The Old G7 And The Hypothetical New G7: Impact On The World Economy

While the world seems to be constantly floundering in financial, geopolitical, and economic turbulence, IMF’s semi-annual World Economic Oultook report suggests that 7 big emerging markets are now bigger, in GDP terms, than the long established “Group of Seven (G7) leading industrialised nations,” when measured at purchasing power parity (PPP).

It includes China, India, Russia, Brazil, Indonesia, Turkey, and Mexico, Gavin Jackson and Keith Fray at the Financial Times flagged up the change.

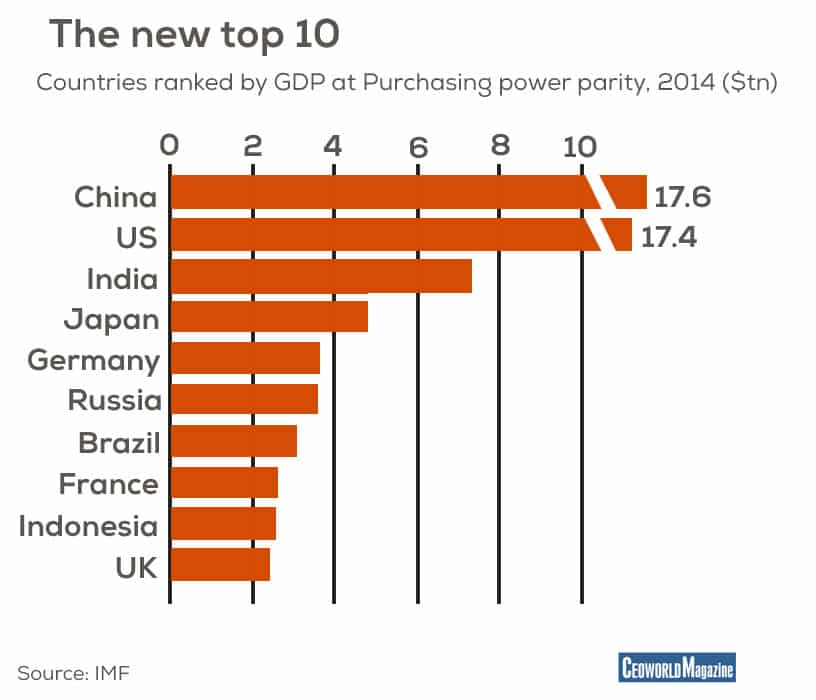

Furthermore, the new attempts to measure GDP also confirm that, in PPP terms, China is now the world’s largest economy, overtaking the United States.

At market exchange rates, the US economy is worth $17, 4 tn and the Chinese $10.4 tn. With an adjustment for relative prices, Chinese economy moves up to first place, with a GDP of $17.6 trillion.

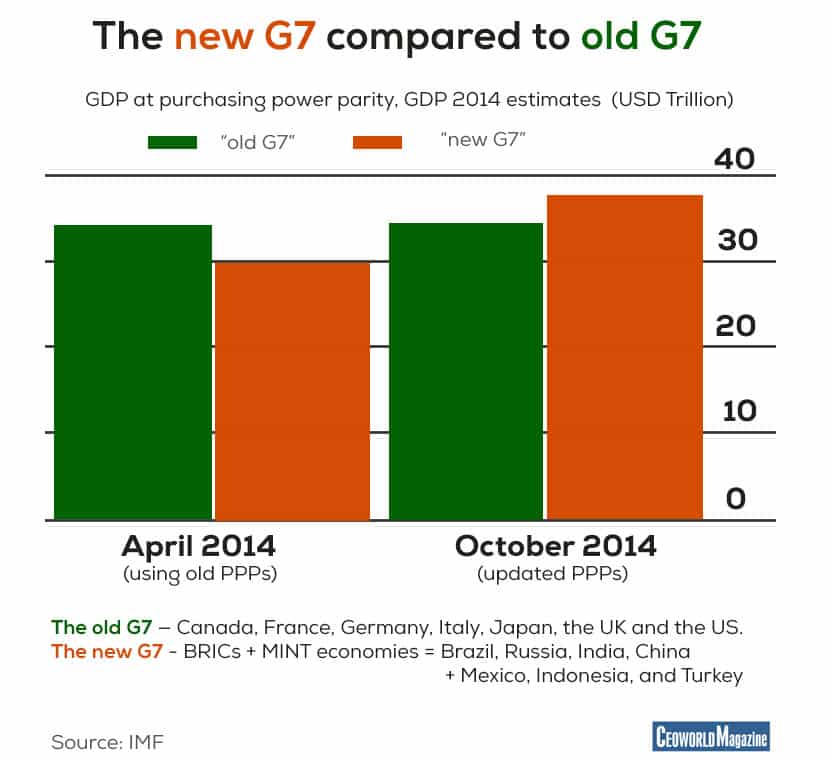

The new G7 compared to old G7

The New Big Seven or new G7, comprising the 4 BRICs economies (Brazil, Russia, India, and China) and three of the so-called MINT economies (Mexico, Indonesia, and Turkey) – has a combined GDP of $37.8 trillion (at purchasing power parity) compared to $34.5 trillion for the old G7 (Germany, Italy, France, Japan, Canada, the United Kingdom and the United Stares).

The old G7 (combined GDP of $37.8 trillion) — Canada, France, Germany, Italy, Japan, the UK and the US.

The new G7 (combined GDP of $34.5 trillion) – BRICs + MINT economies = Brazil, Russia, India, China + Mexico, Indonesia, and Turkey

Countries ranked by GDP at Purchasing power parity, 2014 ($tn)

Why the importance to purchasing power parity (PPP)?

A shirt will cost you less in Shanghai or Mumbai than in New York or London, so it’s not entirely reasonable to compare countries without taking this into account. Basically, the method used by the IMF adjusts for purchasing power parity, explained here.

As we’ve become accustomed to a global financial system in which the United States has had by far the biggest influence. But this is changing..

The International Monetary Fund (IMF) has said India has recovered from the economic slowdown. The IMF projected slightly stronger growth in India in 2014 than its April Outlook projection — from 5.4% to 5.6% — and kept its 2015 projection unchanged at 6.4%.

The IMF’s China 2014 growth forecast remains unchanged at 7.4 per cent. The 2015 forecast too remains at the April level of 7.1 per cent.

“India has recovered from the slump thanks to policy decisions and renewed confidence,” Olivier Blanchard, IMF Chief Economist, said at a press conference on the Outlook’s release.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER