

The report also noted that 90% of the world’s biggest companies had a presence in at least one tax haven.

The final 5 were the Bahamas, Jersey, Barbados, Mauritius, and the British Virgin Islands.

The 15 biggest corporate tax havens in the world, 2016

| Rank | Country | Characteristics |

|---|---|---|

| 1 | Bermuda | 0% corporate income tax (CIT), 0% withholding taxes, lack of participation in multilateral anti-abuse, exchange and transparency initiatives, evidence of large-scale profit shifting. |

| 2 | Cayman Islands | 0% CIT, 0% withholding taxes,31 lack of participation in multilateral anti-abuse, exchange and transparency initiatives, evidence of large-scale profit shifting. |

| 3 | Netherlands | Tax incentives, 0% withholding taxes, evidence of large-scale profit shifting. |

| 4 | Switzerland | Tax incentives, 0% withholding taxes, lack of participation in multilateral anti-abuse and transparency initiatives, evidence of large scale profit shifting. |

| 5 | Singapore | Tax incentives, lack of withholding taxes, evidence of substantial profit shifting. |

| 6 | Ireland | Low CIT, tax incentives, evidence of large scale profit shifting |

| 7 | Luxembourg | Tax incentives, 0% withholding taxes, evidence of large scale profit shifting |

| 8 | Curaçao | Tax incentives, 0% withholding taxes, lack of participation in multilateral anti-abuse, exchange and transparency initiatives, evidence of substantial profit shifting. |

| 9 | Hong Kong | Tax incentives, 0% withholding taxes, evidence of large scale profit shifting. |

| 10 | Cyprus | Low CIT, tax incentives, 0% withholding taxes. |

| 11 | Bahamas | 0% CIT, 0% withholding taxes, lack of participation in multilateral anti-abuse and transparency initiatives. |

| 12 | Jersey | 0% CIT, 0% withholding taxes, evidence of substantial profit shifting. |

| 13 | Barbados | Low CIT, 0% withholding taxes lack of participation in multilateral anti-abuse and transparency initiatives. |

| 14 | Mauritius | Low CIT, 0% withholding taxes, lack of participation in multilateral anti-abuse and transparency initiatives. |

| 15 | British Virgin Islands | 0% CIT, 0% withholding taxes, lack of participation in multilateral anti-abuse and transparency initiatives. |

Photo: Bermuda Mega Yachting by Cosmos Yachting.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER